Nigeria’s Fintech space is gradually showing signs of maturity and consolidation. Most CEOs are looking to become the next big winners after Interswitch. Like I must have described in previous posts, there is a bandwagon effect when it comes to innovation.

This, however, is not peculiar to only Nigeria. It is a global phenomenon. This means that once an entrepreneur opens up a segment of a market, people flow in, as though they were all working on the project around the same time.

The Bandwagon Evolution

Back in the days, everyone wanted to build a mobile wallet (Paga is doing it, so can we). But that was a long and fruitless road. People realised quickly that building a mobile wallet for the unbanked was a long and treacherous journey – your safe return is not certain.

So, I guess entrepreneurs took the easier route by trying to convince the banked people to start using mobile wallets. This didn’t catch on because having a mobile wallet is redundant if one already has a bank account. Rather, it becomes an additional burden. I wouldn’t want to download your app when I already have my bank app that provides all the services you are offering.

At another time, you would have thought that the problem of payment was the only problem that Nigerians faced since every entrepreneur suddenly had ideas around online payment. These ideas had little or no differentiation from the last 10 entrepreneurs you could have spoken to.

Gratefully, entrepreneurs have slowed down on payment since it appears that the spoils are being shared by two companies – Paystack and Flutterwave. But I sincerely believe that the larger opportunity is offline – POS, Cash in and Cash out, and other additional services layered on the POS devices. I will write about this at another time.

After the payment wave came to an end, lending and savings showed up. I am not sure which wave came first, but at some point, all we saw were lending and savings products. Again, the need is obvious as Nigerian banks are useless! They will never provide you any loan, neither will they give you high interest on your savings. So I get it. But ever since one player started that, everyone now thinks that lending and savings are the new goldmine.

Unfortunately for the lending guys, they don’t have the liquidity to lend, as the same useless Nigerian banks will not provide them liquidity. The entrepreneurs don’t know too many HNIs, so these tech businesses have to ration the amount they give to one person. I am not going to talk about the rate being charged, but from a customer’s perspective, half bread is better than none I guess.

On the savings side, they need to entice people with high-interest rates to make them part with their money. These people don’t trust a bunch of young techies telling them to set up recurring deductions on their hard-earned salaries account to save.

You will ask the question, what if these boys disappear with my money? These are valid concerns, so these savings businesses will have to start by building trust. Giving people their money when they request for it amongst other things

Now, the wave I am noticing is that of digital banking. Everyone wants to have a digital bank. ALAT opened up that space and now, entrepreneurs are launching digital banks in partnership with traditional banks.

Interestingly, I had recommended in a previous post that Fintechs should aim to be a bank (digital) themselves. So maybe some entrepreneurs read that article, or maybe not. Maybe it is just a natural progression of the industry.

Savings Announcements

Something interesting happened a couple of weeks ago, we woke up to this announcement by Paylater, that it is launching its savings feature! Once Paylater went live with that information, Paga followed suit.

Figure 1 Tayo Oviosu – Tweet Crop

I observed though, that Paylater announced its intention to start in June, but Paga mentioned that it has launched already. Maybe Paylater heard of a potential Paga announcement, then they jumped ahead of the story.

Anyway, Paylater and Paga have joined the savings business. Cowrywise, Piggybank, MyKolo, etc have built their businesses on savings for some time now, so what should they do? I have my thoughts on how they should respond, but I have to be paid a fee to have a conversation about that.

Platform means business

I can understand why Paylater needed the savings product. It needs to source cheaper deposits. Cheaper in this sense is relative because Paylater might offer its saving client a higher interest rate of potentially double digits.

This is not cheap you might wonder, but if Paylater charges 1% per day on loans, offering 15% per annum shouldn’t be too much stress for them. But again, I wait to see their strategy on that.

Paga, on the other hand, has just built a big mobile wallet business. I am sure that Tayo will just think in his mind, “What else can I offer these people? Sure, they can save. Eureka! Savings.” Tayo has built a platform, hence he can layer additional services on that platform.

Just the same way Whatsapp built a messaging app but could start to layer on payment, P2P money transfer, voice and video calls, conference calls to rival Zoom and Skype.

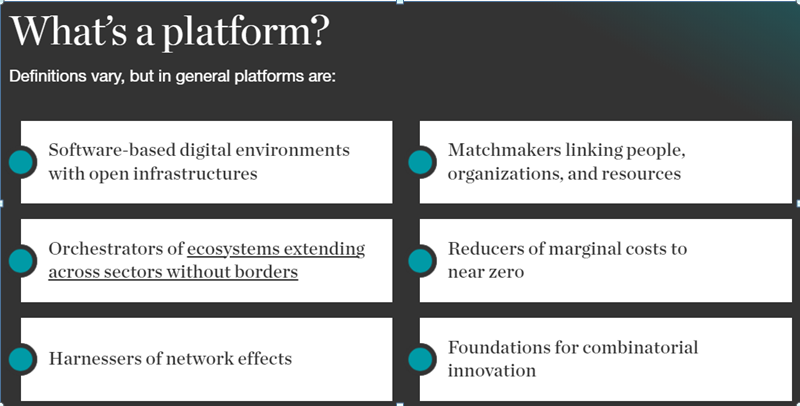

Figure 2 McKinsey Quarterly

Payment guys are cheering you on!

We will continue to watch how this consolidation shapes up. How the Savings guys will respond, and what additional services will be layered on. But from what I can see, entrepreneurs will have to choose their regulator – Central Bank of Nigeria (CBN) or the Securities and Exchange Commission (SEC), maybe the National Insurance Commission (NAICOM) since it appears that Insurtech will start to catch on soon. I guess we are all waiting for Casava.

That said, the payment guys are cheering on since they will be the ones to enable the payment – collection and disbursement of savings or loans. It will be interesting to see how this eventually shapes out.

Happy Entrepreneuring

@AremoFisayo

Fisayo you’re my favorite 🙂

Your insights are wonderful

Insightful! Thanks for sharing this.

I brought merchandise off of Amazon through a third party. I paid 1.98 for electronics that was going out of business but it is a scam. I never received anything or my money refunded. This is the website that was provided to me and nothing else. Just wanted you to know that my company will be investigating the fraud charge that is about to be placed. Why are people so hungry for money and to get it they lie about it.