Arnold Dublin-Green-Market Views| About Six months ago I wrote on my buy case for Nigerian local currency bonds. The main reasons, among many, were, that slowing inflation, the general improvement in Nigeria’s macro outlook and more importantly, reduction in the supply of local bonds would lead to an uptrend in prices.

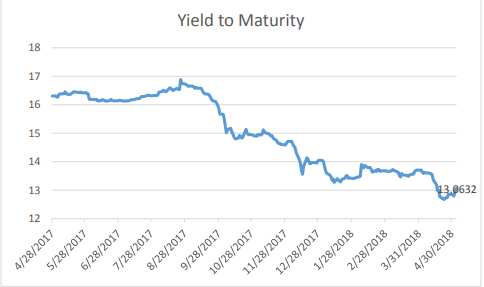

One of the indices I use to track the Nigerian Bond market is the Bloomberg Nigeria Local Sovereign Index or BNGRI, a market value weighted index that measures the fixed-rate local currency securities issued by Nigeria. This Index has seen a price rally of over 15% over this 6 month period.

The yields in the index have dropped by 200bps over this same period.

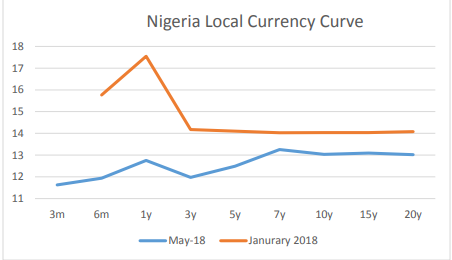

This rally has been across the curve causing the yield curve to begin to take a normal look.

The 1yr paper has experienced the highest drop in yield compared to other maturities.

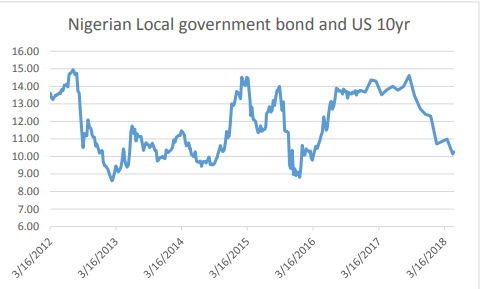

Spreads have tightened at a quick rate over the past 6 months approaching historically low levels. The last time spreads were this tight, was in the last quarter of 2015. Strangely, this was in the period JP Morgan decided to expel Nigeria from its index due to tough controls the central bank imposed to prevent a currency collapse.

Oil price began its descent to sub $40 per barrel, and the nation was left with no finance minister. Another factor that should have added to rising yields was the implementation of the Treasury Single Account (TSA).

To reduce borrowing costs, extend credit and in the hopes of improving the government’s fiscal policy, the administration decided to fully implement an account that collects all government funds.

However, following the implementation of this TSA, the decision of the monetary policy committee (MPC) to lower the Cash reserve requirement around the same period released liquidity into the market causing yields to collapse.

Other periods that show tight spreads are periods of economic stability in the country, mainly due to stable oil prices. One of the fascinating relationships exists between bond prices and crude oil price.

Spreads were range-bound between 900 and 1100 through this period of relatively stable oil prices. And now with the recent oil rally this year, bonds are now beginning to trade at previous levels.

In the long term, rising oil prices put downward pressure on yields and vice versa. In the short term, the chart shows that crude oil prices continue to work harder until bond yields start to fall.

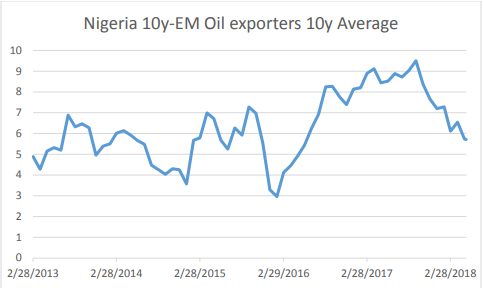

The spread between Nigeria 10y yields and its market counterparts tell me that there is still some downside to going in yields. Nigeria is lagging to a degree.

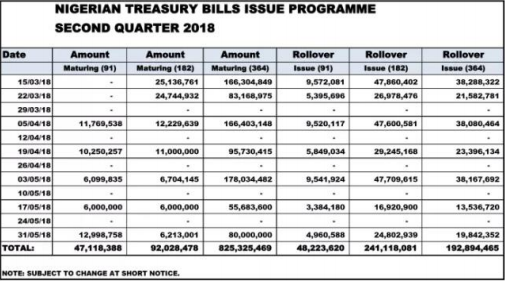

Visible reduction in issuance of local currency debt can be seen as the Central bank has signaled a change in the debt mix, leaning towards US Dollar debt.

This point to a continuous increase in bond prices. Expect front-end yields to continue to decrease in moderation.

Although yield downside from here is limited as the central bank has begun signaling a floor in interest rates with a recent hike in 3M and 9M bills at 11.4% and 12.1% respectively pushing yields higher on the secondary market.

However, there is still a shrinking supply of the 1y T-bill, which is now offered at a yield of 10.75% at the time of writing. I think the hawkish signals from the central bank will begin to reflect across the curve as Market participants start to reassess their position