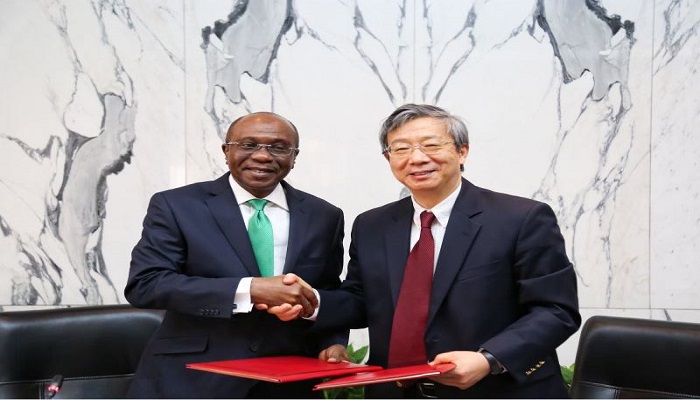

Nigeria and China have finalized a currency swap between the reserve banks of both countries. The Peoples Bank of China (PBOC) disclosed this in a notice on its website. Governor Godwin Emefiele signed on behalf of the CBN, while Governor Yi Gang signed on behalf of the PBOC.

The size of the swap facility is RMB 15 billion/NGN 720 billion. The agreement is valid for three years and can be extended upon mutual consent.

Prior to this

Preliminary discussions concerning the swap began in 2011 when then CBN Governor Lamido Sanusi had suggested that Nigeria would hold a small percentage of its reserves in renminbi.

Following President Muhammadu Buhari’s trip to China in 2016, the Industrial and Commercial Bank of China Ltd (ICBC), and the CBN signed a deal on yuan transactions.

How does the swap work?

The two banks will exchange their respective currencies. The CBN will then sell Yuan to commercial banks. They, in turn, will sell to individuals and businesses. At the end of the agreement, both banks will return the initial amounts taken.

Read an extended explanation of the Nigeria/China Swap Deal

Who benefits from this?

Nigerian businessmen importing goods from China can now get direct access to Yuan rather converting to dollars.

Data from the Nigerian Bureau of Statistics (NBS) Foreign Trade Report for Q4 2017 shows China was the country’s largest import partner, accounting for 22% or ₦465.13 billion of all imports.

The Chinese Civil Engineering Construction Company (CCECC) is currently handling several major infrastructure projects in the country including the Lagos Ibadan railway line and the Mambilla hydroelectric project.

For the CBN, the move will reduce pressure on the nation’s foreign reserves. Nigeria imports a huge proportion of both finished goods and raw materials.

China has increasingly taken steps to position the Yuan as a reserve currency. A reserve currency is a currency widely used in international trade that a central bank holds as part of its foreign reserves. The US dollar is the major reserve currency in the world.