The Nigerian Stock Exchange is worth over N14 trillion and counting. This is a remarkable improvement from under N10 trillion just over two years ago. Last year alone, Nigerian Stocks gained over 40% and the market was one of the best performing exchanges in the world.

The rise of market capitalisation of companies on the exchange has also furthered the financial status of investors in these companies, particularly its majority shareholders.

This select group of shareholders are billionaires in their own rights (in Naira, that is) and have seen their wealth soar over the recent months. Let’s take a look at some of them and how much they are possibly worth based on their direct and indirect holdings in these stocks.

*Valuations were calculated using closing prices as at April 6, 2018.

Aliko Dangote

Aliko Dangote (popularly called ‘Alhaji’) is the founder of the Dangote Group of Companies, over which he presides as President and Chief Executive Officer. He began business in 1978, with the trading of commodities before moving into full-scale manufacturing. He has been the Chairman of Dangote Cement since its formation and is also the Chairman of other listed companies in Dangote Industries.

Aliko Dangote leads the pack by virtue of his holdings in Dangote Cement, Dangote Sugar, Dangote Flour Mills and NASCON Allied industries.

He is the majority shareholder in Dangote Cement through Dangote Industries Limited (DIL) with an 85.06% stake amounting to 14,484,431,294 shares. At the company’s closing price of N254.90 on our cut- off date, this amounts to a net worth of N3.69 trillion.

DIL also has a 62.19% stake in NASCON Allied Industries amounting to 1, 647, 763, 557 shares. At N21.20, its closing price on our cut- off date, this equates to a value of N34.9 billion.

Aliko Dangote holds a direct stake of 635,095, 014 shares valued at N13.6 billion.

DIL holds a 68% stake in Dangote Sugar refinery amounting to 8.16 billion shares. At N21.45 per share, Aliko’s total stake is valued at N188.6 billion.

DIL has a 75.7% stake in Dangote Flour Mills amounting to 3,785,000,000 shares. At our cut- off date, this gives a valuation of N52.2 billion.

DIL also holds a stake in Jaiz Bank valued at N1.7 billion.

Dangote, in addition to being Africa and Nigeria’s richest man, is also Nigeria’s richest capital market billionaire with shares valued at N3.95 trillion

Jim Ovia

Jim Ovia is the founder of Zenith Bank Plc. He was Group Managing Director from its inception in 1990 till his resignation in July, 2010 due to a CBN policy. He was appointed Chairman in July 2014.

Jim Ovia has a direct holding of 2,946,199,395 shares and indirect holding of 1,593,494,151 shares in Zenith Bank. At the bank’s current share price of N27.10, this equates to a net worth of N79 billion. The value of the additional shareholding would raise his net worth by N43.1 billion. This brings the total value of his holdings to N122.1 billion.

Ratan Mahtani

Ratan Mahtani, whose Indian family have been in Nigeria since the sixties, is an accomplished entrepreneur who currently serves as the Deputy Chairman of Churchgate Group. He is also on the board of Aegean Investments Ltd, First Century International, T F Kuboye & Co, and International Seafoods Limited.

He has direct holdings of 28,544,005 shares and indirect holdings of 1,083,670,994 shares in Stanbic IBTC Holdings. At Stanbic’s price of N49 on our cut- off date, this equates to a net worth of N54.3 billion.

Austin Avuru

Chief Executive Officer,

Seplat Petroleum

Austin Avuru is the co-founder and Chief Executive Officer of Seplat. Prior to joining Seplat, Mr. Avuru spent twelve years at NNPC beginning in 1980, where he held various positions including well site geologist, production seismologist, and reservoir engineer.

In 1992, he joined Allied Energy Resources in Nigeria as a pioneer deepwater operator, where he worked for the next ten years as exploration manager and technical manager. In 2002, Mr. Avuru established Platform Petroleum Limited and held the role of managing director until 2010, when he left to take up the CEO position at Seplat.

Avuru holds 74,546,740 shares in the company. This amounts to N49.5 billion, as at our cut- off date.

Femi Otedola

Mr. Otedola is the Chairman of the Board of Directors of Forte Oil Plc (formerly known as African Petroleum Plc). In 1999, he ventured into the oil and gas sector by incorporating Zenon Petroleum & Gas Limited, an indigenous company engaged in the procurement, storage, marketing and distribution of petroleum products. In 2001, he incorporated Seaforce Shipping Company Limited.

Otedola became the largest shareholder in Forte Oil in 2007 when he acquired a 28.7% stake in the company from the Nigerian National Petroleum Corporation (NNPC) for $120 million.

Femi Otedola has a direct holding of 186,260,357 shares and indirect holding of 838,472,441 shares in Forte Oil Plc. Going by the company’s valuation as at cut-off date, he has a net worth of N7.4 billion. The indirect holdings are worth an estimated N33.5 billion, giving him a net worth of N40.9 billion.

ABC Orjiako

Chairman/Co-founder,

Seplat Petroleum

Dr. Ambrose Bryant Chukwueloka (ABC) Orjiako is the Chairman and Co-founder of Seplat Petroleum. Dr Orjiako trained as a General Surgeon, later sub-specialised in orthopaedic and trauma surgery, and became a fellow of the West African College of Surgeons in 1996.

Whilst still practicing at the National Orthopaedic Hospital Igbobi, Lagos, Dr Orjiako established and managed various companies in the upstream, downstream and services sectors of the oil and gas industry in Nigeria. He also has other business interests in construction, real estate development, pharmaceuticals, and shipping.

Dr Orjiako went into full-time business in 1996 after eleven years of active medical practice. He co-founded Seplat in 2009 and became the Chairman. He is also the Chairman of Neimeth Pharmaceutical International Plc, which is listed on the NSE.

Orjiako has 47,251,325 shares in the company. The shares are valued at N31.4 billion going by his shareholdings as at cut-off date.

Herbert Wigwe

Group Managing Director,

Access Bank

Herbert Wigwe is the GMD/CEO of Access Bank. He worked in Guaranty Trust Bank for over 10 years, before exiting in 2002 to turn around Access bank as Deputy Managing Director (DMD). He was appointed Group Managing Director on 1st January, 2014.

He has a direct stake of 206,231,713 shares in Access Bank and indirect shareholding of 2,480,582,395 through United Alliance Company of Nig. Ltd, and Trust and Capital Limited.

At the bank’s current share price of N12, this equates to a net worth of N2.4 billion for his direct holdings. Adding the indirect valuation gives him a total net worth of N32.1 billion.

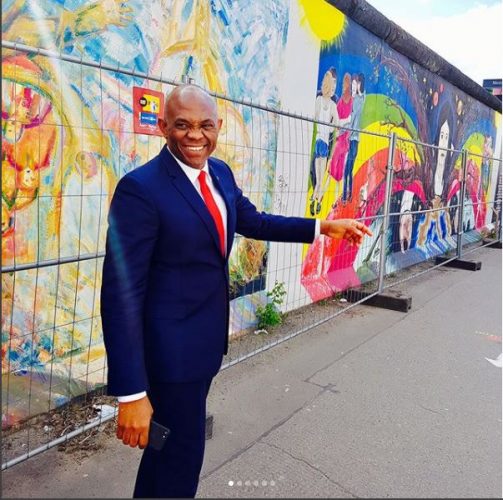

Tony Elumelu

Chairman,

UBA Plc

Tony O. Elumelu is the Chairman of the United Bank for Africa (UBA). Elumelu led a team that took over the distressed Crystal Bank in 1997. The bank was then renamed Standard Trust Bank (STB). STB acquired UBA in 2005 and he became the Group Managing Director (GMD).

Elumelu retired following a CBN policy. After his retirement, he established Heirs Holdings and the Tony Elumelu Foundation. In 2011, Heirs acquired a majority stake in Transcorp Plc.

Elumelu has direct holdings of 189,851,854 shares in UBA and indirect holdings of 2,083,024,416 shares. The stock closed at N11.90 per share on our cut off date, thus valuing his holdings at N24.7 billion.

He has an indirect holding of 256,238,449 shares in African Prudential Plc through Heirs Holdings Limited. Afriprud closed at N4.09 on Friday’s trading session, valuing his stake at N1 billion.

Elumelu also has an indirect holding of 78,185,694 shares through HH Capital Limited in Afriland Properties Limited. Afriland is a real estate firm listed on the NASD OTC Exchange. Using the share price of N3.20 as at our cut off date, this amounts to N250 million.

In Transcorp Plc, he has total holdings of 1,010,731,556 valued at N1.5 billion.

Mike Adenuga

Michael Adeniyi Agbolade Ishola Adenuga Jr is a Nigerian billionaire businessman, and the second richest person in Nigeria. His company, Globacom, is Nigeria’s second largest telecom operator and has a presence in Ghana and Benin.

Forbes has estimated his net worth at $5.8 billion as of 2017, which makes him the second wealthiest Nigerian behind Aliko Dangote, with a net worth of $14.1 billion.

Mike Adenuga, has direct holdings of 103,259,720 shares and indirect holdings of f 516,298,603 shares through Conpetro Limited in Conoil Plc. Conpetro Limited holds 74.40% of Conoil’s issued share capital.

At Conoil’s current price of N30.80 per share, this gives him a net worth of N3.1 billion for his direct holdings. Indirect holdings have a value of N15.9 billion.

Adenuga also has 1,620,376,969 shares, or a 5.62% stake in Sterling Bank. This amounts to N2.5 billion.

His capital market holdings thus amount to N21.5 billion.

Oba Otudeko

Ayoola Oba Otudeko is an industrialist and the current Chairman of FBN Holdings Plc. Professionally, Oba Otudeko is a Chartered Banker, Chartered Accountant and a Chartered Corporate Secretary.

He also has significant stakes in Honeywell Flour Plc, a member of the Honeywell Group he founded and FBN Holdings (First Bank).

Otudeko has a total of 537971137 shares in First Bank. At our cut off date of April 6th 2018, this gives a valuation of N6.5 billion.

Oba Otudeko’s shares in Honeywell Flour Mills are valued at N12.7 billion. He holds 5,303,363,565 shares through Siloam Global Resources Limited.

His total net worth thus amounts to N19.2 billion.

Your calculation of dangote’s share value is wrong. His share value in Dangote cement is in trillions . His shares in Dangote sugar are worth 136 billion naira (not 13.6 billion as you claimed). You also did not include Oba otudeko’s shareholding in First bank (over 500 million shares from my last record ) and Guinness (18,490, 657 from my last record). You also did not include a number of people in your list like Atedo Peterside (with significant shareholding in Stanbic IBTC, Nigerian Breweries, Flour Mills of Nigeria, Cadbury and Unilever), Pascal Dozie (with significant shareholding in Diamond Bank and MTN), Subomi Balogun (with Significant shareholding in FCMB ), Chief Oludolapo Ibukun Akinkugbe (Significant shareholding in First Bank, Stanbic IBTC, Wamco Friesland etc), Tunde Folawiyo ( with significant shareholding in Access Bank and MTN Nigeria, T Y Danjuma (with significant shareholding in Guinness NIgeria, Wamco Friesland , First Bank and May and Baker, Otunba Adekunle Ojora (Ecobank Transnational, Oando, NCR etc) , Victor Odili (largest Nigerian shareholding in MTN Nigeria estimtated at close to 200 million dollars. Mike Adenuga’s shares in Julius Berger Nigeria were also not included

Atedo Peterside’s holdings were not included because there was no way to verify them as at 2017. If they were significant, they would have been stated. significant being 5% and above. The valuation of his shares in the other blue chip firms you mentioned are not worth up to N10 billion. Oladapo Akinkugbe’s holdings can not be independently verified by us, since there are no public records.

MTN Nigeria is not a publicly listed firm. Mike Adenuga’s shares in Julius Berger can not be attributed to him, since neither him nor the company have made no such declaration. Though we can infer that they belong to him since Bella Adenuga is his daughter and Gladys Talabi is a key staff of his.

TY’s holdings in those blue chip firms are also not publicly stated, with the exception of May and Baker. Pascal Dozie’s stake in Diamond Bank is held through Kunoch Holdings which is run not just by himself but is his family investment vehicle. Diamond is also ye to release its FY 2017 results which we like to use so as to have a uniform reporting base and because holdings do change within a financial year.

Adekunle Ojora’s holdings are also not significant in the firms and are not publicly stated, hence there is now way to verify his worth with the exception of his holdings in NCR, which is not worth up to a billion.

Going forward, we will be covering several billionaires every week, as there are several others that didnt make the cut.

You still did not address the calculation of dangote’ s shares and the exclusion of Oba Otudeko’s shareholding in First Bank in the computation for him

That will be amended. Thank you for the observation.

Aliko’s holdings in the cement company is in trillions of Naira

Thank you for the observation

A format similar to Bloomberg’s billionaire index would have been more appropriate in presenting this information. Of course, I’m aware the BBI is a more sophisticated platform. Thanks for taking the time to compile this.

How do you expect retail investors to compete in a market dominated by the elite???