The Central Bank of Nigeria (CBN) has issued a new set of penalties for organizations that flout its Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) rules.

The new penalties stipulate fines on banks, their directors, and other key officials for money laundering infractions.

Highlights of the new regulation

- According to the CBN, banks and board members or chief compliance officers will all be sanctioned for 31 out of the 48 money laundering infractions listed in the new regime.

- For each of the 31 infractions, the new regime stipulates minimum fines ranging from ₦500,000 to ₦1.2 million on board members or chief compliance officers or the internal auditor, and fines ranging from ₦1 million to ₦20 million on the offending bank.

- Failure to approve the AML/CFT policies and procedures by a bank attracts a minimum penalty as follows: N1 million on each member of the board and N20 million on the Deposit Money Banks (DMB).

- Similarly, ₦5 million fine would be levied on the bank in the first instance and N1 million for each year that the contravention continues; “Failure to communicate the AML/CFT program of the organization to the employees.

- Failure to review/update the AML/CFT policies and procedures at least every three years would attract a minimum penalty of ₦750,000 on the Executive compliance officer in the first instance and ₦750,000 for each year that the contravention continues and N500,000 on the Chief compliance officer in the first instance and ₦500,000 for each year that the contravention continues.

The Minister of finance, Mrs Kemi Adeosun had recently restated the commitment of government to monitor the inflow of funds into the country to forestall terrorism funding noting that the government is monitoring all formal channels through the Nigeria Financial Intelligence Unit (NFIU) and other bodies, also monitoring ‘non-formal cash-based structures’, which can often be used for illicit purposes.

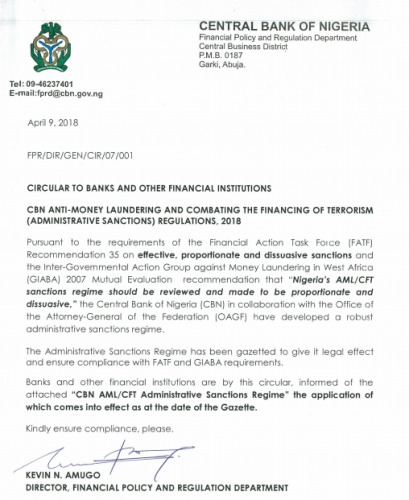

Snapshot of the circular

Should an investor be worried?

Well, not if you are just a regular retail investor. However, as a banker, you should be worried considering the amount you could be on the hook for if you are charged and found guilty of contravening the provisions of the regulation.

For customers of banks, this is an added comfort for the safety of your money deposited with your banks. An incentive against poor handling of your deposits is purely in your favor and won’t cost you anything.