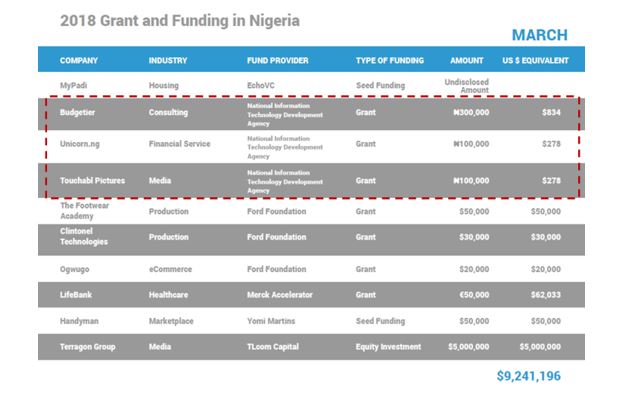

According to reports by Techpoint, Nigerian Startups raised a total of $9.24m in Q1 2018. The report reveals that 14 were involved in forms of capital raise in Q1 2018, and a higher percentage of that figure is from foreign investors, while grants make up almost 64% of the total number of deals.

I was not surprised by the investor list, until I saw an unusual name – National Information Technology Development Agency (NITDA). I was impressed; a Nigerian agency is actually doing the job it is expected to do.

I was however immediately ashamed to see the funding amounts. At that point, my hope and enthusiasm sank. Looking down the same list, while NITDA was giving grants in total of $1,390 (N500,000), the Ford Foundation gave $100,000 to 3 companies, and Lifebank got a $62,033 from Merck Accelerator.

This is at best shameful. I can imagine what it took the entrepreneurs to earn N100,000 from a Nigerian government agency. They probably would have had to spend much more than that amount in travel or accommodation expenses or just the value of time it would take to earn this grant commitment. In fact, we need to ask the entrepreneurs if they have actually gotten the money in their bank accounts or if NITDA is waiting for the presidency to access the Treasury Single Account to withdraw N100,000 for them.

Who is NITDA?

According to information on their website (Thank God they have one), National Information Technology Development Agency (NITDA) was created in April 2001 to implement the Nigerian Information Technology Policy and co-ordinate general IT development in the country.

It was mandated by the National Information Technology Development Act (2007) to create a framework for the planning, research, development, standardization, application, coordination, monitoring, evaluation and regulation of Information Technology practices, activities and systems in Nigeria.

Its role, therefore, is to develop Information technology in the country through regulatory standards, guidelines and policies. Additionally, NITDA is the clearing house for all IT projects and infrastructural development in the country. It is the prime Agency for e-government implementation, Internet governance and general IT development in Nigeria.

In line with implementing its mandate, the agency oversees the development and deployment of information technology in the country through human capital development, provision of IT infrastructures and creation of an enabling environment for the development of IT. This is to enable Nigeria to become a key player in the global knowledge-based economy.

As a result of the dynamics of IT and multi-faceted effects of its applications, a lot of NITDA initiatives are still on-going while some have been completed.

NITDA hosts annual and periodic conferences, seminars and workshops to awaken the psyche of Nigerians to the appreciation and usage of emerging technologies. And one of the goals of NITDA is to develop globally competitive manpower in IT. Various activities have been embarked upon to fulfill this goal.

Why am I angry with NITDA?

A major point in the NITDA Act is the establishment of the National Information Technology Development Fund. The Federal Inland Revenue Service (“FIRS”) is expected to collect the tax and remit to the fund.

According to the Act, a levy of one percent of the profit before tax of companies and enterprises enumerated in the third schedule to this Act with an annual turnover of N 100,000,000 and above and such paid by the companies shall be tax.

Based on the third schedule, companies operating in these sectors are liable to paying the 1% tax on their PBT:

- GSM service providers and all telecommunications companies

- Cyber companies and internet providers

- Pensions managers and pension related companies

- Banks and other financial Institutions

- Insurance companies

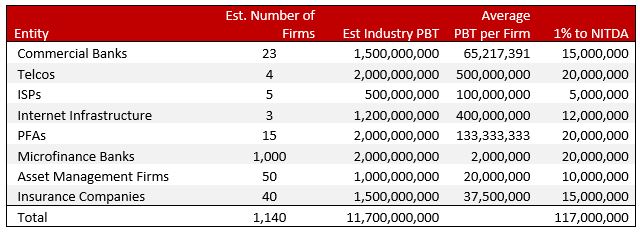

Based on this act, all Nigerian banks and telcos make over N100m per annum. Most PFAs, ISPs, insurance companies, merchant banks, major asset management companies, microfinance institutions will make over N100m, thus, qualifying them for the 1% tax on their PBT.

Let’s take a look at NITDA’s Potential Tax Revenue

Banks and insurance companies have the most public information, so I will estimate for other institutions. I will leverage information about these sectors from my former life as an investment banker to make a calculated guess on what their PBT should be.

Conclusion

If NITDA makes this much in revenue annually, its is a shame to award N100,000 grant to any startup. However, what can I say? The cash will probably pay the salaries of 2 call center agents for a month, thus extending the runway of these startups. Looking at the brighter side right?

Happy Entrepreneuring

@AremoFisayo

Fisayo Durojaye