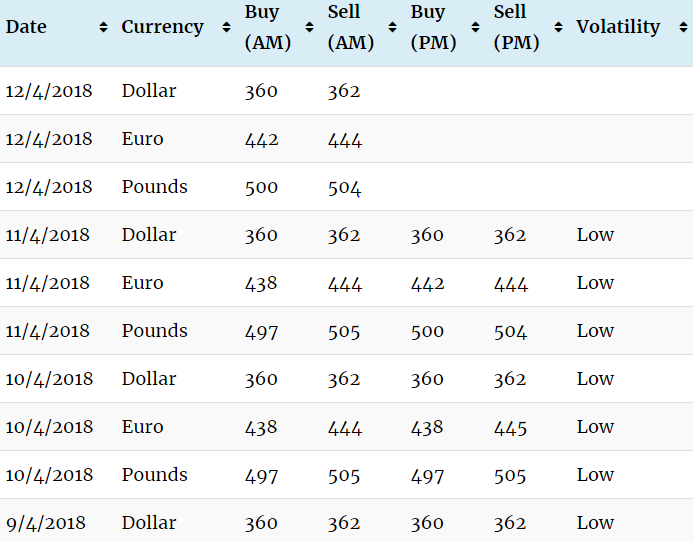

The Naira, today rose to ₦360 at the parallel market and ₦305.55 at the official rate.

This marks the highest rate witnessed in the past one month. A currency is said to be trading at a high when it trades at a smaller figure than previous. The move from over N400 to a dollar, to the current rate of N360 is known as appreciation or a “high”.

Factors responsible for the appreciation

The recorded improvement is due mainly to the rise in crude oil prices. In the past few months, crude prices have increased considerably up to the $70 mark. This morning, the price climbed up to $71.66 following US President (Donald Trump’s) issuance of warnings against Syria and Russia. This is the highest the price has been in 3 years.

Another related factor which is responsible for the improvement is the increase in Nigeria’s foreign reserves. The rebound in oil prices helped to improve the country’s foreign reserves which hit $46.7billion earlier this month. The country’s foreign reserve has shown consistent improvement over time and is projected to hit $50 billion before the end of 2018.

It should be noted that the robust reserves have also enabled the Central Bank of Nigeria to maintain its weekly Forex interventions which the apex banks consistently been committed to in a bid to stabilize the economy and checkmate inflation. Just last week, the CBN injected the sum of $339.89m into the Retail Secondary Market Intervention Sales.

Correct me if I am wrong. It appears this article contradicts itself on so many fronts. The title suggests that the Dollar appreciated against the Naira. Most paragraphs of the article amplifies that the Naira is rising against the Dollar. Meanwhile the table shows that the Naira is depreciating against the Dollar.

Thank you for your observation. It has been amended.

Appears unclear, your article – did the Naira appreciate or depreciate. The table and the title of the articles seems to suggest the later, however the main body of the articles suggests that the Naira appreciated.

Thank you for the observation. It appreciated. We will amend the article to explain more clearly.

Thank you for the observation. It has been amended.

…article*