Tier two lender Wema Bank today released its financial statements for the year ended December 2017 after the initial delay.

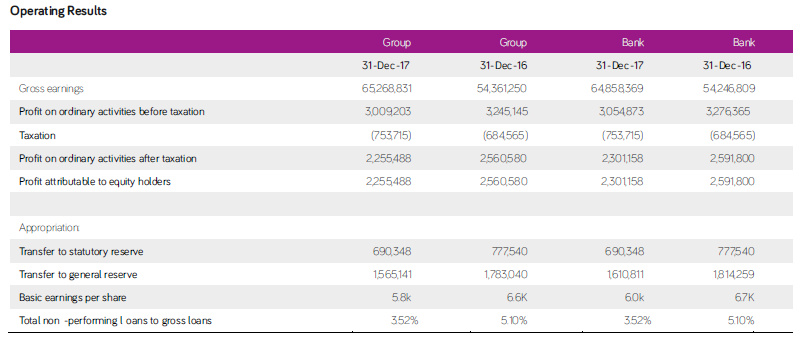

The report shows a growth in the bank’s gross earnings from ₦53.9 billion recorded in 2016 to ₦65.3 billion in 2017.

The bank’s interest income also grew from ₦44.6 billion in 2016 to ₦53.1 billion. The net interest income also grew from ₦18.65 billion in 2016 to ₦19.77 billion in 2017.

Profit before tax for the year under review stood at ₦3.01 billion against ₦3.25 billion recorded in 2016. Profit after tax dropped from ₦2.56 billion to ₦2.26 billion in 2017.

The bank also noted the success recorded with its ALAT mobile banking platform on which 200,000 new customers were enrolled in May 2017, who have carried out over 900,000 transactions valued at ₦12 billion.

The Bank was incorporated in Nigeria under the Companies Act of Nigeria as a private limited liability company on 2nd May 1945 and was converted to a public company in April 1987.

The Bank’s shares, which are currently quoted on the Nigerian Stock Exchange, were first listed in February 1991.