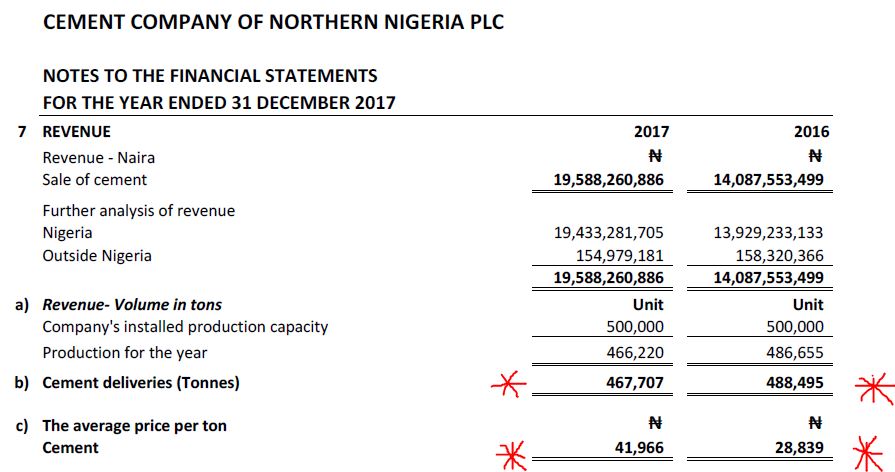

Cement Company of Northern Nigeria (CCNN) recently released its financial statements for the year ended December 2017. Revenue was up 35% from ₦14 billion in 2016 to ₦19.5 billion in 2017.

Profit before tax jumped 141% from ₦1.7 billion in 2016 to ₦4.2 billion in 2017. Profit after tax increased by 157% from ₦1.2 billion in 2016 to ₦3.2 billion in 2017, the highest in the company’s history.

CCNN has declared a dividend per share of ₦1.25 per share amounting to ₦1.57 billion.

Price increase was the major driver

The company’s superlative results were majorly due to an increase in sales price. The average price per tonne rose by 46% from ₦28.8 million in 2016 to ₦41.9 million in 2017. This more than offsets the slight drop in production and cement deliveries.

Production for the year fell slightly from 486,655 tonnes in 2016 to 466,220 tonnes in 2017. Cement deliveries were dipped from 488,495 tonnes in 2016 to 467,707 tonnes in 2017.

Cement Company of Northern Nigeria Plc (also known as Sokoto Cement) was incorporated as a limited liability company on the 15th August 1962 and commenced business operation in1967. The Company was listed on the Nigerian Stock Exchange on the 4th October 1993.

BUA International Limited holds a 50.72% stake in CCNN through Damnaz Cement Company Limited a wholly owned subsidiary

The principal activities of the Company are the manufacturing and sales of cement to the general

public.