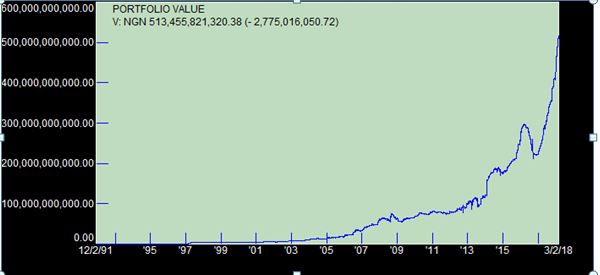

Helped by performance in equity market and net inflows, Nigeria’s mutual fund industry added ₦84 billion to end with total assets worth ₦0.513 trillion as at March 2, 2018.

This marks the sixth consecutive weekly rise in AUM for Mutual Fund industry since January 19th 2018

Mutual fund AUM has been on the increase since 2006 and the increase has accelerated remarkably in recent times especially as investor sentiments and awareness improves.

Source: Quantitative Financial Analytics

In 2017 alone, AUM surged by about 89% from ₦224.8 billion to ₦426 billion due to a net inflow of about ₦186 billion as well as estimated aggregate profit of ₦16 billion recorded by the industry in 2017.

That the mutual fund industry has crossed the half-trillion mark is quite a milestone given the seeming lack of transparency in the industry. Though the AUM has continued to increase, the dynamics of the industry remains relatively the same as investors remained overweight on money market mutual funds despite the ongoing trend in the yield curve. Of the ₦512 billion total asset value as at March 2, 2018, ₦368.9 billion resides in money market funds, representing 72% of the industry AUM.

The industry is not only growing in terms of asset under management (AUM), it is also growing with regards to the number of funds. In 2017, 16 new funds were added to the SEC NAV Summary report compared to the 10 funds added in 2016 and so far in 2018, 2 new funds have been added.

The fact that as at 2006, mutual funds were relatively unknown with total assets of less than ₦35 billion compared to its half a trillion Naira value today implies that mutual fund has come to stay.