In Nigeria today, second-hand bookselling has become a major source of income for a lot of people. It is a thriving sector which is helping to curb unemployment, whilst silently stimulating economic growth in the little ways that it can. For this reason, it deserves a special recognition.

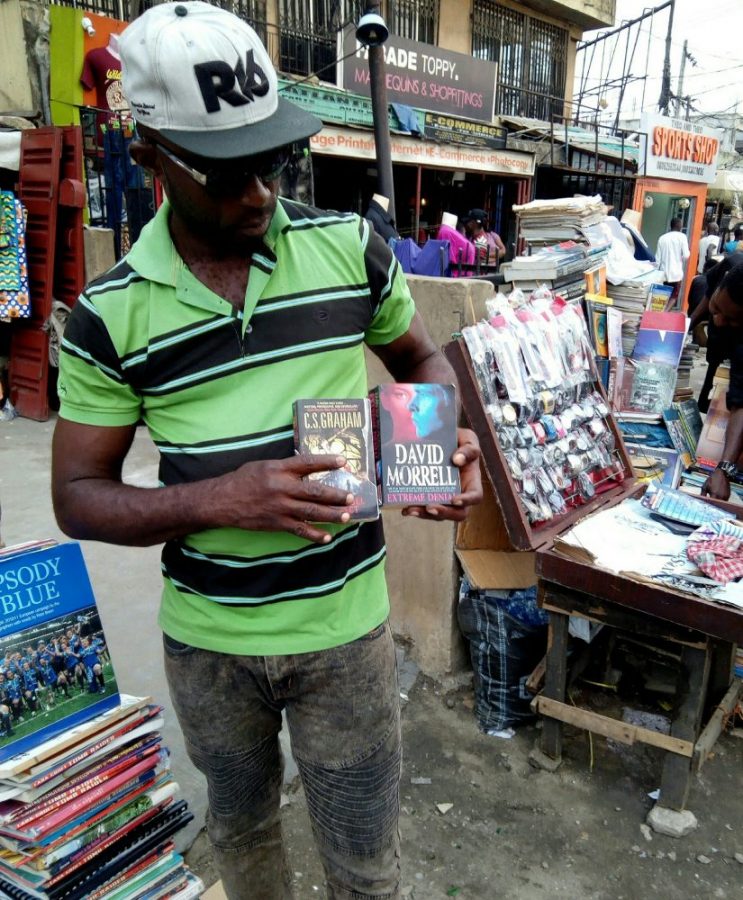

It is, therefore, in a bid to get more insight into the business that Nairametrics visited the popular Ojuelegba Under Bridge in Lagos where some booksellers and their customers were interviewed. Here, we met Chinedu Alex, a bookseller who was standing beside his wares that were displayed by the roadside. He courteously asked if he could help us find any specific titles; a good customer service skill by the way. But then we were on a different mission.

Before long, Chinedu was telling a little bit about the story of his life. He came to Lagos as a nineteen-year-old with a burning desire to study pharmacy at the University of Lagos. Coincidentally, his uncle with whom he was living, owned a neighbourhood pharmacy store. So, young Chinedu worked in the store as an apprentice, even as he prepared for his entrance examinations into the university. He was so determined to gain admission so much so he bought a lot of books with his spare money and read them all. Eventually, he wrote the exams, passed them but still could not study at the university because his uncle would not pay his tuition.

For years to come, Alex continued to work in his uncle’s pharmacy store even as he kept acquiring various science textbooks and reading them in readiness for when he would finally become a student. Unfortunately for him, that time never came.

In 2012, he had a fallout with his uncle and got dismissed from his apprenticeship without a settlement. All he had in his possession at the time were his many textbooks, his clothes, and a few thousand naira notes. The young man had to decide whether to go back to the village or stay in Lagos and start a business. He chose the latter.

How the second-hand bookselling business works

Second-hand booksellers such like Alex sell everything from textbooks/magazines published in the early 1990s, to more recently published materials. These books are gotten from different sources, including former students who no longer have a need for the books, lecturers and others who need to get rid of their old books in order to create space for newer ones.

A bulk of the second-hand books are also imported. Alex told me that sometimes, containers arrive at Nigeria’s port with sizeable amounts of second-hand books in them. Consequently, people like Alex are notified by their contacts at the ports to come check the books.

“We buy the books In bulk. We do not buy them one by one the same way we sell. What happens is that when we see all the books, we tell them how much we want to buy everything. And so we buy everything.” -Alex

Why do people buy second-hand books?

There are two main reasons why Nigerians buy second-hand books. According to another second-hand bookseller named Favour Chuks whose shop was right next to Alex’s, some buyers of second-hand books are readers who cannot find what they want to read in regular bookstores. He revealed that some of his customers have repeatedly told him how difficult it can often be to get certain books in regular bookstores in Lagos. So, they come to the second-hand booksellers who somehow always have these books.

The second reason why Nigerians buy second-hand books is when the original books are too expensive for them. This situation is particularly peculiar to medical textbooks which Alex said are generally expensive. Sometimes, medical students from the nearby University of Lagos come to give them a list of books to get for them. They prefer to buy from Alex in order for them to save money.

Note that whereas an original medical textbook could cost as much as N20,000, a fairly used copy of the same book may cost just N5,000 when purchased from second-hand booksellers.

Is it a lucrative business?

The least price for a book or magazine sold by a second-hand book is N250. Some books are as expensive as N3500. Now when you compare these prices with how much it costs the booksellers to acquire the books, you’d realise that they make nearly 100% profit in the business.

The question, however, is whether or not they get enough customers to patronise them. After all, there is a widely held belief that Nigerians don’t read; something Alex vehemently refuted by the way. As a matter of fact, he said he makes as much as N8,000 from selling those second-hand books per day. This would not be the case if Nigerian do not read as many people like to believe.

Note that Nairametrics was with Alex and Favour for nearly two hours, during which time at least eight people came around to check out some books. Five of those people made purchases of books ranging from N250 – N1000. People buy everything from novels to inspirational books. But the sale of textbooks to students seemed to be the biggest source of income to both traders.

One of the customers that came around was Susan, a Master’s student at the University of Lagos. She wanted to buy a book on Gender Studies. She told us that she prefers to purchase second-hand books because they are “affordable and reliable.”

What determines the prices of books?

Second-hand booksellers largely determine book prices by author’s popularity and buyer’s demands. According to Alex and Favour, those two factors are intertwined in the sense that it is the popularity of an authour’s name that mostly determines the demand for their books.

However, some genres are in greater demand than the other because they typically sell out faster than the rest. Examples of such genres are- inspirational/spiritual, university textbooks and romance novels.

Challenges in the business

A major challenge faced by second-hand booksellers in Lagos Nigeria is the constant harassment by Lagos State officials. This is because street trading is illegal in the state, even it serves as a source of livelihood to millions of Lagosians such as Alex and Favour.

Indeed, the economic impacts of the second book business cannot be underestimated. It provides sources of employment to many and helps low income [students] afford books to study. In its little way, the business helps the economy to grow.

This business of selling second hand books is my desire but don’t know how to start. Can some help me. I am resident of Oyo state.