The Nigerian stock market started the year straight out of the blocks with double digit gains and was one of the best performing stock markets in the first month of 2018. Leading the table of best performers were banking stocks among which was First Bank or FBNH as the group is now referred to.

FBNH stock is up 312% in the last one year alone and there are new indications that it could even perform better in 2018 if the report by ARM is to be believed. ARM shared its latest review of the Tier 1 banks upgrading the stock to a “Strong Buy” a departure from the cautious stand it had taken in times past.

According to ARM, they are now rooting for FBNH because it looks increasingly attractive underpinned by improving asset quality and above par core banking metrics. Another major reason why it is so bullish on FBNH is that it believes the bank will have “lower provisioning” thus presenting a strong upside. Provisioning refers to the amount a bank as to net of its income as loans that it believes could go bad. The lower bad loans provisioning the better a bank’s result might be.

Based on this, they are valuing the share price N16.69 implying a 32% upside from its current price of N12.50. FBNH gained 8.23% today.

See the analysis below

Regaining its Mojo; Upgrade to STRONG BUY

Across our Tier 1 banking universe, we beam our spotlight on FBN Holdings (FBNH). The bank trades at a P/B of 0.7x compared to peer average of 1.4x, and its FY 17E P/E of 6.6x is at a sizable discount to current P/E of 18.8x. Furthermore, at current pricing, our 2017E dividend translates to a dividend yield of 6.8%.

Our View

Following a dramatic share price decline (-21.7% from the year-peak of N14.75), FBNH looks increasingly attractive underpinned by improving asset quality and above par core banking metrics. Precisely, we see further potential upside from lower provisioning, resilience in Net Interest Margin (NIM), operational efficiency and possible streamlining of branches.

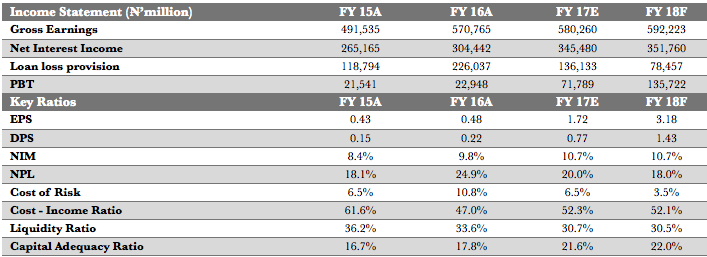

Consequently, we estimate FY 17E EPS of N1.72 (9M 17: N1.28) and N3.18 for FY 18F – implying a 260% and 85% growth in EPS in FY 17E and FY 18F accordingly, given the materially low base in 2016.

Table 1: Summary of Result and Forecast

Lower provisioning guides to earnings expansion

Over the last 11 quarters, FBNH has booked ~ N442 billion on loan loss provision stemming from deteriorating loan quality with NPL ratio and Cost of Risk printing at 25% and 10.8% respectively as at FY 2016 (FY 2015: 18.1% and 6.1%).

Irrespective, over the first nine-months of 2017, asset quality has recovered with NPL and cost of risk declining to 20% and 6.4% respectively. Much of the improvement has come from the downstream oil and gas sector where NPL concentration declined to 11% in 9M 17 from 35% in FY 16. Going forward, we expect to see sizable improvement from its upstream Oil and Gas (O&G) exposure which currently constitutes 43% of NPL as at 9M 17.

Given the recovery in crude oil production and higher crude oil prices, we expect upstream O&G NPL to moderate to ~30% in FY 18. Thus, Atlantic Energy loan, of ~ N140 billion, is expected to remain the major NPL in its upstream O&G books.

Overall, we forecast NPL and Cost of Risk in FY 18F to print at 18% (FY 17E: 20%) and 3.5% (FY 17E: 6.5%) respectively. This implies FY 2018 loan loss provisioning of N78.5 billion relative to N138.1 billion for FY 17E.

Asset quality risk and earnings

We present a sensitivity analysis of Cost of Risk and provisioning (impairment) to earnings. Our analysis shows a 300bps increase in Cost of Risk to 6.5% (same as 2017) which according to our estimates imply a 7% decline in EPS for FY 2018E.

We highlight that our stress test analysis here is based on a worst-case scenario where the bank may have to provide more for specific assets with concerns. The possibility of this scenario playing out is small, in our view. Consequently, we maintain our base case assumption of 3.5% Cost of Risk, which guides to PAT of N114 billion for FY 2018F.

Table 2: Sensitivity Analysis of Cost of Risk to Earnings

In summary, with a focus on leveraging lower funding cost, operational efficiency, adequate capital buffer, no plans to grow risky assets, and lower loan-loss provisioning, downside risk to 2018 earnings now seems moderated than was earlier expected.

Overall, we forecast 2018F EPS of N3.18 (+85% YoY) and DPS of N1.43.

FBNH trades at a P/B of 0.7x compared to peer average of 1.4x with FY 17 P/B of 0.4x at a discount to a peer average of 0.9x. Furthermore, at current pricing, its 2017E dividend translates to a dividend yield of 6.4%. Our FVE of N16.69 translates to a 32% upside from current pricing.

Consequently, we rate the stock a STRONG BUY, reflecting attractive valuation and a view that fundamentals will improve going forward.