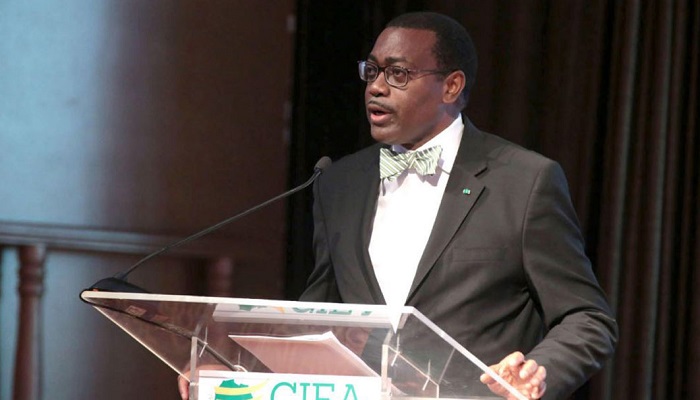

The African Development Bank (ADB) will provide close to $2 billion worth of loans to Nigeria between 2018-2019. President of the ADB Akin Adesina made this known while being interviewed by Bloomberg on the sideline of the commissioning of the bank’s office complex in Abuja. The bank has granted Nigeria about $6 billion in loans till date.

Where will the money go to ?

Most of the money will go towards strengthening the power transmission structure in the country. $250 million will be channeled towards rehabilitating transmission lines in the country, while $200 million on a solar power project in Jigawa state.

$400 million which serves as the second tranche of a $1 billion budget support programme will also be released. The first tranche of $600 million was released in November 2016.

Why is Nigeria borrowing ?

2017 was a difficult year for the country due to a sharp drop in oil prices, as well a fall in crude oil production volumes. The loan is especially key, because it is denominated in dollars. The fall in crude oil revenue, lead to the federal government ramping up borrowing in order to meet capital expenditure. States and local governments had to be bailed out because they were unable to meet salary payments and other obligations.

Crude oil prices have since rebounded to close to $70 a barrel, and production volumes have recovered due to relative peace in the Niger Delta.

About the ADB

The African Development Bank Group (AfDB) or Banque Africaine de Développement is a multilateral development finance institution. The AfDB was founded in 1964 and comprises three entities: The African Development Bank, the African Development Fund and the Nigeria Trust Fund.

The AfDB’s mission is to fight poverty and improve living conditions on the continent through promoting the investment of public and private capital in projects and programs that are likely to contribute to the economic and social development of the region.

The bank’s headquarters are in Abidjan, Cote D’Ivoire.