Africa’s largest mezzanine fund manager, announced today that it has provided $12.5 million of funding to Purple Capital (www.PurpleCapng.com), a prominent Nigerian real estate company and financial service provider. Purple Capital is the developer of the iconic 6,000m² Maryland Mall (www.MarylandMallng.com), a neighbourhood shopping centre in the Ikeja district of Lagos.

The newly opened Maryland Mall offers one-of-a-kind experiences for adults and children, with over 35,000 visitors experiencing the mall’s varied attractions each week. Entertainment options include one of the only skating rinks in Lagos, a vibrant food court, restaurants and over fifty retail shops. The centre is home to leading multinational and local brands including Shoprite, Miniso, Uber, Genesis Cinemas, Stanbic IBTC and The Place. Maryland Mall is located on Ikorodu Road, one of the busiest thoroughfares in Lagos, and entices passers-by with one of the largest LED visual display screens in West Africa.

Purple Capital is headquartered in Lagos and has built a high-quality property portfolio, including upmarket residential estates in the Lekki suburb of Lagos.

Warren van der Merwe, Chief Operating Officer of Vantage Capital, said, “The Purple team epitomizes the best of Nigeria’s entrepreneurial spirit with its ability to navigate a demanding operating environment to create market-leading developments. Maryland Mall is one such development, a uniquely inviting family destination for Lagosians of all ages.”

Johnny Jones, Associate Partner at Vantage Capital, added, “Vantage is currently investing over fifty million dollars from its third-generation mezzanine fund in real-estate projects across Sub-Saharan Africa. We have reviewed over fifty real-estate opportunities since we launched our latest mezzanine fund but have only selected four to support. We are impressed with the Purple team’s cost-effective execution and believe their business is an excellent fit for our investment style.”

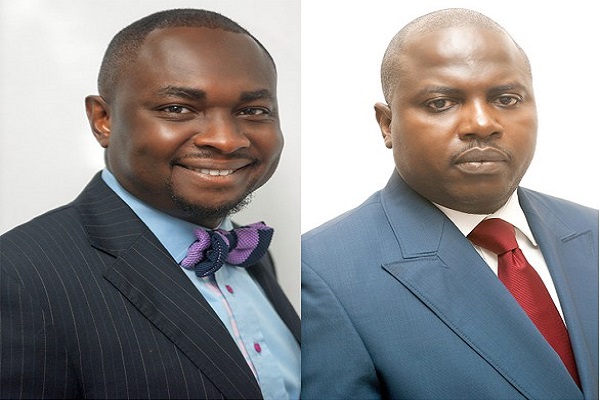

Laide Agboola, Managing Partner of Purple added, “’We are excited about Vantage Capital’s partnership with Purple on this refinancing and investment transaction which helps us reset, consolidate and gear up for exciting opportunities in the future. It also provides a seal of approval and increased possibilities for growth across our focus areas of financial services and real estate development.”

Obinna Onunkwo, Managing Partner of Purple also added, “Our focus on good corporate governance, high-quality deal origination and execution was a strong attraction for Vantage Capital as an offshore investor. Their investment acts as an enabler to our long-term growth strategy in Africa’s largest economy.”

The Purple investment is Vantage Capital’s sixth transaction in Fund III, a $280 million (R4 billion) fund, with a 55% allocation to countries outside South Africa. Purple Capital represents the 24th transaction executed by Vantage across three generations of mezzanine funds with aggregate capital deployed to date of $277 million (R4 billion).

Vantage was advised by Adepetun Caxton-Martins Agbor & Segun, one of Nigeria’s top commercial law firms known for its finance and cross-border M&A work, and Werksmans a leading South African corporate and commercial law firm. Purple Capital was advised by Bloomfield Law Practice, a ‘practical and hands-on’ Nigerian law firm with expertise in corporate commercial, private equity, real estate and financing matters.