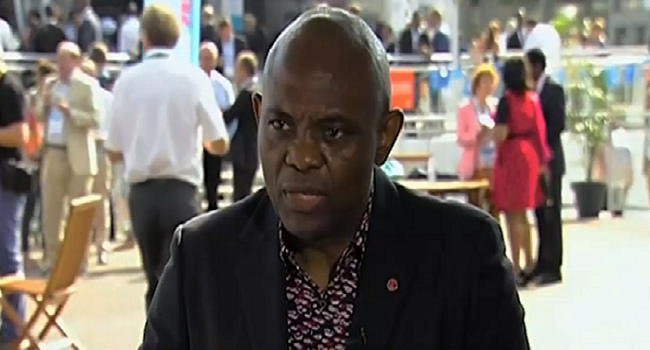

The Ghana Deputy Minister of Trade and Investment Hon. Carlos Kingsley Ahenkorah rained appraisals in Lagos on the innovations Nigerian banks have brought to the banking sector in Ghana. He said in Lagos that the innovation and transformation of the Ghana’s banking sector is credited to the Nigerian banks which invaded the country.

He acquiesced that before the introduction of Nigerian banks, his country’s banks usually demanded for their accounts holders to keep some minimum balance in their accounts, which the Nigerian banks have succeeded to stop.

Specifically, he said “I must be honest to admit that the current transformation in our banking sector is credited to Nigerian banks. Before your banks came, our banks formally demand accounts holders to have a minimum balance in their accounts, until Nigerian banks came out to say you don’t need to have a minimum balance in your accounts before our local banks changed their condition.”

Commending Nigerian Banks, Ahenkorah added that in spite of the obvious changes Nigerian banks have made in the banking sector in Ghana, they are still open to improvement. He also appealed to other Nigerian banks not established in Ghana yet to plant their roots in his country.

Regarding this, he said, “I know your country has many banks. Some of these banks have not come to Ghana to establish their presence, we are calling on these banks to come over to our country and invest. Our government has open door policy for our brothers and sisters in other African countries to come over to Ghana and invest.

“We are appealing to the nationals of all the African countries to come over to Ghana and invest. Africans must learn to trade with one another instead of the nationals of other continents.”

This goes a long way to strengthen relationships and partnerships amongst African countries.