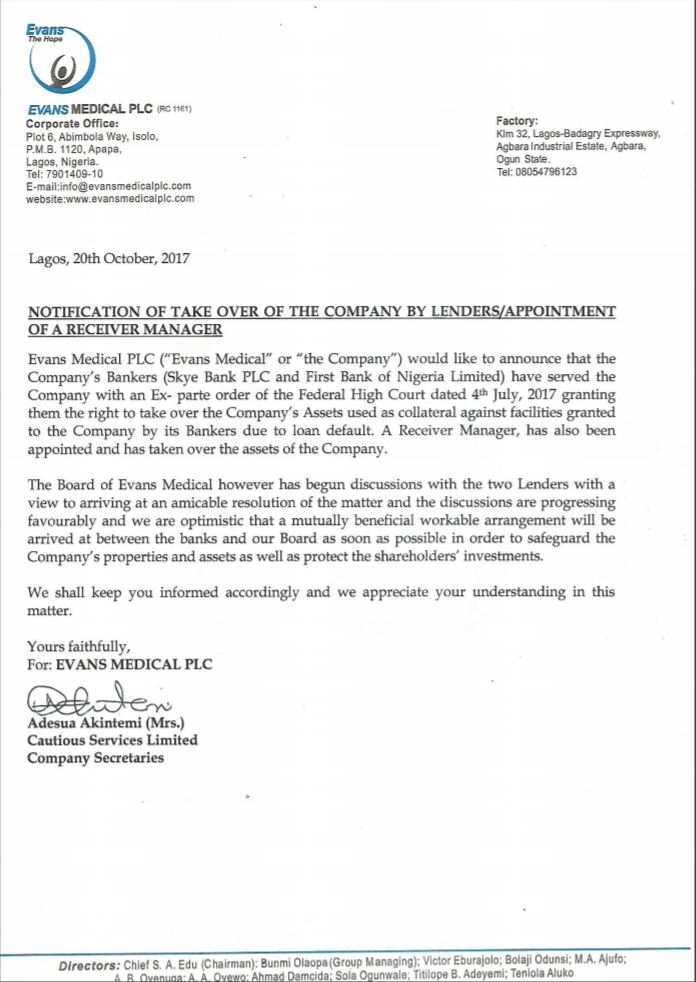

In an unprecedented move for the Health Care Sector, Evans Medical Plc announced on Friday that it has been served an Ex-Parte Order of the Federal High Court.

The order gave Skye Bank the rights to takeover the assets of the company which was used as collateral against loans granted to the company.

Evans Medical, according to the NSE, was to be placed on de-listing watch-list subject to filing Quarterly Compliance Report.

What you need to know about Evans Medical

- Evans Medical last released an annual report in 2014

- Its last interim report was in the second half of June 2015

- In its last interim report, Evans Medical had a total outstanding loan of about N5.7 billion, with N3.7 billion of the loans classified as current liabilities

- In its 2014 annual reports, its auditors PricewaterhouseCoopers stated that there were existence of material uncertainties which may cast significant doubt about the company’s ability to continue as a going concern.

- The company at the time posted a loss of about N1 billion and had just N1.2 billion left as Net Assets.

- The last annual report also shows the company owes Skye Bank, First Bank and the Bank of Industry (BOI). BOI’s loans was N1.1 billion at the time.

- The company claims it has begun discussions with “two lenders” and that it was progressing “favourably and are optimistic” an arrangement will be agreed soon.

Evans Medical Plc is one of Nigeria’s largest Pharmaceutical Manufacturing Company, It started business in Nigeria in 1954 and has since then been committed to the health of the Nation.

See snapshot of Press release below;