On a global scale, there is a silent acknowledgement of the fact that cryptocurrencies are and will continue to gain more relevance. This is with the exception of Nigeria. For the most part, financial regulatory authorities have continued to out their foot down on cryptocurrencies, doing everything they can to make it impossible to use in Nigeria. Now, judges have joined the bandwagon.

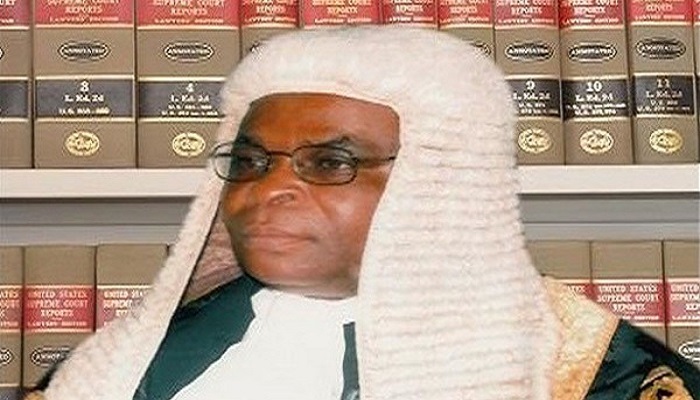

This became clear as, led by the Chief Justice of Nigeria, Walter Onnoghen, they have come out to oppose the use of cryptocurrencies, discouraging Nigerians from doing business with them. According to them, cyrptocurrencies are posing challenges to orthodox financial intermediation models across the world and are disruptive technologies.

Speaking at the National Seminar On Banking and Allied Matters For Judges, the Chartered Institute of Bankers of Nigeria (CIBN) also aired the same view and called for proactive measures to mitigate the impact of the trend.

“One of the side effects of the disruptive technology, artificial intelligence and other new tools is the use of the same technology to undermine the control systems in banks and other financial institutions. Unfortunately, fraudsters are usually a step ahead of operators, and operators are usually a step ahead of regulators. This explains why policies and regulations aimed at fighting crimes, albeit cybercrimes, are more reactive than being pro-active. We need the judiciary to improve on the speed at which cybercrimes are tried and dispensed with. We need the judiciary to assist in strengthening the statutory framework for fighting cybercrimes in this country,” Prof. Segun Ajibola, head of CIBN said.

Earlier this year, the Central Bank of Nigeria (CBN) had issued a statement barring deposit money banks and all other financial institutions from the operation of any form of virtual currencies, stressing that they are not recognised as legal tenders in Nigeria. How long and how successful can they be against this growing global wave?