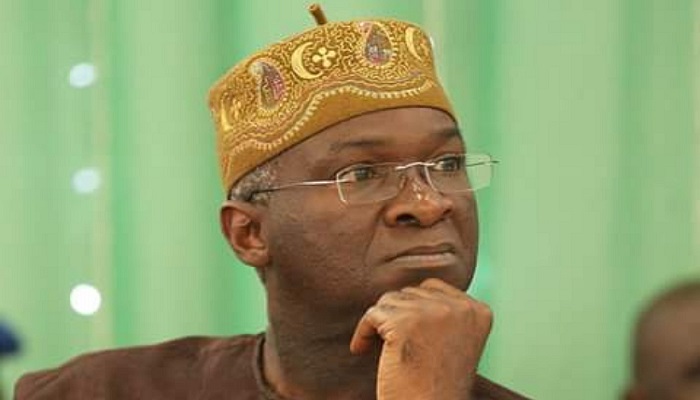

Minister of Power, Works and Housing Babatunde Fashola has revealed intentions of government to reintroduce tolls on the country’s expressways. Fashola made the disclosure while addressing members of the Manufacturing Association of Nigeria (MAN) who visited him in his office. Toll gates would be installed on roads that have been completed by government, which recently raised funds through a Sukuk bond. N16.7 billion will be allocated to each geo political region in the country to fix federal roads.

Roads projects being prioritized include Ibadan-Ilorin road, Suleja-Minna road, Kano-Maiduguri road and the Lokoja-Benin road. Others are the Enugu-Port Harcourt Expressway and the construction of the Kaduna Eastern By pass.

How government benefits

Government is hampered by a lack of funds to maintain roads in the country, due to a drop in income and other competing needs. Tolling the roads, frees funds for the government which can be applied to other pressing areas such as security.

What is different this time

The Federal Government in the late 80s and early 90s introduced toll gates on various highways in the country, but the exercise was marred by corruption, and under remission of revenue by the operators. To curtail this, government will make payment of the tolls electronic, as is currently optional on some tolled roads in the country. This reduces cash payments, and ensures money is credited directly to bank accounts.

Are there other options ?

Some analysts have argued that the Federal Government should hand over some of the roads to state governments. Others have also suggested that the roads be concessioned. Concessioning will involve handing the roads to private companies for a fixed period of time. The companies will then recoup their expenses from tolls and other sources of revenue.

Implications of the move

Reintroducing tolls could lead to an increase in transportation fares as transporters may decide to transfer the costs to passengers. This could also affect prices of goods and services, as virtually every commodity in the country is moved by road.