On this Episode of Everyday Money Matters, Tunji and Ugo answer several questions on tax payments, pension and insurance, as well as how an artisan can grow his business without compromising quality.

Question: My business has been operating for 4 years, how do i get a tax clearance certificate ?

Answer: Ugo says it is advisable to get your tax clearance certificate in the first 18 months of your business. When you start a business, get a Tax identification Number (TIN) after registering with the Corporate Affairs Commission (CAC).

TIN unifies VAT and income tax registration. If you are doing anything with banks or corporate, they will ask you for a TIN. Keep record s of your expenses, and deduct 5% of everything that is VATable.

To get tax clearance, get your books audited. Companies with a turnover of N5 million per annum, would be charged around N80,000 to be audited. Companies with a turnover of N10 million per annum, would be charged around N150000 for auditing.

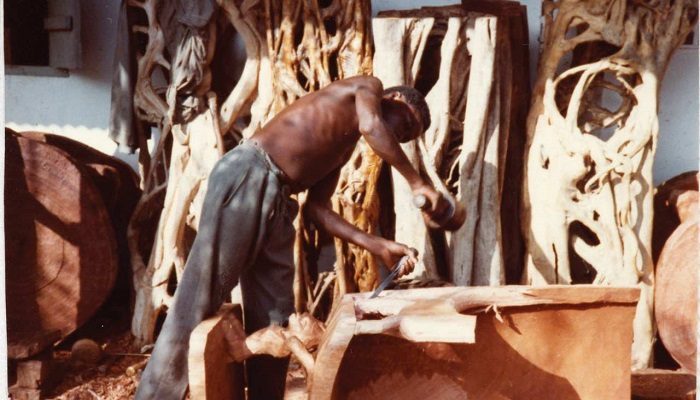

Question: Henry from Ojo is a wall finisher who specializes in plastering, but has not registered his business. Clients are not willing to pay for a standard plastering job. How can he make his business different?

Answer: Ugo might have to do several jobs at a discount so word of mouth from satisfied clients will eventually sell him. He should also inform them of this, so they will recommend him to other clients. Henry should not dilute the quality of his business for any reason. He should also register his business so people know he is a professional.

Tunji says Henry should open an instagram account and record some videos, as his business is a visual one. He should also put some showmanship while doing that. In addition, he should not work for free, but can ask for referrals or endorsements in place of money.

Malik, a caller says Henry should go to the rural areas where jobs are available. Once people see his handwork, he will get jobs.

Question: Bola, a caller would like to know if his colleague should pay pension and insurance on a salary of 35,000.

Answer: Tunji says pension payments are a proof of income and could be useful when applying for a loan. There are several insurance pacakages that work by deducting small sums of money or airtime.

Ugo says pension is statutory, while insurance is voluntary. She should focus on the pension, while she tries to grow her income.

Everyday Money Matters holds On Wednesdays between 7.30am-8.00am on LagosTalks 91.3 Fm. You can follow the conversation on twitter using the hashtag emm