For all intent and purposes, it looked like the perfect scenario- a multi-billionaire native industrialist coming in to invest several millions of dollars in order to produce a commodity that the country was spending billions of Naira importing at a time when the forex crunch was at its hardest. This fairy tale stayed at just that- a fairy tale- for the state-of-the-art, billion-Naira Dangote tomato paste constructed in Kano Nigeria. For many, and probably most important for the Federal Government, that plant was supposed to save the country 400,000 tons of tomato paste imports annually and millions, if not billions of dollars. Unfortunately, the plant lies idle with several attempts to resuscitate it failing.

For Aliko Dangote, owner of the plant and Africa’s richest man, the greatest dent is probably to his ego as a businessman. For someone used to success, this blip could be irritating. In financial terms, though, the N4 billion or $12.74 million investment sitting idle is unlikely to cause any sleepless nights for a man whose cement business alone posted revenues worth N615 billion in 2016. And in any case, he has made arrangements to get his raw material himself, so the plant will work. It’s just a matter of when.

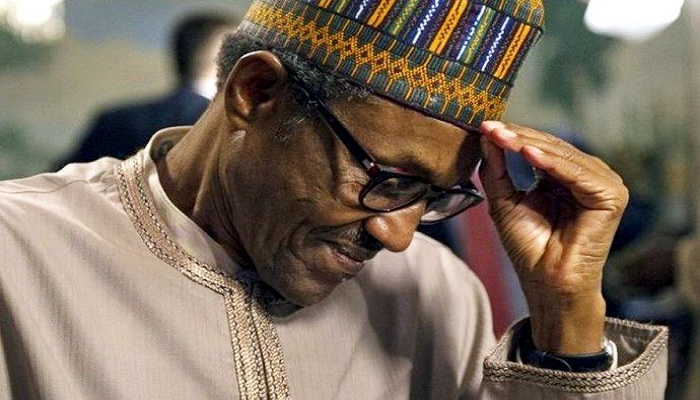

For the Muhammadu Buhari-led administration, this is another story entirely. One of the President’s mantras has been “We must produce what we eat.” Unfortunately, so far, his administration has failed at solving the problems that plague the agricultural sector. To make matters worse, this is coming at a time when oil prices have dipped significantly, effectively shrinking the government’s revenue as oil exports are responsible for over 70% over government revenue. As a result, the FG emphasized on diversifying the economy with agriculture voted as one of the most promising substitutes. So far, agriculture has not lived up to its billing.

This is not to say that the Buhari administration has not done anything in this regard. To encourage agriculture investments like the Dangote plant, the government has waived duties for greenhouse and processing equipment. Rice farmers, and very soon, tomato farmers benefit from subsidies from the FG. Despite these attempts, hardcore problems continue to hamper the rise of agriculture as a substitute for oil.

Take the tomato paste issue as an example. Nigeria produces a whopping 1.5 million tons of tomatoes annually. About half of what is produced, 750,000 tons of that is wasted each year. Given that Dangote’s plant can run a full capacity of 1,200 tons a day, the wasted tomatoes in Nigeria in one year can keep Dangote’s plant busy for 625 days or 21 months.

Yet, bad roads, erratic power supply and an obsession with producing oil are results of decades of endemic corruption where government has focused on what can bring in money for its members rather than infrastructural development. This has also affected agricultural practices. Low quality seed, scarce irrigation services, lack of storage facilities and the ever-greedy middle men are other problems that the FG need to tackle if agriculture is to take a central position in country’s economy.

If not, there is trouble on the horizon for the FG. There are not many other investors apart Aliko Dangote, if any at all, that can afford to keep workers on a N5 million per month wage bill for doing nothing while their investment remains idle. Already, another tomato factory in Lagos threw in the towel in November 2016, unable to import tomatoes due to a lack of hard currency as Nigeria struggles with recession. Investment, job creation, forex conservation and self-sufficiency will all continue to be dreams if investors continue haring stories like these. Oil will continue to reign supreme and diversification will go down as another fantasy of the Buhari administration.