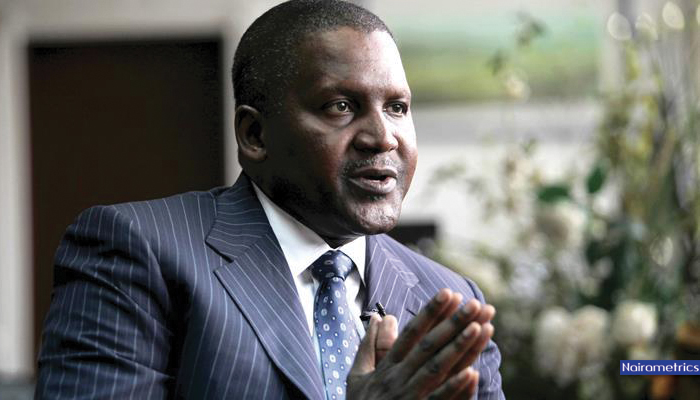

Aliko Dangote is known as Africa’s richest man and a big time business man with operations across the contient. According to Forbes, Dangote has an estimated net worth of $13.5 billion. So how was this net worth arrived at ? Forbes uses holdings in publicly listed companies that are easily verifiable. Here is a break down of how Forbes arrived at his net worth

Dangote Cement $9.6 billion

Data from the 2016 Annual report of Dangote Cement Plc shows Aliko Dangote is the beneficial owner of Dangote Industries Limited (DIL). DIL holds a 90% stake in Dangote Cement totalling 15,494,247,300 shares. Besides this, Dangote also holds 27,642,637 shares totalling 0.16%. Dangote Cement shares closed at N225 per share totalling N3. 4 trillion. Using an exchange rate of N362.5 to a dollar of the estimated value of the DIL stake is $9.6 billion, while his stake in the firm is worth N6.2 billion or $17.1 milllon.

Dangote Sugar $310.1 milllion

Alhaji Dangote through DIL and in his personal capacity holds 8,775,541,295 shares in Dangote Sugar Refineries Plc. Using last Friday’s NSE closing figure of N12.81 per share, the total value of the shares is N112, billion which equates to $310.1 million.

National Salt Company (Dangote Salt) $58.2 million

DIL holds 1,647,763,557 shares in the company. Using last Friday’s NSE closing figure of N12.81, total value of the shares is N21 billion. Converted to dollars, that equates to $58.2 million.

Dangote Flour Mills $62.6 milllion

Dangote Industries Limited holds 3,783,277,052 shares in the company giving him a 75.67% stake. At last Friday’s NSE closing figures of N6 per share, his stake in the firm is valued at N22.6 billion translating to $62.6 million.

In addition to holdings in these companies, Dangote has other investments in unlisted firms, as well as real estate which can take his net-worth above $13 billion as calculated by Forbes.

What affects his networth

From the breakdown above, one can deduce, the share price of his entities and the exchange rate between the naira and the dollar is a strong determinant for determining his net-worth. If the exchange rate strengthens in favour of the naira and the share price of his companies appreciate, his net-worth will rise.

Comment:pls i need your help everything has become high pls