Last week, the Finance Minister, Kemi Adeosun announced that the Federal Executive Council had approved a plan to refinance $3billion (N1.1trillion) worth of Nigerian Treasury Bills with issuance of 3-year dollar bonds. The aim of the plan, which is still to go the National Assembly for approval, is to lower debt service costs as by switching domestic debt for external borrowings, the FG would incur lower interest costs by replacing the former with the latter.

Despite higher oil prices prior to 2014, a lack of fiscal discipline under the Jonathan administration implied that alongside record oil receipts, Nigeria embarked on a domestic borrowing spree which underpinned an upswing in debt service costs.

However, in 2016, following the collapse in crude prices and attacks on oil production, the FG was forced to rely on domestic borrowings to plug the shortfall. Even worse, soaring inflation which pushed the CBN into tightening mode implied that these borrowings were at more expensive interest rates. Unsurprising debt service costs jumped in 2016, with the ratio to fiscal revenues spiking to 45%. In simple terms for every N100 the FG earned, it paid N45 to finance debt.

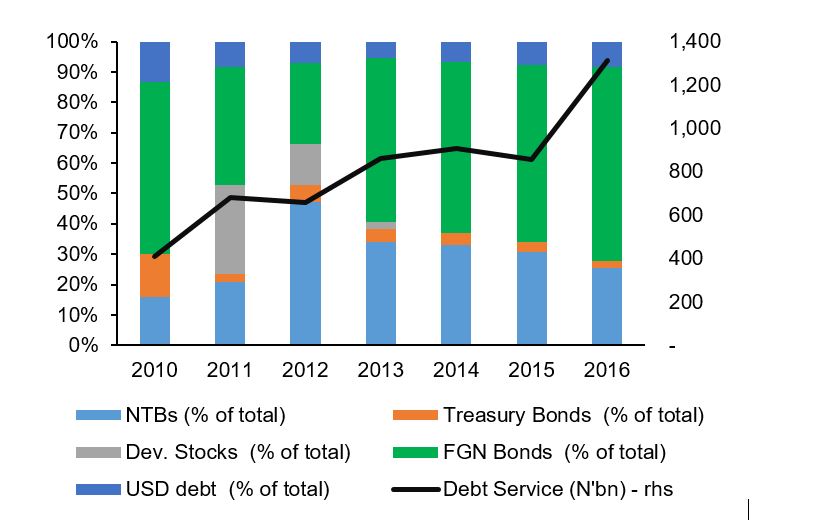

Figure 1: FGN Debt service components

Source: CBN

Over the last seven years, interest costs on NTBs has accounted for 30% of debt service costs and the total outstanding debt amounted to N3.6trillion at the end of Q1 2017. As is clear from the chart above, the larger share of these costs emanated from domestic debt, which is catalyzing the need to refinance.

So, will the refinancing plan lower debt service costs?

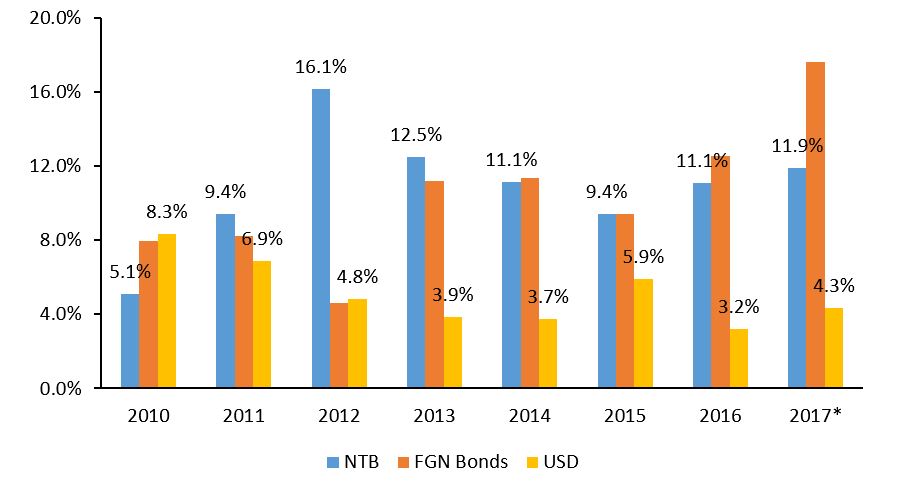

From data available from the CBN, NTB debt service payments amounted to N102billion in Q1 2017 (2016: N336billion). Assuming all things remain constant, for the sake of analysis, the proposed 30% cut implies a N31billion slash in quarterly NTB debt service and by extension N93billion per annum. As stated in the press conference, the NTBs would be financed via issuance of a $3billion Eurobonds in 2018 at 7-8% which translates to extra debt service costs of $210-240million per annum (N64-73billion using N305/US$).

Assuming one uses the current interbank rate N366/$, an event which is likely in 2018 as the majority of FX rates now hover between N360-370/$, the incremental debt service cost rises to N77-88billion. Under this scenario, the plan saves only N5-16billion (less than 1% of budgeted 2017 debt service cost). In summary, the savings from the NTB refinancing plan are negligible. This would appear to explain why fixed income markets, after briefly turning bullish on the Thursday morning post announcement, are now firmly in bearish mode.

The reason behind the minuscule nature of the gain from the plan is that it does not address the two elephants in the room. Firstly, the plan does not tackle FGN bonds which account for over half of debt service costs (2010-16 avg: 51%, Q1 2017: 68%) without which it’s hard to lower debt service costs. In addition, it refused to address the cost issue with interest rates where CBN’s record paper issuance in the last two years has underpinned a steep rise at the short end of the yield curve.

To support the currency the CBN has launched a blistering attack on system liquidity which has seen the apex bank net issue N1.95trillion worth OMO bills alongside N1.1trillion in Stabilization Securities relative to net FGN borrowings (NTB and bonds) of N1.58trillion. Outside a solution to lower cost on bonds and monetary easing the Finance Ministry’s plan to lower debt service costs appears more of a fairytale than real world. A more cynical mind would add that the move entails greater risk given the naira’s one-way street history against the dollar. If oil prices trend lower again, devaluation risks would more than offset anticipated savings from the dollar debt.

While some will argue that Nigeria earns a lot of USD from oil, the developments over the last few years suggest the era of $100/bl oil are unlikely to re-appear anytime soon. Worse our growing population and by extension import demand implies the ability of the CBN to get away with import suppression policies as in the last two years is limited. Thus, a policy of substituting debt matched to recurrent expenditure, which is what NTB debt is typically used for, for dollar debt merely stores up trouble in the future.

Figure 2: Estimated Interest rate on government debt components

Source: Authors computation *Q1 2017 annualised

What then should the FG do?

The refinance approach avoids the 800pound gorilla in the form of FGN bonds and leads to tiny gains. A more commonsense approach would involve the FG buying back some bonds. Ideally, this would occur if the FG had inserted callable options on these bonds but as things stand the FG is locked in and any attempt at restructuring is legally inadmissible and is a technical default. The only hope, given the current conditions, is for the FGN to wait for a period of monetary easing and buy-back bonds in the secondary market and re-issue those bonds at more manageable rates.

Does monetary easing appear on the horizon? Though inflation has started to decline, the CBN has maintained a ‘no retreat, no surrender’ approach in 2017 reflecting its desire to limit the amount of naira available for dollar speculation. However, at some point over 2018, inflation is bound drop below the 12% threshold the governor bandied at the July 2017 MPC which implies scope for easing. Given the scale of likely CBN bill issuance in 2017 with its outstanding obligations now over N7trillion (2016: N5.6trillion), monetary easing is likely to be accompanied by a steep collapse in interest rates. Given the inverse relationship between bond prices and yields, prospects for lower interest rates imply high bond prices. Thus,

In 2015, the CBN eased monetary policy in Q4 but the FG for whatever reason simply did not bulk up its borrowings over the period. We are potentially at another juncture in 2018, the finance minister is best advised to drop this refinancing idea and plan towards establishing a program to buy-back some of this debt at lower rates. Yes, the idea would involve paying a premium upfront but it far outweighs the currency mismatch headaches inherent in the refinancing plan. NTB debt is largely used to finance recurrent expenditure and meet short-term fiscal obligations. Rolling this up into medium term debt of a different currency worsens the problem. The underlying income and expense associated with NTB borrowings are naira denominated so why introduce exchange rate mix into the picture.

[1] Using Interbank USDNGN rate of 366. Using the official exchange rate implies a refinancing of N915bn worth of bonds.

Insightful. Thank you

Good luck to them .govt or any analyst.the issue is neither here or there.refinance in dollar or naira does not exist.if the govt refinance treasury in naira or dollar.they will be still trapped.loss of earn in oil cannot affect the economy and I am sure the govt knows about this.THE PRIVATE SECTOR HAVE STARTED TO BORROW OR REFINANCING IN DOLLAR.

THE NATION OR THE ECONOMY HAVE MOVED ON.THIS DATA USED IN THIS ANALYSIS IS OUT OF DATE BY 2 YRS.the economy is overreaching everything,it is cleaning up even in Nigerian politics,anybody who uses ths data is a demented man