United Bank of Africa, (UBA), announced earlier in the week that it had obtained shareholder approval to cancel over 2 billion ordinary shares held in trust for its Staff Share Investment Trust. An article from Nairametrics suggested the transaction could result in a cash windfall for the Trust as a cancellation of the shares implied a corresponding reduction in cash or share capital.

Contrary to our earlier opinion, some of our analysts have clarified some of the issues surrounding the cancellation of the shares. According to our sources, no cash will exchange hands in the deal, as the shares in question were not held by any staff member of the bank but rather held in trust for staff who could potentially own it. Thus, it can’t be termed a buy back.

Explanation

Staff Share Investment Trust (SSIT)

The Staff Share Investment Trust is a scheme setup in the Standard Trust Bank days (STB) and was used to hold shares in STB on behalf of staff. The bank at the time used it as a reward to their staff who have met defined performance benchmarks.

For example, a company looking to reward its employees can do so in a number of ways. It can decide to pay its staff bonuses, give them long service awards, send them on all expense paid vacations, buy them gifts or as in this case, offer them shares in the company.

Startups, (as STB was at the time) typically offer their earliest employees equity in their company in exchange for loyalty or consideration. However, before this shares is vested , the employees must achieve the set performance benchmarks.

Vesting, is a financial term for transferring or bestowing an asset to someone or an entity after a condition may have been met within a stipulated period. In this vein the shares was never transferred but held in trust for the shareholders

UBA is therefore saying that the over 2 billion shares they are cancelling represents shares that they had purchased on behalf of staffs and would have transferred it (vested it) to them had they met performance metrics. Cancelling the shares now suggest, those metrics were probably not met and as such will now be “repossessed” by the bank.

We however understand that the remaining portion of the shares held in trust and amounting to about 151 million units is unaffected by this move.

Will cash be paid in lieu of the share cancellation

UBA carefully used the word “repossessed” in explaining their actions insisting that this transaction was not going to cost the bank a kobo. According to them, since they had already paid for this shares in the past and have now decided not to transfer it to employees, they are simply taking it back. Also, since Nigerian laws does not permit companies to hold their own shares, they will have to cancel it.

Unanswered Questions remain

Despite the robust explanations by the bank, a few pertinent questions remain unanswered. Figures from the 2016 annual report of the bank show the Earnings Per Share was calculated using 34,054,857,094 shares, excluding the shares held by the SSIT.

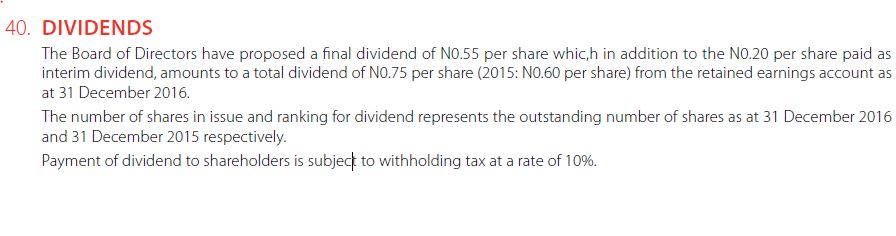

Dividend per share is however calculated using 36,279,526,321 shares which including the shares held by the staff investment trust.

Put simply, the bank has used two different outstanding share figures to calculate earnings and dividend per share respectively. In addition. the bank’s balance sheet does not contain any entry in respect of the dividends and bonuses accruing to shares held under the trust. As the confusion rages, the bank has maintained silence in the midst of a lack of transparency. Emails to the bank’s investor relations unit have not been replied, as at the time of posting this story.

Put simply, the bank has used two different outstanding share figures to calculate earnings and dividend per share respectively. In addition. the bank’s balance sheet does not contain any entry in respect of the dividends and bonuses accruing to shares held under the trust. As the confusion rages, the bank has maintained silence in the midst of a lack of transparency. Emails to the bank’s investor relations unit have not been replied, as at the time of posting this story.