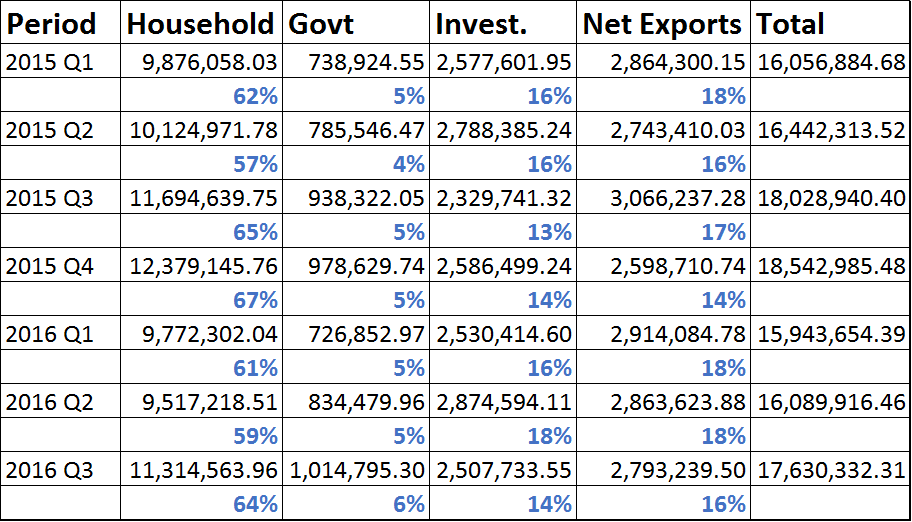

Data from the National Bureau of Statistics show Nigerians spent a N11.3 trillion in the third quarter of 2016 as household consumption expenditure. This was a whopping N1.79 trillion higher than what was spent in the second quarter of the year.

The data is obtained from the Bureau’s third quarter GDP by expenditure report which measures Nigeria’s gross domestic product from the point of view of expenditure. The more renowned way of estimating a country’s GDP is via its production.

However, the expenditure approach which still results in the same estimates shows the impact of Government, Investments, Household and Exports has on a country’s GDP. It is also our favourite way of looking at GDP at Nairametrics.

[wpdatachart id=114]

GDP by expenditure 2015 – 2016 (tip click on the labels to toggle charts)

Household Expenditure

Household consumption refers to the amount spent personally by all Nigerians to acquire goods and services within the country. According to the data, Nigerians spent N11.3 trillion in the third quarter of 2016 compared to N11.69 trillion spent in the corresponding quarter of 2015. Household expenditure for the third quarter was also 64% of GDP compared to 66% in the corresponding quarter. Sub-Saharan Africa as a household consumption expenditure to GDP of about 69%.

As the chart above depicts, the drop-in household consumption in the first and second quarter of 2016 may have contributed significantly to Nigeria’s fall into recession.

What this means? This suggest that Nigeria’s GDP growth rate is driven largely by Household Consumption. As the chart above depicts, household consumption expenditure has always been a larger component of spending in the economy.

Government Expenditure

According to the data Government Expenditure was N1 trillion in the third quarter of the year compared to N938.3 billion in the corresponding period last year. This perhaps reflects challenges with funding the budget amidst a dip in government revenues since 2014. Government expenditure was therefore just 6% of total spending though up from 5% last year.

What it means – This is a relatively low figure considering that the government is thought to drive the economy via spending. However, it also mirrors the fact that Nigeria’s budget is not even up to 10% of our GDP confirming that the private sector drives economic growth in the country

Investments Expenditure

Nigeria’s investment expenditure was N2.5 trillion in the third quarter of 2016 compared to N2.3 trillion in the corresponding quarter in 2015. This means a total of N2.5 trillion was committed towards investment in the country. Investments into Nigeria also makes up about 14% of total GDP compared to 16% in the corresponding quarter. On the average investments contribute about 15% of GDP.

What it means – Despite the harsh economic environment, Nigerians kept to the same level of investments.

Net Exports

This is the difference between Nigeria’s export and import. A positive net export means that Nigerians exported more than they imported. Nigeria recorded a net export of N2.8 trillion in the third quarter of 2016 compared to about N3 trillion in the corresponding period in 2015. The data also shows total exports for the period was N4.5 trillion compared to imports of about N1.7 trillion. Nigeria’s Net exports was about 16% in the quarter under review down from 17% in the same period in 2015.

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg?resize=75,75)

‘the private sector drives economic growth in the country.’ As usual.