In a notice sent yesterday to the Nigerian Stock Exchange (NSE), Julius Berger stated its intention of going into partnership with Petralon energy an oil and gas firm. The two companies intend to develop oil fields.

A common denominator between both firms

The two companies in question have a common denominator, Mutiu Summonu as chairman. Summonu was the former Managing Director of Shell Petroleum Development Company (SPDC) and Country Chairman of Shell Companies in Nigeria, and has over 30 years’ experience in the oil and gas industry. Mike Adenuga taking a more active role in the company could also mean he would be amenable to an oil and gas partnership. Prevailing low crude oil prices means many oil and gas assets will be trading cheaply.

Why is Julius Berger making this move?

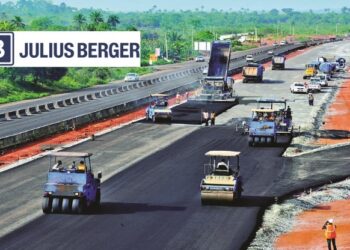

For the construction firm, the move is a strategic one, competition from Chinese firms has made the construction industry less attractive. The Federal Government in September 2016 signed a $5.1billion contract with the China Civil Engineering Construction Corporation (CCECC) for construction and rehabilitation of railway lines across the country. The Chinese firms can get cheap financing from their home country at single digit interest rates, and can also go ahead without waiting for mobilization. Excess capacity in China, means labour and equipment are available at a cheap price.

The Federal Government currently owes contractors including Julius Berger, billions of Naira, and these loans have hampered their operations. The recession has also made the private sector to cut back on construction activities, and many real estate developments have seen a drop-in occupancy rates.

Petralon also benefits

Petralon energy is a relatively new company, so partnering with Julius Berger (and indirectly with Mr Summonu) gives it access to capital and connection in high places. The Federal Government is also scheduled to hold a licensing round in 2018, and the company will have a greater chance of success by partnering with a bigger company. Petralon energy began operations on its first oil field in partnership with Tako E&P Solution in 2014. Julius Berger was established in 1950 and is one of Nigeria’s oldest construction companies.

Mutiu Sumonu is chairman of both Petralon Energy and Julius berger. This is simply a synergistic effort in addition to his previous experience in Shell