The Asset Management Company of Nigeria (AMCON) has announced that it is awaiting CBN’s approval to sell the Peugeot Automobile Nigeria (PAN) Ltd to Aliko Dangote, and two Nigerian states.

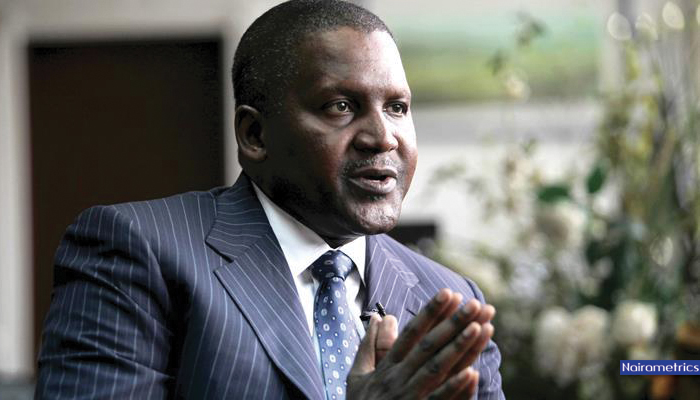

According to Reuters, AMCON is “close” to concluding the deal and only just awaiting regulatory approval. Here is AMCON’s CEO, Ahmed Kuru

“We have concluded all processes on the bids since about two months ago, all we are waiting for (now) is the approval of the central bank,”

PAN Acquisition

Last year, March 2016, the government of Kaduna state announced that it had tabled a bid to acquire the vehicle assembly plant from AMCON, hoping that it will help it create jobs.

PAN is located in Kaduna state and has PSA Peugeot Citroen as its technical partner with a capacity to assemble 90,000 cars a year, according to its website. Kaduna state restructure it to operate to full capacity of assembling between 90,000 and 100,000 cars yearly. PAN is also said to be worth about N15 billion based on its last valuation.

The acquisition according to Reuters, will be made by a consortium of Dangote, Kaduna and Kebbi and the Bank of Industry (BOI). The name of the consortium is not yet stated.

The automaker is worth over 15 billion Nigerian naira ($49 million) according to its last valuation, Kuru said, but declined to name the company Dangote and his partners are using to acquire the automaker.

Why this favours Dangote?

- Since Alhaji Aliko Dangote changed his strategy from trading to manufacturing almost two decades ago, central upon his focus, was to acquire moribund government assets on a cheap, turn them around and turn them into money-making behemoths.

- The same strategy was applied with house hold names such as Dangote Cement and NASCON. PAN will be a new additional to this deal and with an expected concessionary interest rate from BOI, it could use its economies of scale to turn the vehicle assembly plant into a major competitor.

- Since PAN also has an installed assembly plant, land and other possible assets he can leverage on, he can deploy is large economies of scale to execute a turnaround for the company.

- Kaduna state also provides it with a political leverage it can also use to reduce its business turnaround time, while building on his contacts in the North to increase market share.

- Dangote already has major links across the political divide, both in states and the federal government and could also strike a deal that will see government functionaries use Peugeot as official vehicles. PAN was the official vehicle used by government functionaries in the nineties.

- This announcement also comes just days after the Federal Government issued executive orders favouring the consideration of Made in Nigeria for most government procurement.

- Dangote’s refinery plans also provides an additional vertical for this potential acquisition.

- It is also instructive to add that Peugeot vehicles are easier to handle by Nigerian mechanics and could present a cheaper option for millions of Nigerians looking to own their first vehicles,