Nairametrics| As a result of claims that made the rounds a few weeks ago, the Central Bank of Nigeria (CBN) has released a new guideline to prevent a repeat occurrence of what the bank termed to be ‘a misunderstanding’.

The CBN’s new directive now requires that banks file their returns on the sale of foreign currency in dollars to avoid ambiguities, which the apex bank claims is partly responsible for the misunderstanding that led to erroneous media reports.

[read more=”Read more” less=”Read less”]

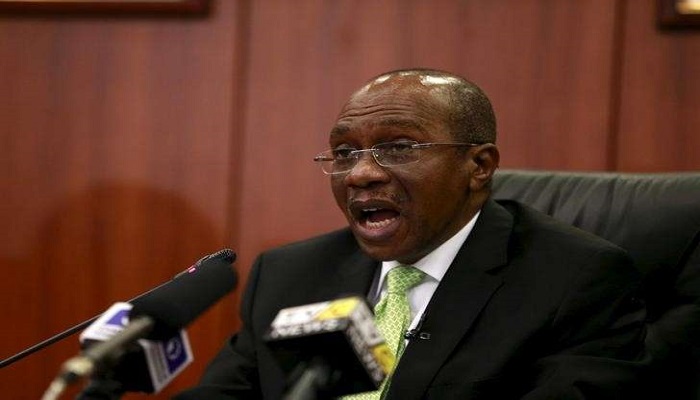

According to the Acting Director of Communications in CBN, Isaac Okorafor, the allegations of inconsistencies in the foreign exchange rates given to foreign exchange buyers by the CBN was rather a reflection of transactions in third currencies such as the Japanese Yen and South African Rand.

“Following observations of different exchange rates after the last publication on our website, we called for explanations from the banks concerned. In response to our queries to them, apart from some observed formatting errors, the concerned banks reported that the returns were sent on the basis which the transactions were conducted. The transactions concerned were consummated in third currencies such as Japanese Yen and South African Rand (YEN/ZAR), Euros to Dollars and Dollars to South African Rand (USD/ZAR).”

“As a result, there is no way any DMB or the CBN will deal in forex transaction at the rate of 61 kobo to the dollar, N18 or N3 to the dollar as was erroneously reported. The aforementioned are third currency transactions and when properly translated, will be in line with the prevailing forex rate range in the interbank market,” Okorafor said.

It is as a result of this the CBN is now requiring banks to report the purchases and sales of foreign exchange between the commercial banks and their customers in dollars to prevent this misunderstanding from repeating itself.

[/read]

so what is known as a cross rate can cause so much confusion….our press are financial illiterates or plainly mischievous

it can cause so much confusion