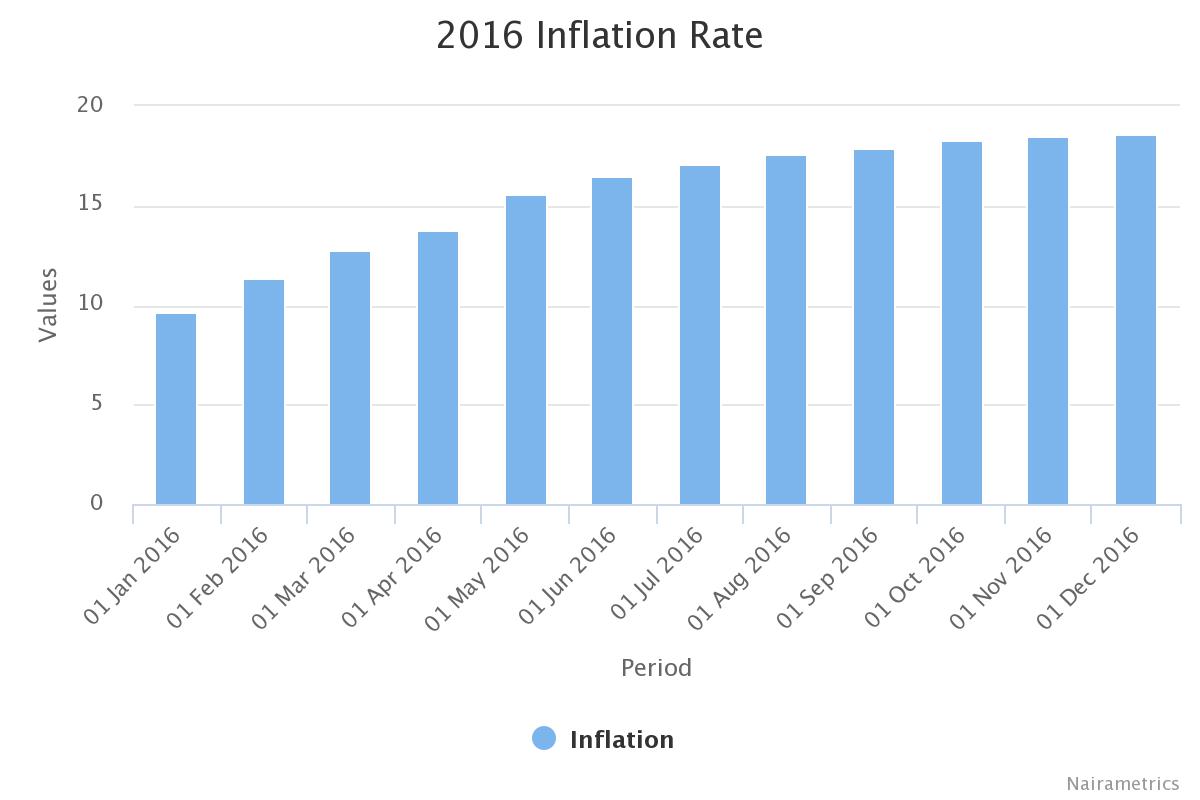

Inflation nudges further… festive season impact inherent

The rate of increase in inflation sustained its upward trend to close 2016. The National Bureau of Statistics (NBS) announced this morning that compared with December 2015, prices rose by 18.55 percent. With the numbers in December, Headline inflation, thus averaged 15.6% in 2016 (highest annual average reading since 2005). Breakdown of price sub-indexes shows critical upside impact from the food inflation index, which rose by 133 basis points to 17.39% while the Core Inflation index, rose by 62 basis points to 18.1% from 17.48% in November.

The rise in the Food index was significant when price increases between consecutive months are measured, advancing 45 basis points to 1.33% in December from 0.88% in November. This highlights the strength of the impact of Food inflation on the cumulative measure. December also saw a marginal 9 basis points decline in the Core index, from 0.71% to 0.62%. The aggregate impact of the two indexes led to moderation in the Headline Inflation to 0.78% from 0.83% in November.

The released data emphasizes the impact of price increases in the Food department as the driver of aggregate prices. Additionally, we belief that, the faster pace of adjustments in price increases between consecutive months suggests a strong impact from festivities-related spending in December. Also, that Food inflation trumped Core inflation in the month under review suggests waning impact of the exchange rate on imported consumer goods. It also imply that consumers were more traditional in their spending habits in the outgone festive season.

[wpdatachart id=80]

IMPLICATIONS OF INFLATION DATA

Policy

Heading further into 2017, status quo deserves attention to mitigate underlying risks, primary among which is the exchange rate. Although, recent readings indicate a favorable oil price trend in the international market, the diversification of country’s revenue base need to be fast tracked to boost economic recovery. On balance, policy tightening has been over stretched and easing is long overdue to manage these challenges.

INFLATION OUTLOOK

We expect a lower inflation rate of 18.38% in January 2017. We have observed the steady decline in Core Inflation and in the month-on-month adjustments in recent months. In addition, the naira if likely to lose some additional value in the coming weeks if the MPC outcome fail to meet market expectations. Despite these underlying factors, the impact of the high base effect that characterized inflation numbers in 2016, should see some level of decline in 2017 price levels.

Download this article as report below;