The National Bureau of Statistics last week reported that Nigeria’s household consumption real GDP growth rate for the 1st and 2nd quarter of 2016 was -1.06 and -6% respectively and -1.3% for the first half of 2016. They also reported that compensation for employees in Nigeria generated a real GDP growth rate of -10.68% and -17.58% respectively and -14.27% in the second half of 2016. These set of data confirms that ordinary Nigerians are neck deep in a recession.

The Bureau arrived at this conclusion using the GDP by Expenditure and Income approach. Unlike the production approach, the income and expenditure approach basically estimated Nigeria’s GDP from the point of view of the income and expenditure of Household, Government, Investments and Net Exports. You still arrive at the same GDP numbers and growth rate as the production approach.

In contrast to household’s still in recession, the data shows that the government avoided recession by returning to growth of 6.2% in the second quarter of 2016 compared to a contraction of -22.6% in the first quarter. This is probably due to the reported implementation of the 2016 budget in the second half of 2016.

Household Consumption

According to the Bureau, in the first two quarters of 2016, household consumption fell year on year in real terms, by 1.05% in the first quarter, and by 6.00% in the second. This according to the bureau, reflects the difficulties that consumers have faced in recent quarters, with rising unemployment, and high inflation eroding purchasing power. In 2016, unemployment rose to 12.1% and 13.3% in the first and second quarter of 2016 compared to 7.5% and 8.2% in the first and second quarters of 2015. However, the higher prices resulted in year on year growth in nominal consumption remaining positive. Household Consumption also accounted for 58.11% of real GDP in the first quarter of 2016, and 58.55% in the second.

Employee Compensation

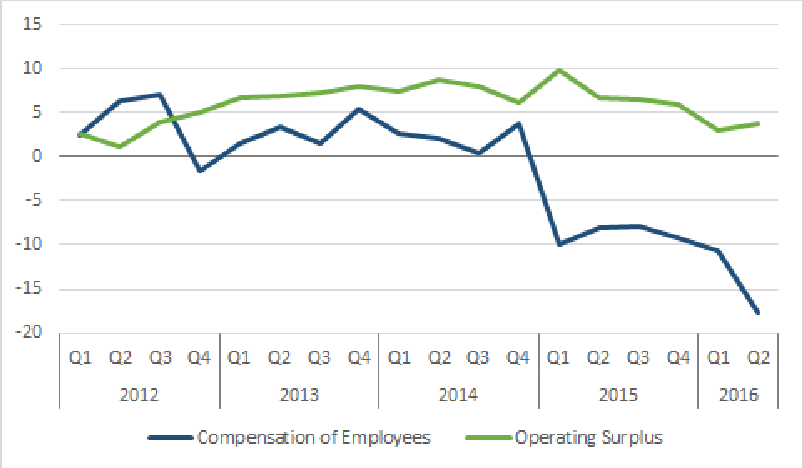

Employee compensation which measures compensation of formal sector employees has recorded negative year on year growth since the beginning of 2015. Things however got worse in 2016 as employee compensation contracted by -10.68% in the first quarter and –17.58% in the second quarter in 2016. This according to the Bureau were the lowest on record. Job creation in the formal sector was also the lowest recorded in the first quarter of 2016, and was less than a quarter of the average over 2013-2015.

In contrast, the informal sector, which according to the Bureau is made up of business profits and remuneration of those who are self-employed, recorded a GDP growth in real of 3.10% in the first, and 3.77% in the second quarter of 2016. According to the Bureau, the informal sector now makes up 77.24% of domestic income, in the second quarter of 2016, from 72.95% in the same quarter of 2015.

Why are things this bad?

The revelation by the NBS highlights how bad things are for ordinary Nigerians and also puts into perspective the challenges facing consumer goods companies in the country. This of course all started with the drop in the price of crude oil which triggered a massive depreciation of the Naira. With the exchange rate going South, inflation rate ticked Northwards rising to as high as 18.3% as at October 2016. Galloping inflation rate economist opine impact on cost of goods and services as they are also expected to rise in tandem, a common feature with supply push inflation. The immediate effect of this is that Nigerians have continued to see their purchasing power dwindle. Lower purchasing power means you every one naira earned is worth probably around 80 kobo when spent.

With household consumption down by as much as 6%, industries face a drop in sales, massive inventory pile ups and rack up operating expenses. This in turn ensures that companies can’t raise salaries or wages as they struggle to remain solvent by either cutting expenses or freezing growth in operating expenses. Cutting expenses, sadly also includes laying of millions of Nigerians which further reduces household expenditure and disposable income.

What does this mean to me?

This latest report confirms things are still likely to get worse before it gets better. With inflation rate stubbornly high at above 17% in the three months following the second quarter of 2016, we expect household consumption to continue its decline in the third and fourth quarter of the year. Nigeria’s third quarter GDP real growth rate contracted by a wider margin (-2.2%) in the third quarter of 2016 implying that employee compensation will likely contract further perhaps getting closer to -20%.

Companies relying on consumption expenditure to survive are looking at these numbers are probably sensing no economic respite at least in the near term. Jobs will continue to be lost and fewer jobs will be created. Employee compensation (salary and wages) will remain frozen or even reduced just as companies align their expenses with their income.

What is the government doing?

The Nigerian Government is expected to release its economic blueprint sometime in December and many hope to see a plan that could take Nigeria out of a stubborn recession. Evidence shows a flurry of poor monetary polices and non existent fiscal polices that may have at least cushioned the economic hardship Nigerians are facing. Rather what most critics point to are policies that actually negate private sector led economic growth.