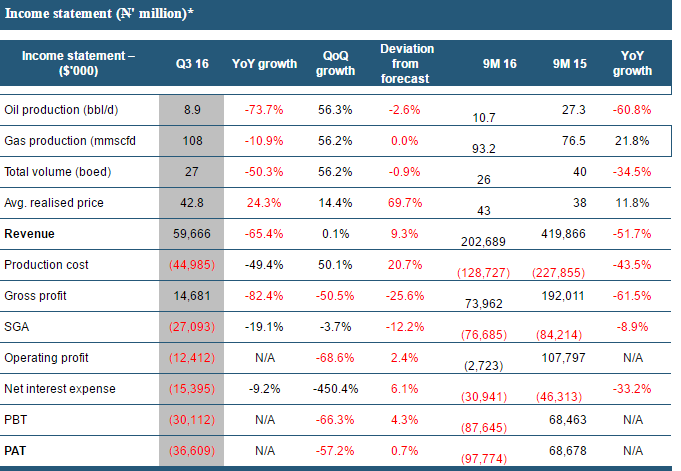

Seplat Petroleum Development Company Plc (Seplat) published its 9M 2016 result which chiefly reflected obvious challenges from shut-ins in the Trans Forcados Pipeline (TFP). Sales declined 51.7% YoY to $202.7 million due to a 66% decline in crude revenue after lifting adjustments to $127 million. Gross profit for the period was 61.5% lower on a year ago basis to $73.9 million. Similarly, Seplat reported Loss before and loss after of $87.6 million and $97.7 million respectively vs. PBT ($68.4 million) and PAT ($68.6 million) over 9M 15.

On the positive, gas revenues expanded 48% YoY to $77 million largely driven by 22% YoY rise in gas production to 93MMScfd, reflecting capacity expansion at the Oben gas processing plant as well as a 30.4% YoY increase in gas prices to $3.03/Mscf.

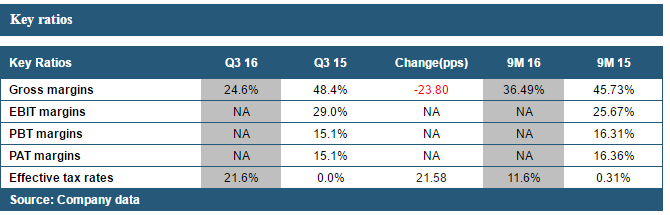

Similarly, Q3 16 revenue weakness (-65.4% YoY, +0.1% QoQ) owing to a 79.9% YoY decline in crude revenue to $29.4 million. This together with unrealised foreign exchange loss of $1.7 million as well as loss on hedging of $1.2 million more than offset operational efficiency as evidenced in the cutback of operating (-19.1% YoY) and net finance (-9.2% YoY) cost. Consequently, the company posted loss per share of $0.06 when compared to EPS of $0.05 in Q3 15.

Dulling earnings further was its tax provisioning (effective tax rate of 21.6% Q3 16). Seplat has taken a prudent approach in its tax treatment, excluding the effect of pioneer tax status pending the outcome of a review by Nigerian Investment Promotion Commission (NIPC) on whether an extension of the pioneer tax incentive will be granted beyond the initial three-year period (which concluded at the end of 2015). Assuming pioneer tax status, loss after tax should come to $26.5 million ($36.6 million excluding pioneer tax status).

Seplat currently trades at a P.E of 10.6x compared to peer average of 15.5x. Seplat has appreciated by 92.1% YTD. We currently have a SELL recommendation on Seplat using our FVE of N235.4

More analysis to follow.