Yesterday in Algeria OPEC oil ministers arose from a meeting to announce a cut/freeze of 32.5-33 MBPD. The finer details and decisions about who gets to cut what and by how much will be made at their next meeting in Vienna on November 30. The world markets have already started reacting to this news.

How does this impact Nigeria?

Industry experts who spoke with SBM Intelligence all agree that it is good for Nigeria as it brings in more much-needed foreign exchange to the Federal Government, a development which will help ease the will translate to much-needed revenue to fund the government’s ambitious 2016 budget and ease FX supply worries that currently plague the market.

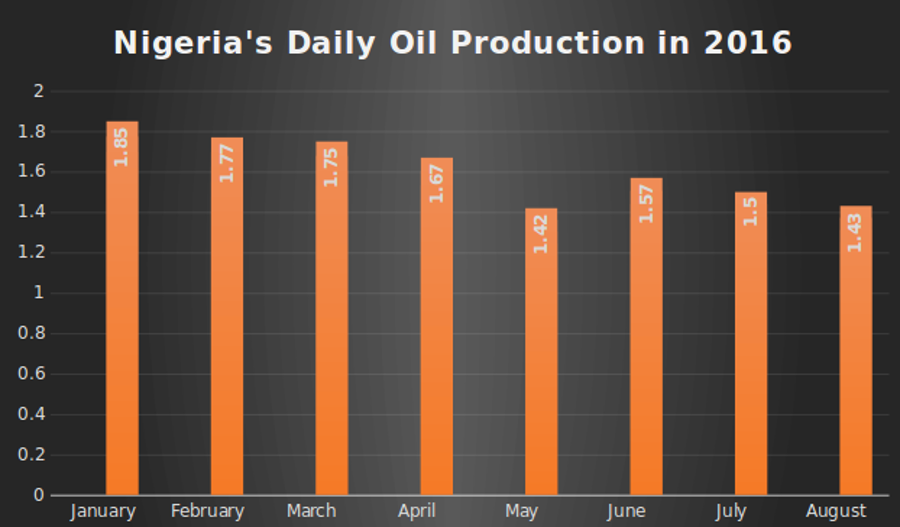

A look at Nigeria’s production figures from January to August 2016 shows:

It is well documented how this has been impacted by the escalation of militancy by the Niger Delta Avengers which has targeted oil facilities. Brent Crude, which made a $2 gain today, is expected to add an additional $7 -$10 by end of Q4, 2016. Just as importantly, Nigeria benefits more if they can tackle the militants who have yet again disrupted the critical TNP (Trans Niger Pipeline) impacting Bonny Terminal, as well as news today, 29 September, 2016, of the bombing of a delivery line operated by the NPDC in Ughelli South/North in Delta State.

This should not impact downstream (petrol, diesel) prices too much, but additional dollar supply should ease marketers concerns tremendously as they will certainly get easier access to dollar supply. It remains to be seen how the government will react in a scenario where landing cost of petrol and diesel, because the Expected Open Market Price of the products, rises above the current ceiling of ₦145 per litre of petrol. The most logical thing will be to either raise prices, or to formally reintroduce the petrol subsidy. Either option will have far-reaching political and economic consequences.

All of this is predicated on the fine details that will be agreed to by all OPEC members when they meet again in November. OPEC has made pronouncements in the past which died at the point where details had to be worked out. Many industry watchers see this as a move aimed at increasing the price of crude in the short-term to aid valuation of Saudi state oil companies in preparation for their IPOs. Hopefully, Nigeria’s quota will not be curtailed further as the country currently under-supplies.

It is important to note that the Nigerian’s Minister of State for Petroleum, Ibe Kachikwu, has asked that Nigeria be exempted from further cuts implying there is potential for Nigeria to ramp up production to January levels, or even slightly higher. It is also key to note that the shale suppliers and non-OPEC markets are watching keenly as they are not bound by whatever cuts are agreed. An increase in prices will bring some of the shale companies in the United States back to the field and we may go back to where we were at the end of last year. Many of them have pegged the threshold for their return to the field at the $50/bbl mark. That scenario, is not good for Nigeria. Interesting times are ahead.

No glo network