Since the news about first oil in Aje field, offshore Lagos have reached the wires, not a few Lagosians have openly rejoiced in their new status as an oil producing state. Forget that tripe about becoming a non-oil economy, most people I know want some oil to be found in their backyard. Credit goes to the Lagos government who has moved swiftly, earning early the rights to rents from Aje field from the Revenue Mobilisation and Fiscal Commission. But here is some good and bad news. Much oil and gas has been found and more would be found in the nearest future but Lagos would never benefit from it. Sadly.

I will tell you why.

Before February 2004, the onshore-offshore dichotomy and the 13% derivation principle were the basis for sharing oil wealth in Nigeria amongst the states and federal government. The onshore offshore dichotomy model was derived from the Exclusive Economic Zone Decree (1978) while Sani Abacha’s (yes, the much maligned Sani Abacha) 1995 constitutional conference prescribed and adopted the 13% derivation. With the onshore-offshore dichotomy, littoral states only earned their derivation entitlements from oil revenues found onshore and within their coastal baseline. When democracy returned, the governments of the Niger Delta states started agitating for the abolition of the onshore-offshore dichotomy and demanded access to resources offshore of their states.

In the United Nations Convention on the Law of the Sea (UNCLOS) which Nigeria has ratified and abides with (the USA is not a signatory yet, but that’s for another day) the following maritime zones are recognised:

(i) the 12 nautical mile (22 km) Territorial Sea (TS)

(ii) the additional 24 nautical mile (67 km) Contiguous Zone CZ (according to Article 33 of UNCLOS) making 36 nautical miles beyond the baseline;

(iii) the 200 nautical mile (370km) Exclusive Economic Zone EEZ from the baseline [according to Article 57 of UNCLOS]; this makes the territorial sea AND the Contiguous Zone PART of the EEZ, with an additional 176 nautical miles beyond the Contiguous Zone;

(iv) 350 nautical miles (650km) of the EEZ — (Extended EEZ)

The argument before February 2004 was whether the littoral states’ claims to environmental pollution and impact from oil fields far away and several kilometres into the exclusive economic zone were valid. The states wanted derivation to be based on all oil found within the 200 nautical miles EEZ (370 km) and this naturally drew a battle line between them and non-oil producing states. (Note that this states/federal government fight for revenue is popular amongst many oil producing countries — USA, Brazil, Libya etc.) The Obasanjo government in accommodating a solution settled on the onshore/offshore abrogation bill of February 2004 (backdated to April 2002) which describes the limit of the littoral states as the 200 metre water depth isobath contiguous to a State of the Federation.

Now that’s where the real problem lies.

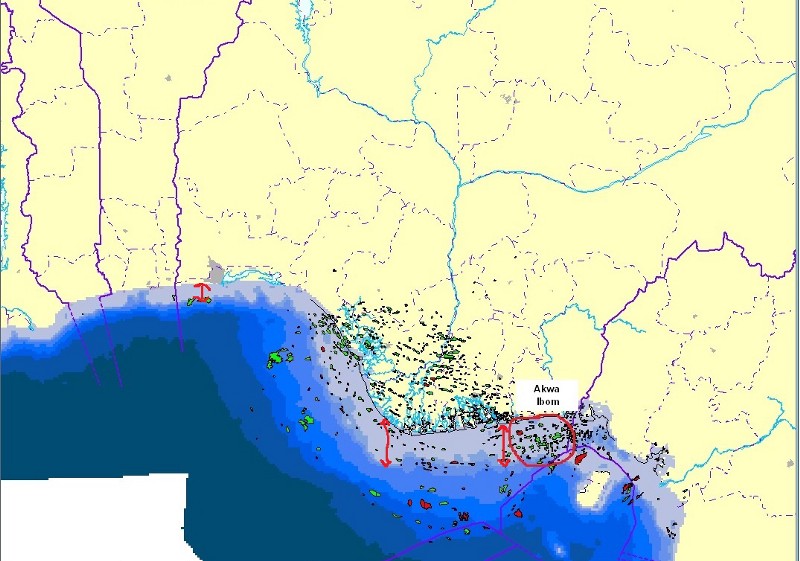

Instead of using the 200 nautical miles (370 km) Exclusive Economic Zone EEZ as anticipated, the bill cleverly recommended a limit of ‘200 metre water depth isobath’. It was a masterstroke by Obasanjo, the Federalist. Now, what does an isobath mean? An Isobath is a line representing the horizontal contour of the sea bed at a given depth. Essentially a 200 metres Isobath, means a line representing the horizontal contour of the sea bed at 200 metres depth. In other words the 200 metres Isobath off the Nigerian Coast is a line joining all points off the coast of Nigeria (from Lagos to the boundary with Cameroon) where the sea is 200 metres deep. Are you getting the gist? So instead of a limit of 200 nautical miles distance from the shore, the states’ limit is 200 meter isobath depth from the shore. This has very serious consequences.

For states whose sea bed plunges sharply into the sea, the 200m water depth isobaths would be closer to shore while states with gently sloping sea beds would have a farther derivation belt. Lagos, Ogun and Ondo States’ sea bed are typically in the former category while the likes of Bayelsa, Rivers and Akwa Ibom are in the latter. I consulted a 2004 paper by Professor Itse Sagay in preparing this essay and in his estimate, Lagos’ derivation belt could be about 28km compared to Ondo’s of about 50km, Delta 60km, Bayelsa 70km, Rivers 70km, and Akwa Ibom 80km. Essentially, Akwa Ibom has a derivation zone about three times that of Lagos with the same isobath rule. See the map below and you know why Akwa-Ibom became the No1 oil state. The oil fields (in green) are more stretched along its deep sloping sea bed. Akwa Ibom won the maritime lottery. (For oil though because same issue is probably why ports have draught issues in the Niger Delta while Lagos attracts more Ports investment.

Lagos has now been accredited for derivation by the RMAFC but in his speech to Governor Ambode, the Chairman of the Commission noted that Lagos is only qualified for derivation on production from 4 wells out of the five in the Aje field as the last well fell beyond the 200 isobath water depth. Note that the Aje field is just 24 kilometres from the coast of Lagos and in water depth of about 100 meters — a shallow, near-offshore field by industry deep-water standards. And there also lies the problem for Lagos. Most of the future production from offshore Lagos is farther into the Atlantic. Ogo field (OPL 310) with about 1 billion boe is farther ashore while OPL 325 also recently acquired by Lekoil are all beyond the short 200 isobath nature has bequeathed on Lagos. Even in OML 113 where Aje field is, further developments south of the field would offer Lagos no benefit. Lagos has no oil ladies and gentlemen. It’s only a little better than an inland state like Taraba.

Lagos may have to find a way to secure more oil rents, starting from the obvious. First, did Lagos independently verify the isobath measurement by RMAFC? Maybe an argument can be made for a reevaluation? The Lagos Development Commission bill, a replica of the Niger Delta Development Commission may be floated. Most of the fields offshore Lagos are gas rich. Lagos may start to collaborate with these companies on best ways to ensure the gas lands in Lagos. And ultimately, depending on the political possibilities, Lagos may collaborate with the Niger Delta to apply the 200 nautical miles limit instead of the isobath principle.

Over to you Ambode.

Follow Ade on twitter @Damoche