Commentary

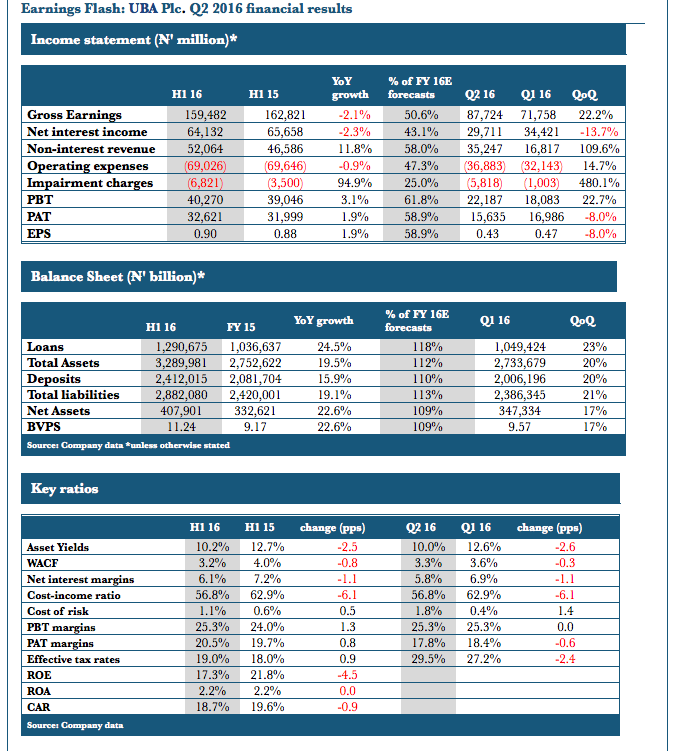

- Yesterday, United Bank for Africa Plc. (UBA) released audited H1 2016 results wherein earnings were modestly higher YoY (+2% YoY) as increased loan loss charges moderated impact of strong non-interest revenues (NIR). Relative to our estimates, earnings are tracking modestly ahead due to a faster rise in NIR on account of FX revaluation gains.

- In addition, UBA maintained its interim dividend of N0.20 per shareas in 2015 which translates to a dividend yield of 4.5% using price as at last close.

- Scanning through the results reveals that, akin to Access, UBA booked a N16 billion FX revaluation gain on derivatives which offset an FX translation loss of N4.2 billion. This was the main source of strong NIR over the period.

- Further supporting NIR was robust e-business income (H1 16: N18.1 billion vs H1 15: N6.4 billion) with the line item now accounting for half of fee incomes vs 21% in 2015.

- Nonetheless, as with the rest of coverage, UBA reported an over four fold QoQ rise in impairment charges to N5.8 billion. The upswing pushed annualized cost of risk 140bps higher QoQ to 1.8% (H1 16: 1.1%, FY 16E: 2.5%).

- In line with sector-wide trend, UBA reported a 130bps QoQ contraction in CAR to 18.7%as NGN depreciation underpinned a 23% QoQ rise in net loans.

- UBA currently trades at P/E and P/B of 2.7x and 0.4x which are at discount to peer average at 4.9x and 0.8x respectively.

- Last trading price of N4.45 is at a 16% discount to our last published FVE (N5.15) which implies an OVERWEIGHTrating. Our estimates are under review.

- Conference call details and more analysis to follow.