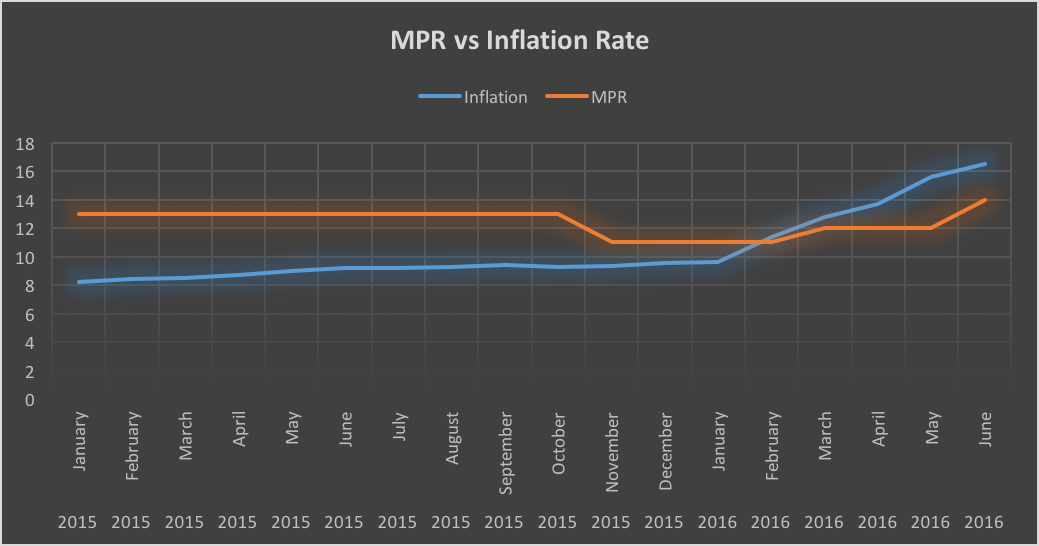

The Central Bank of Nigeria (CBN) Governor Godwin Emefiele has announced an increase of the benchmark monetary policy rate from 12% to 14% the highest level since the CBN introduced the rate in December 2006. This was the decision taking by the Central Bank’s Monetary Policy Committee (MPC) at the end of their meeting Tuesday July 26, 2016.

Nairametrics Publisher, Ugodre had on CNBN Africa earlier Tuesday forecasted a 100-200 basis point increase (1-2%) as he opined that the Central bank was raising rates to attract foreign investors. We believe the fact that inflation rate is about 16.5% means the CBN is now left with a rate that provides a negative yield which will deter foreign portfolio investments.

A higher MPR means foreign investors can fly to the safety of a 14% interest rate to hedge against Nigeria’s galloping inflation rate and depreciation of the naira.

The Central Bank also released the following as decisions of the MPC;

(i) Increase the MPR by 200 basis points from 12.00 to 14 per cent;

(ii) Retain the CRR at 22.50 per cent;

(iii) Retain the Liquidity Ratio at 30.00 per cent; and

(iv) Retain the Asymmetric Window at +200 and -500 basis points around the MPR

According to available data, the Central Bank of Nigeria has had MPR above inflation for 62 times out of a total 115. This data dates back to December 2006 when the CBN introduced the MPR.