The Central Bank of Nigeria has released results of its latest Treasury Bills auction. The CBN on June 22nd offered N48.12 b, N69.b and N50b in treasury bills maturing in 91, days, 182 days and 364 days respectively. From the offer put forward, it was able to sell N18.1b, N11.3b and N50b maturing in 91, days, 182 days and 364 days respectively.

Read: How to invest in treasury bills

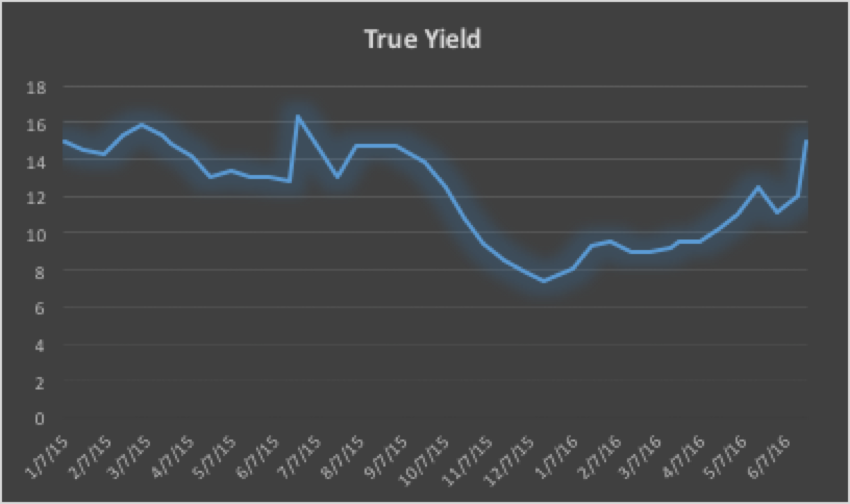

The Central Bank sells treasury bills on a bi-weekly basis to investors using the amount raised to fund government expenditure or control money supply in the economy. In the latest auction, treasury bills rates spiked to as high as 14.9% while true yields were about 17% per annum for a 365 days investments. This means if you bought Treasury Bills for a tenor of 364 days, the CBN will pay you an interest rate of about 15% per annum. Since the interest is paid upfront, the true yield is about 17%

Treasury Bills rates have been increasing in the last few weeks due to government borrowing, rising inflation rate and the exchange rate.

Government Borrowing – Government borrowing has increased in 2016 due to the need to finance its expenditure. With Nigeria yanked off the JPM Emerging Market Bond Index, the government now relies mostly on the local market to borrow short-term funds. The CBN has earmarked a sum of about N1.07 trillion for sale as treasury bills in the 2nd quarter 2016. According to available data, it appears that the Government is also beginning to borrow more than before as borrowing via treasury bill has trended upwards when compared to previous borrowing. For example, treasury bills auctioned for any particular period is often used to finance treasury bills payment that has fallen due. Rather than maintain that structure, the government borrows more.

Inflation Rate – the consumer price index has trended higher in the last 6 months as prices of goods and services respond to the over 45% depreciation of the Naira against the dollar. The 40% rise in electricity cost has also helped push inflation rate higher. Nigeria’s inflation rate has risen from about 9.6% in January 2016 to about 15.6% in May. With inflation rate trending higher, a treasury bills rate of below 16% suggest a negative return after adjusting for inflation. It is therefore anticipated that the rate of government’s borrowing will trend higher than the inflation rate to ensure that it is attractive to investors.

Sterilization – The CBN was also said to have sucked out about N1 trillion from the economy in a bid to reduce the amount of Naira in circulation. Analysts inform Nairametrics that the CBN adopted this as a strategy to ensure that the exchange rate remained stable ahead of the new flexible exchange rate policy. They believed that the less Naira we have in circulation, the lesser the demand for the dollar. The implication is that government will need to pay higher interest rates.

With so much uncertainty and volatility in the stock market, the attractive yields in the money market could severely impact on the value if stocks. Rather than invest in stocks with most dividends payment set for early next year, some investors are more likely going to invest in risk free treasury bills that offer safer and stronger rate of returns over risky equities. The equities market have posted losses for 7 out of the last eight trading sessions as investors react negatively to the news about troubled banks, the imminent recession and the shock of Brexit.

See Treasury Bills table for June 22, 2016 below

What does this have to do with our economy

It has a lot to do with the economy.this is the reason I advocate they made economics compulsory in colleges and universities