The stock market hit its year high at 31,073.30 points before trending down till date to 29,305.40 points

The market spiked on the 15th of June 2016 from 27,034-27892 points as CBN announced its New FX Policy to 31,073.30 on the 23rd of June (over 4,000 points).

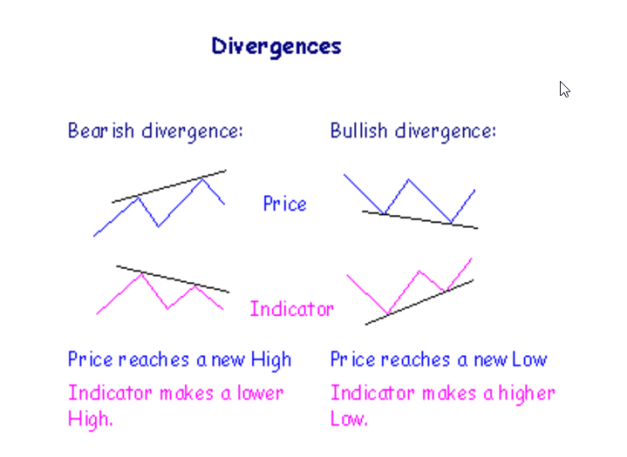

Though the spike made a New high in price but on Indicator, thus creating “A bearish divergence”.

A bearish Divergence is a situation in a bear cycle when two technical indicators move in opposite directions and signal a near-term turning point in the trend.

Table of Divergence

NSEASI

- price hits 31,073 points high while indicator did not make same high

NSE30

NSE BANKING

- Worst hit sector as RSI levels have broken its trend lines

Some Bull chip stocks in Bearish Divergence

GTB

NB

Zenithbank

Once again the market finds itself at a crossroad, two paths lie ahead; a small and narrow road upwards and an easy and broad way downwards.

Though market is trending within a thin line of RSI50 indicating Bulls still have power to fight the Bear rallies but the huge bearish divergence created last week continues to remain true and Odds still truly favors a move to downside for the intermediate term.

The 28,700 points will be next minor support levels to watch before the Next drop.

Visit Rasheed’s blog here