The Nigerian economy is at risk of experiencing its first full-year recession since 1987, after output contracted 0.4 percent in the first quarter from a year earlier. A drop in oil output to a 27-year low and paralysis in other sectors due to fuel and foreign-exchange shortages mean that economic growth is likely to remain negative for the rest of this year. The naira devaluation is unlikely to help much, with its beneficial impact expected beyond the end of this year.

The first quarter contraction does not come as a surprise, but the drop in oil production was actually less damaging to activity than anticipated, dragging on real GDP growth by only 0.2 percentage point in the period compared with 0.7 percentage point in the fourth quarter and 0.6 percentage point in 2015. Oil production of 2.11 million barrels per day for the first quarter, as reported by the Nigerian Statistics Office, was at the top end of estimates of 1.8-2.1 million, in a Bloomberg survey and as quoted by the U.S. Department of Energy.

Instead, it was manufacturing that experienced the sharpest drop in activity, falling by 7.0 percent year over year. This is likely to have been partly connected to a decline in domestic demand but also to the difficulties of importing input materials, due to foreign-exchange controls.

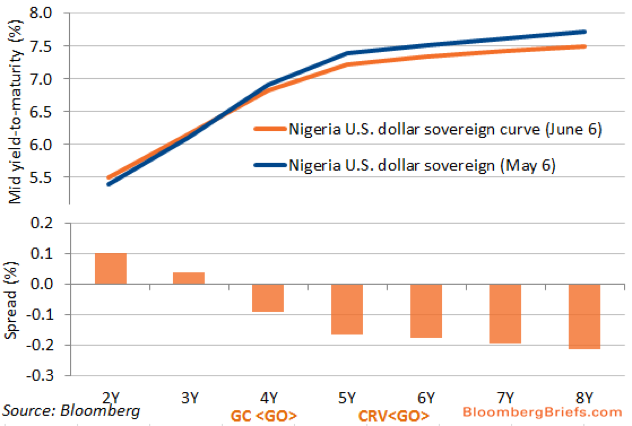

Nigerian U.S. dollar sovereign bond yields have tightened over the past month in longer dated maturities, according to Bloomberg analysis using the CRV and GC functions on the Bloomberg terminal. — James Batty, Bloomberg Brief

While service-sector growth was positive, it was a mere 0.8 percent year over year compared with 4.8 percent in 2015. As a result, services contributed only 0.4 percentage point to headline growth in 1Q compared with 2.5 percentage point in 2015, 3.6 percentage point in 2014 and 4.2 percentage point in 2013. This shows how the dwindling of hydrocarbon revenue since the drop in the price of oil in late 2014 has affected domestic demand. While agriculture was the only sector growing at close to recent trend rates — 3.1 percent compared with 3.7 percent in 2015 and 4.3 percent in 2014 — it appears not to have benefited materially from any import substitution as the cost of overseas foodstuff has risen.

A technical recession — two successive quarters of contraction — could come as soon as the second quarter. BI Economics’ estimates of quarterly growth, on a seasonally adjusted basis, suggest the economy contracted by 1.5 percent in the first quarter, the first negative reading since third quarter 2011. Attacks by Niger Delta militants have reduced oil output by 30 percent this year, bringing it to 1.4 million barrels per day in May, the lowest in 27 years, according to Oil Minister of State Emmanuel Kachikwu.

A number of foreign oil companies have declared force majeure on shipments from oil terminals so far this year, starting with Shell in February. There is a risk of further attacks, as it is unlikely that the government and themilitants will resolve the dispute in the near term. With the fiscal deficit legally capped at 3.0 percent of GDP, lower oil production will also have a direct impact on how much the government can spend this year — the prolonged delay in passing the 2016 budget until early May has also affected expenditure. Add to this the shortage of fuel and foreign exchange and it is clear that economic growth could be more sharply negative in the remaining quarters of the year.

With Nigeria’s population estimated to be growing by 2.5 percent annually, living standards are now stagnating following the drop in oil prices in mid-2014. GDP per capita is likely to slide further as higher black-market rates for foreignexchange push up inflation, which has prompted a reaction from the Central Bank of Nigeria. The CBN held its policy rate at 12 percent on May 24, but Governor Godwin Emefiele said it was time to introduce greater flexibility in the management of the foreign-exchange market. He has yet to release the details of the new policy.

A weaker currency would undoubtedly weigh on domestic demand and growth in the near term but should spur foreign investment and increase the competitiveness of domestically produced goods. The latest Bloomberg survey was published before the first quarter GDP data were released, and the weakness of growth means the expectations of a 2.5 percent expansion for 2016 will probably be disappointed.

Click here to see more of this analysis on the terminal

Article was obtained with permission.