Last week, Nigerian stock market commenced a rally that was to eventually send the All Share Index into positive territory for the first time in weeks. The market reacted happily to the new Flexible FX Policy that will now be adopted by the Central Bank. After reading the article below, we also believe now that investors who must have received this Renaissance Capital (Rencap) opinion on the forex policy must have also been driven into a buy frenzy. The opinion seems to suggest one that foreign investors will surely like to see and could mean the time for them to inflow money back into the market could be near.

Here is the opinion piece below;

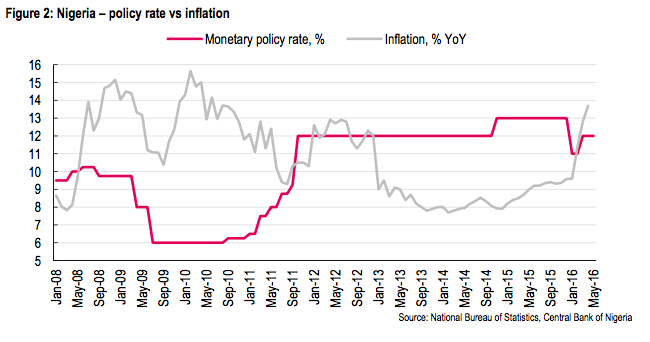

RENCAP: The highlight of last Tuesday (24 May) monetary policy committee (MPC) meeting was the decision to introduce a flexible interbank FX market. Whatever FX framework the central bank unveils in the next few days/weeks is a positive step in the right direction. Negative growth also compelled the MPC to refrain from hiking the policy rate (12%) and cash reserve ratio (22.5%), in our view.

More flexible policy

The anniversary month of President Muhammadu Buhari’s presidency (May) has been eventful. The 2016 budget was signed, petrol subsidies removed, and now Nigeria appears to be moving towards a more flexible FX policy. The MPC announced it will introduce greater flexibility in the interbank FX market, while retaining a small window for critical transactions. The central bank has been mandated by the MPC to work out modalities of achieving a more flexible interbank FX market.

Probable FX framework

We think the fixed peg at NGN197-199/$1 will be sustained to support imports for critical sectors, as deemed by the government, such as agri-business, manufacturing, exporters, fuel refineries, and the power sector. Central Bank of Nigeria Governor Godwin Emefiele mentioned in the Q&A session that imports of capital goods for new investment for industries that source raw materials locally would be eligible for the ‘import critical window’. We expect all other FX transactions to be directed towards a new, flexible interbank FX market, which the central bank will cease funding. This market would be funded by exporters, i.e. international oil companies, and autonomous sources, in our view. We expect that alongside the unveiling of a new FX policy framework, the authorities will specify the transactions that will take place at the fixed peg window.

Will the naira be allowed to fully float on the interbank market?

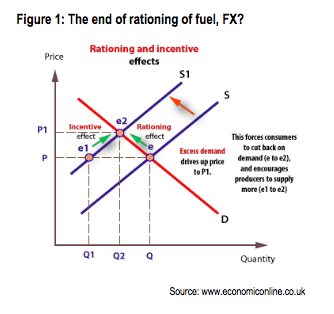

We are inclined to think not. This view is informed by the partial deregulation of petrol prices on 11 May, and Nigeria’s history of managing the FX rate. The ideal scenario would be for the central bank to let the market set the new interbank FX rate without restriction, and in so doing allow for an appropriate level to be found. We think this is somewhere between the fair values suggested by our two real effective exchange rate models – NGN255/$1 and the longer dated one, at NGN315/$1. At this new ‘price’ for the naira, demand and supply would be brought into equilibrium through a decrease in FX demand (rationing effect) and increase in FX supply (the incentive effect) [Figure 1]. This would imply short-term pain, not least because of the inflationary effect, and high interest rates. But we believe decent growth would return, particularly given the low base effect.

We think the new flexible rate will be managed

We believe the central bank may set a ceiling for the interbank FX rate, or specify a band within which the naira may trade. If the ceiling or band proves to be too low, say NGN240/$1, only limited FX liquidity will come into this market, and the interbank FX rate would soon hit the ceiling, or weak end of the band. And the opportunity for a parallel FX market rate that diverges from the interbank rate would be sustained, implying three exchange rates. Inflation would also rise in this scenario, but growth would be weaker.

MPC suspends its hawkish stance.

When we met the central bank two weeks ago, we asked if slowing growth would spur the MPC to suspend its hawkish stance, in favour of growth. The central bank’s response was that accelerating inflation was its primary concern and it would act to contain it. It appears as though the negative growth number for 1Q16 that came out last Friday (20 May) compelled the MPC to rethink its stance. Yesterday, the MPC elected to keep both the monetary policy rate and the cash reserve ratio (CRR) unchanged at 12.0% and 22.5%, respectively. We had expected the CRR to remain unchanged because the central bank had acknowledged that inflation was not due to monetary expansion. In yesterday’s statement, the committee also said the March rate hike needed time to work. We think it is positive that the MPC suspended its rate hiking cycle, so that an economy in decline is not further undermined.