Standard Bank Group Ltd. is the largest lender by assets in Africa’s second largest economy South Africa, while FBN Holdings is the largest lender by assets in Africa’s biggest economy, Nigeria.

Standard Bank today said it expects to report that 2015 profit increased by as much as 35 percent because of reduced losses at its international operations.

FBN Holdings on its part issued a profit warning, saying: “earnings will be materially below that of the prior year… as a result of the recognition of impairment charges on some specific accounts.”

While Standard Bank has moved aggressively to restructure its operations after over-extending itself through acquisitions, FBN Holdings seems not to have learnt the lessons of the 2008/2009 Nigerian financial crises.

In 2014 Standard Bank incurred losses of 3.7 billion rand linked to its operations outside Africa. The bank last year completed the sale of its Brazilian unit and also sold a 60 percent stake in its U.K. operations to Industrial and Commercial Bank of China Ltd.

FBN Holdings was one of the banks that had to sell a huge chunk of its non-performing loan portfolio, including a certain troublesome Seawolf oil and gas portfolio to Nigeria’s bad bank AMCON.

FBN Holdings and its management have been unable to effectively exploit the dominant position they hold in Nigeria’s $500 billion economy.

However Standard Bank Holdings has through good risk management and greater vision done well for shareholders even as its $340 billion South African economy suffers from anaemic economic growth.

Five year charts show the value destruction and damage done to shareholders of FBN Holdings

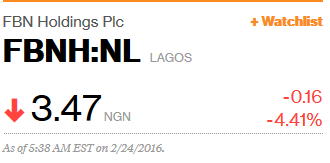

From a peak of N16.60 a share reached in early March 2013, FBN Holdings now trades 79 percent lower at near N3.48 per share (expect to see more sell –off with todays profit warnings).

Investors are giving FBN Holdings an almost bankruptcy type valuation at a 0.2 times book value, compared to 1.68xs book for Standard Bank Group.

It would be nice to see the compensation of those CEOs and top management that brought FBNH to this sorry pass over the past five years, and see if it indeed is aligned with stock performance for the period.

Fig 1: FBN Holdings 5 year chart

Source: Bloomberg

Fig 2: FBN vs. Standard Bank financial metrics

| Bank | Market Cap $’bn | Price to Book | Stock Perf 1 year |

| Standard Bank Group | $12.1 | 1.68 | -28.45% |

| FBN Holdings | $0.674 | 0.2xs | -49.80% |