A see-saw trading week on the Nigerian bourse, the market traded higher on Monday, then lower through to midweek before inking some gains through to the end of the week. The losses in midweek however outweighed the gains at the start and back-end of the week, hence a lower close for the week. The market benchmark was down 1.04% w/w as against an increase of 5.05% recorded in the previous week.

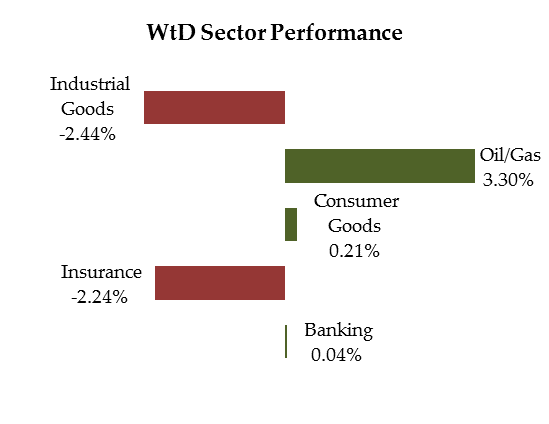

The decline was driven by continued profit taking in the Industrial Goods space. We had seen cement maker DANGCEM which is the most capitalized stock, surge 17.86% in the previous week. Consumer and Banks ended the week, smallish up following a rather volatile trading week. Up until midweek, consumer names like – NB, NESTLE & DANGSUGAR – were on the decline with the latter touching their 52-week lows before recovering towards the end of the week. The Oils continued to be supportive, chalking the most gains on sustained demand for SEPLAT.

Activity levels were markedly lower, with the market seeing a turnover of N9.61bn with a range of N2.923bn recorded on Monday and N0.925bn recorded on Friday. This was sharply lower than the N17.277bn traded in the previous week. We note a decline in activity levels as the week progressed, this particularly worsened in Friday’s session when the market had traded a little above N500mn with 20mins left in the trading session. The interest was mainly in ZENITH & GUARANTY, as both names accounted for about a third of total volumes and about half of total market value.

Our sense is that participation is still being dominated by local institutional investors and a few HNIs. While participation by foreign institutional investors who a mostly staying on the sidelines was mostly skewed towards the sell-side as has been in recent weeks. The interest has also been mainly in tier-1 banks like GUARANTY & ZENITH.

Globally, markets mostly ended the week in the higher. Markets in the China, Japan, UK, Germany, France and US, traded higher for the most part of the week on the back of a rally in the price of Crude oil before faltering on Friday as oil came lower. We had seen the price of Brent crude climb c.7% following the announcement of an output freeze at January levels by Saudi Arabia and Russia supported by Venezuela and Iraq. The impact of this move was however muted when Iran endorsed the plan without making any commitments.

Market Snapshot

- All-Share Index: 24,432.51pts

- Market Cap (NGN): 403bn

- Market Cap (USD): 655mn

- Total Volumes Traded: 202bn

- Total Value Traded (NGN): 641bn

- Daily Average Value Traded – WtD (NGN): 928bn

- Daily Average Value Traded – YtD (NGN): 207bn

- Advance/Decline Ratio: 59

Sector Performance:

Market Screeners:

- Top Risers:

SEPLAT (+19.98%; N302.48); MAYBAKER (+17.50%; N0.94) & GLAXOSMITH (+15.70%; N24.17)

- Top Decliners:

UNITYBNK (-11.76%; N0.60); PORTPAINT (-10.16%; N3.36) & LEARNAFRCA (-10.00%; N0.81)

- Top by Volumes Traded:

ZENITHBANK (228.934mn); GTB (147.873mn) & UBA (123.553mn)

- Top by Value Traded:

ZENITHBANK (N2.641bn); GTB (N2.440bn) & NESTLE (N0.667bn)

- New 52-Week High:

FO (N342.00)

- New 52-Week Low:

CAVERTON (N1.68); DANGSUGAR (N5.16); OANDO (N3.40); CHAMPION (N2.71); NESTLE (N650.00); NNFM (N6.65); UNILEVER (N27.98) & CONOIL (N17.42)