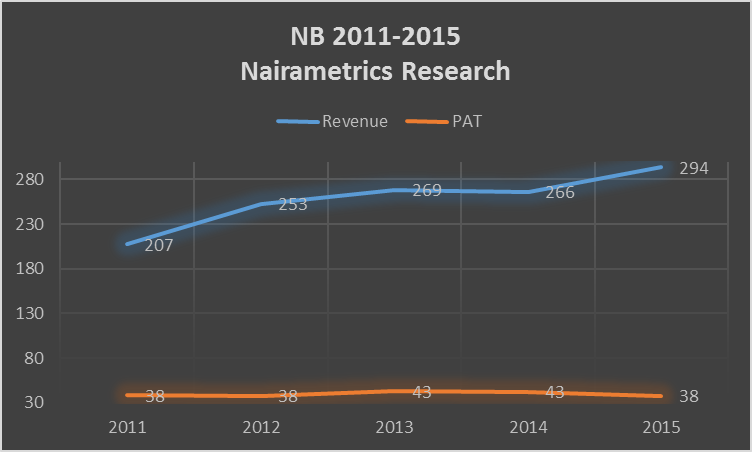

Nigeria Breweries Plc released its 2015 full year results showing profit after tax dropped by 10.5% to N35 billion. The company also reported that revenues also rose 10% to N293 billion compared to 2014 where revenue dropped by about 0.4%. For shareholders the result should bring some form of relief considering that its rival Guinness Nigeria Plc reported an 18% drop in profits its full year ended June 2015 and another 65% drop in half year profits for the period ended December 2015.

Nevertheless, Nigeria Breweries still had a blistering fourth quarter of 2015 to thank. The company reported Revenues of N78.9 billion in the three months ending December 2015. The jump in its revenues for that quarter helped cushion the typically poor third quarter of the year where the company reported a disappointing profit after tax of N4.7 billion. According to analysts, the company has increasing sales of its value brands to thank. As Nigerian move away from more expensive beers, companies like NB are seeing volumes of their value brands rise albeit to the detriment of their more premium brands. The knock on effect is that margins thin out if the value to premium mix is skewed more towards the former.

Source: Nairametrics

Twin problems

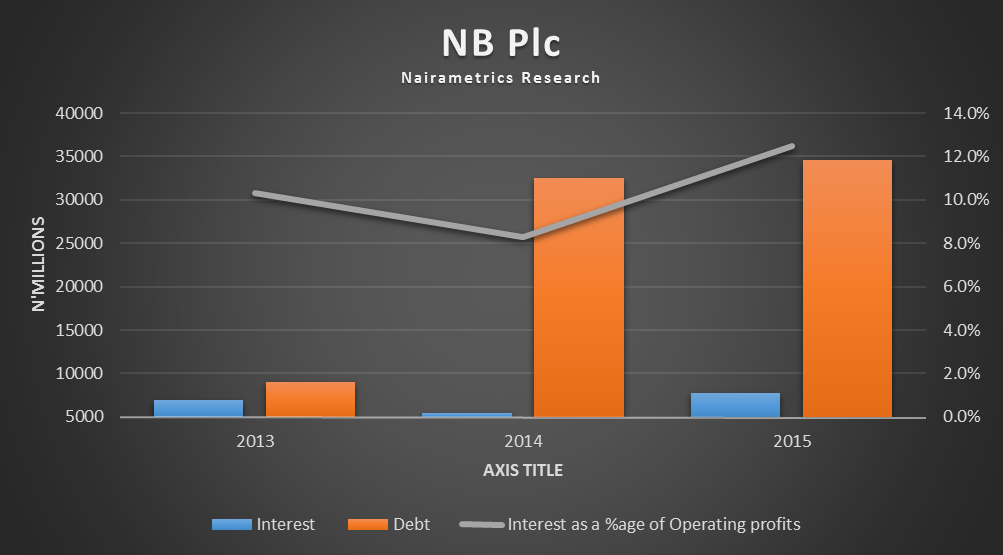

Two major issues however posse major concerns for shareholders of the company beyond the shift to value brands. The first is its rising debt balance. From N9 billion in the 2013, Nigeria Breweries now has a total debt balance of about N34.6 billion. The company last year launched a N100 billion commercial paper out of which it raised N17 billion. From a total debt profile of N52 billion at the end of the first quarter of 2015, it paid down about N18 billion to reduce it to N34.6 billion.

Source: Nairametrics

Why does it borrow so much? Nigeria Breweries has a negative working capital of about N86.7 billion which it needs to finance frequently. In 2014 negative working capital was N61 billion and in 2013 N55 billion. This means the company is not generating enough organic cash flows and will need to continue to rely on short term loans to finance its operations. These loans ironically helps it to fund its dividend payments.

The implications are that interest & loan repayment repayments will have to take front sits over dividends in the next 3 – 5 years. The path to dividend growth for the company is likely to be curtailed because of its cash flow challenges. It has paid about N135.5 billion in dividends in the last 5 years out of profits of N200 billion and revenues of about N1.2 trillion within the same period. In the same period it has incurred finance charges of about N29 billion. We expect this trend to reverse with finance charges gradually eating more into profits. This has already started with dividends dropping by 14% in 2015 after doubling in 2014. A weakening Naira, harsh economic conditions and more shift towards value brands further buttresses this trend.

The second problem the company has is its rising cost of sale. Nigeria Breweries has averaged 50% in Gross Profit Margin over the last decade confirming its superior understanding of the business. However, the scarcity of the dollar and the current Government’s drive to focus more on local input could posse a new and dynamic challenge for the company. According to ARM Research, Nigeria Breweries sources about 60% of its raw materials locally and confirmed that it currently has no problems sourcing dollars. However, the situation is more likely to get worse than improve and this could sooner rather than later feed into costs. In fact, it will have to hope to sell more of its premium brands over value brands if it is to keep gross profit margins at 50%. Operating cost which jumped 14.5% to N80 billion is also a major concern for shareholders even though this was largely due to personal expenses (up by N10 billion) after the company added about 729 employees.

Impact on valuation

The effect of these twin problems will probably be felt on its valuation. At a share price of N97 the current dividend payment implies a dividend yield of 4.7% and a price earnings multiple of 20x. Nothing in its recent performance and in the future suggest that multiple is achievable. In fact, earnings per share has been flat in the last 5 years suggesting it is no longer a growth stock. Surely, Nigeria Breweries is a stock propelled by foreign investors. If they continue to shut out investments into Nigeria then I expect the share price to plummet even further. Local investors will resort to fundamentals when they do not see any momentum in share price appreciation. Currently it is hard to find this momentum.

Miss this insight. 10x