The year 2015 was a very tough year for Nigeria in all ramifications, and Nigerians will be too eager to see the back of it.

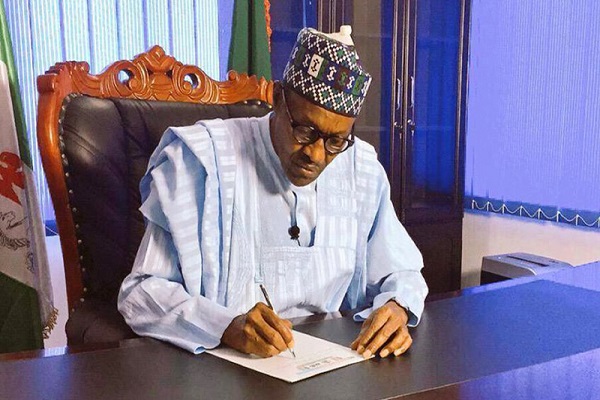

Apart from the euphoria of the successful handover of power from Ex-President Jonathan to President Buhari, every other segment of the economy has pretty much experienced underwhelming news.

The Nigerian All Share Index has declined 22% year to date; the exchange rate is at an all time low; companies have laid off workers in record numbers, while others have been completely run aground due to spiraling operating costs and harsh business terrain. The lingering fuel scarcity and the present subsidy crisis still hangs on, while electricity supply is still less than 5000mw; the insecurity situation doesn’t seem to be ending soon even though the President claims he was ‘technically’ won the battle.

Year 2016 is almost here, and Nigerians are hoping that President Buhari will begin to wave his magic wand, as soon as possible, so that things can get better.

We now look at 5 key economic questions that needs to be answered as we approach the New Year:

a) Will The Oil Price Fall To $20?

Everyone knows that oil prices have fallen this year, but the question that remains unanswered is how low it will go.

Some of the reasons cited for the plunge range from: the slowing growth of the Chinese economy leading to a decrease in demand for oil, to the lifting of the sanctions on Iran, which will cause a surge in supply.

Nigeria will still remain very vulnerable to this oil price volatility, given that the government benchmarked the 2016 budget at $38 per barrel.

The key question will be whether or not the oil price will fall to $20, as Merill Lynch and the IMF have predicted.

Source: NASDAQ

b) Nigeria and the 2016 Budget:

How will the 2016 budget affect Nigeria and Nigerians?

President Buhari presented a budget proposal of N6.08 trillion to the National Assembly, with N1.8 trillion budgeted for Capital Expenditure, and N2.35 trillion earmarked to be spent on recurrent expenditure.

In the 2016 budget, the critical sectors for capital spending will be:

- Works, Power and Housing

- Transport

- Defence

- Interior

- And Special Intervention Programs

Nigerians will be eager to see how this ‘Budget of Change’ will improve their lives.

Will it translate to more homes and better living conditions for them? Will they feel safer? Will there be more money in their pockets to spend? Will it be easier for them to move around?

c) Will The Stock Market Keep Tanking In 2016?

The Nigerian Stock Exchange has lost more than N2 trillion this year alone, as a result of the exit of foreign investors and confusion over the policy direction of the government. This confusion has been reduced, as the recently released budget has given a sneak peak as to what the economic direction of the government is.

Whether or not this will be enough for the capital market to rebound in 2016, time will tell.

Source: Bloomberg

d) Will The Naira Finally Find Its Level?

The Naira has performed badly for the past few months depreciating against the dollar to as low as N265.

The Central Bank of Nigeria (CBN), has been struggling to keep the demand for the dollar as low as possible, employing stringent controls meant to stabilize the Naira.

In July, the Apex Bank banned the importation of 40 items restricting them from gaining access to forex. It also announced that from January, Nigerians won’t be able to use their Naira Debit cards outside the country.

The key question here will be: How far will these measures go in stabilizing the exchange rate? Or will the CBN eat the humble pie by retracting some of its rule.

e) Will Unemployment Rate Keep Rising?

Unemployment has been a serious problem for Nigeria this year. The unemployment was made worse in 2015 as a result of the cutback in business growth.

According to Q3 2015 NBS report on unemployment and underemployment, unemployment in the country rose from 529,923 to 1,454,620 people between June 1 to September 30, 2015.

The Government has said it is working on plans to reduce unemployment in the country by giving unemployed youths a monthly stipend of N5,000, and also granting loans with a 9 percent interest rate to startups through the CBN.

How far these measures will go in curbing the rising unemployment rate in the country will be seen in 2016.

LOL. Who does not have an economic PPE should get one.