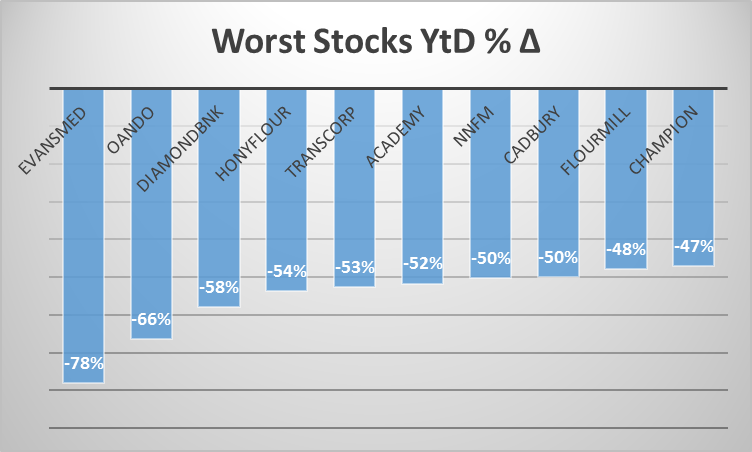

The Nigerian Stock Market has had a tumultuous 2015 with the index down 21% this year to date. December which historically has turned more positive than negative is now looking more likely to close in the red with stocks losing for 6 of the 9 day of trading. The index was down 1.3% last week.

A major contributory factor to he double-digit losses recorded this year are ten stocks who combined have posted over 40% loss in their respective market capitalization.

Common Travails

A critical look at the stocks reveal common travails that may have contributed significantly to their losses this year. For example, Evans Medical the stock that has posted the highest loss at 78% has not released a single result in the last two years. The company’s auditors, PWC, in its 2013 results had also cast doubts about its going concern status suggesting that it may not be able to meet its short term indebtedness. Whilst Evans has remained in business since then, its share price has plummeted by over 78%.

Oando the next highest loser with 66% drop in share price also delayed releasing its 2015 and full year 2014 results. When it eventually did release it in October, the company reported a record loss N189 billion in 2014 and another N47.6 billion in losses in 2015. The company has also announced another round of right issue which most analyst believe will be subscribed by the company’s majority shareholder (who owns about 70% of the company).

Honeywell, NNFM, Flourmills all belong to the flour milling industry that is currently facing intense competition, drop in top line revenue and margins. South Africa’s Tiger Brand has also had to cut its investment in Dangote Flour (now Tiger Branded Consumer Goods Plc). Honeywell Flour Mills for example posted a 17% drop in pre-tax profits for the 6 months ended September 30th 2015. NNFM has also reported an 86% drop in pre-tax profits. Flourmills had to rely on income from disposal of Unicem to make up the numbers.

Diamond Bank leads the pack as one of the worst performers in the baking stock as investors punish the bank for its high levels of loan impairments and its potential impact on the bank’s capital adequacy ratios. The bank has also reported a 21% drop in pretax profits indicative that it might not pay significant dividends in 2016.

Cadbury Plc has reported a huge drop in margins this year and actually reported a 98% drop in profits in its 9 months to September 2015 results. The FMCG sector has been under pressure as consumers react to harsh economic situation in the country choosing to prioritize how they spend their disposable income. For Cadbury, just like Honeywell, NNFM their products are getting squeezed out by cheaper brands and more expensive brands.

For Transcorp, a stock that was among the best performers last year, reality has now set in after investors placed an almost unjustifiable multiple on its earnings that at some point valued it more than UBA. With the share price down 54% YTD, the share price at N1.4 is perhaps still over priced and could still fall further. Champion Breweries like Transcorp also attractive a significant multiple on its share price on the back of a rumored merger with Nigerian Breweries. With the merger talks looking unlikely and fundamentals still weak and below any significant value that can produce dividend payment, the share price is getting pummeled.

Academy Press also attracted some traction at some point during the year as the business turned profitable. However, that traction has fizzled out for investors who are unwilling to hold on to stocks without significant moat. Valuation in this market is no longer a free pass with lesser know brands and non blue chips facing the full wrath of the markets.

Indeed, most of these stocks appear over valued even with this huge price drops. With margins falling, growth stalling and earnings per share set to drop by double-digit percentages by the end of their financial year, it appears light at the end of the tunnel for these stocks could take a longer time to appear.