- Following the public outcry over huge salaries and allowances of members of the National Assembly, President Muhammadu Buhari has ordered a slash in salaries of elected and non-elected officials in the country. The Revenue Mobilization, Allocation and Fiscal Commission (RMAFC) Director General, Elias Mbam, said on Tuesday that senators and members of the House of Representatives will earn less than N1 million by the end of next month. The new salary scale for elected and non-elected political officials, necessarily reflects the socio-economic realities of the country.

- Senators currently earn 240 million naira per annum (20,000,000 naira per month) in salaries and allowances and members of the House of Representatives earn 204 million naira per annum (17,000,000 naira per month). The current minimum wage in the country is 216,000 naira per annum (18,000 per month).

- Some argue that considerable sum for earnings of lawmakers around the world serves as an estoppel against corruption. The more a lawmaker earns, the less likely s/he is to engage in acts of corruption and bribery.

- A United States Senator receives $174,000 yearly as opposed to an average minimum wage earner’s $15,000. A member of the United Kingdom House of Lords basically earns £67,060 per annum as opposed to about £14,000. In Nigeria however, the difference between both earners are quite vast. A lawmaker’s monthly salary is a thousand times more than the minimum wage.

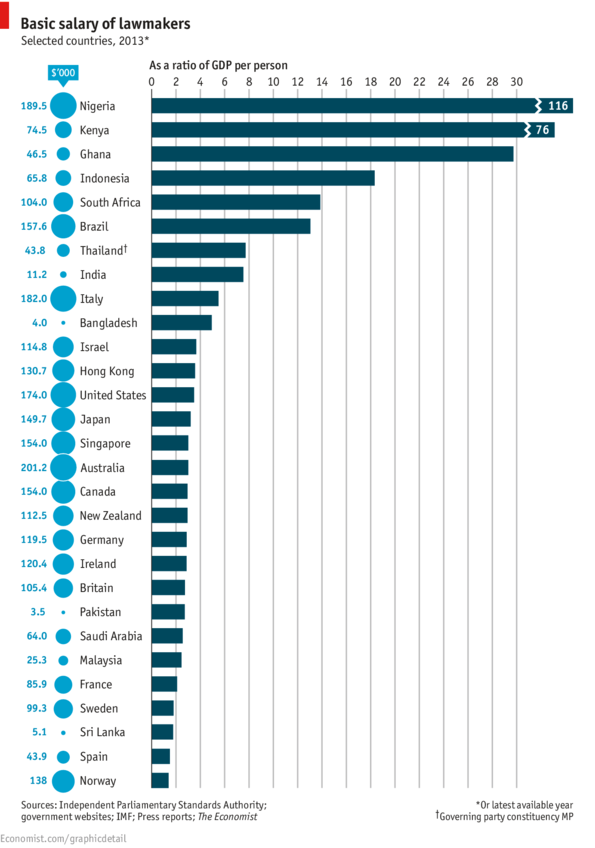

- The infographic below shows basic salary earnings for lawmakers in different countries. Nigeria tops the list:

- Also, Nigeria’s Premium Times features an Infograph that explains allowances available to lawmakers:

- However, the salary slash could inadvertently lead to an increase in corruption. After the slash, it’s possible that lawmakers will solicit bribes from other Nigerians who may need to push for the approval of a bill.

“Big Man Syndrome”

- Lawmakers in Nigeria are already accustomed to a certain lifestyle because of the amount of money they have received prior to the slash. “Big man” syndrome is the rationale behind many corrupt practices- individuals love to show off the gains of their massive wealth. Expensive cars, welfare and trips abroad have become the norm for some of these lawmakers.

Payback

- An individual who may have political ambitions typically will source for a sponsor to tackle the financial costs of his/her ambition. The sponsor views it as an investment, if and when the ambition bears fruit, they will want a return on their investment.

- There are a few cases of lawmakers who were willing participants in scandals involving public funds, but they were never prosecuted. For example, House of Representatives member, Hon. Farouk Lawan allegedly collected a $620,000 bribe from the Chairman of Zenon Oil and Gas, Mr. Femi Otedola in 2012. Apparently, there was video evidence, but Lawan denied the allegation claiming to have “played along to expose” Otedola. A committee investigated the event but Lawan was neither censured by the House nor prosecuted. He still serves as a legislator, representing Bagwai/Shanono Federal Constituency of Kano State.

- While most Nigerian’s are agree that the legislative bodies need a salary cut, President Buhari must back this change with the implementation of constant and effective monitoring of public officials and prosecution of those who seek to augment their salaries by other corrupt means.

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg)