After the fall of Afren, who are next among Nigeria’s oil explorers?

If oil prices remain low, bankruptcies among higher-risk producers will accelerate, Ben Tsocanos, energy analyst at Standard & Poor’s, said this week.

“It’s hard for most projects to make money at $40 (a barrel), at least in the current service cost environment,” Tsocanos said.

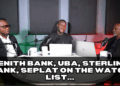

Seplat Petroleum Development Co.

Source: FT

Seplat is one of Nigeria’s oil explorers that investors should be looking at hard.

Its stock is down 59 percent from its April 2014 IPO price of N576 naira, which raised $500 million and 67 percent in the past year.

To be sure Seplat was able to raise capital to beef up its balance sheet before the oil collapse accelerated.

Seplat refinanced debt with $1 billion of new facilities provided by Nigerian banks split between a $700 million seven-year tranche and a $300 million three-year loan, it said in an e-mailed statement in January 2015.

Another major risk to Seplat is political.

The new administration may choose to review some of the firm’s favourable tax positions which would squeeze earnings.

Seplat is also entangled in litigation with the NNPC and other Nigerian oil firms over its bid to buy Shell’s divested assets in the country.

Oando

Source: FT

Oando is the Nigerian oil marketer/ explorer that is the poster boy of convoluted ownership structure, opaque dealings and non filing of FY 2014 financial results 8 months into a new year.

Oando’s stock has lost 61.55 percent of its value in the past year (see chart), although it befuddles us at Nairametrics how investors can buy a stock that has yet to release earnings results since the 3rd quarter of 2014.

Oando might have bought at the peak of the recent oil bull run when it payed $1.6 billion for ConocoPhillips Nigerian assets.

Whatever is the case we would avoid these two stocks until we get some clarity on the trajectory of oil prices and Oandos long delayed results.

![[AFTER AFREN] Which of These Nigerian Oil Companies is Next to Go Bust](https://nairametrics.com/wp-content/uploads/2015/08/Going-out-of-business.png)