UAC of Nigeria Plc. (6 months ended June 2015)

- UAC of Nigeria Plc (UACN) released unaudited results for 6 months ended 30th June 2015 wherein revenues declined 7.2% YoY to

N37.4 billion while PBT and PAT fell 57.6% and 70.2% YoY toN2.1 billion andN1 billion respectively.

Weakness at non-listed subsidiaries weigh on group top-line

- Extending recent run of negative growth, Q2 15 revenues declined 3.5% YoY to

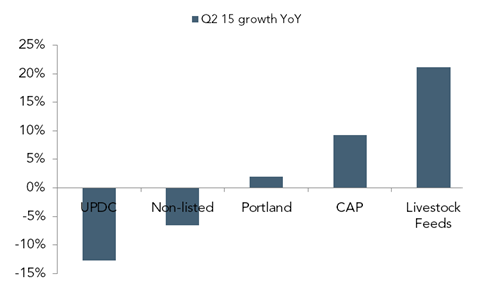

N19.6 billion (Q2 15E:N18.8 billion). Disaggregating the sub-components, sales weakness stemmed from downswing at non-listed subsidiaries (which comprise Grand Cereals Limited, UAC Foods, UAC Restaurants and MDS Logistics) where sales fell 6.6% YoY toN12.5 billion. Management links pressures in the segment to lower sales at the food business due to subdued consumer spending, and at GCL, where an outbreak of bird flu virus in the north culled poultry demand. Similarly, sales at real estate subsidiary UACN Property Development Company (UPDC) shrank 12.8% YoY toN2.5 billion as political uncertainty trailing the inauguration of the new government weighed on real estate activities. Elsewhere, UACN reported positive growth trends at smaller listed subsidiaries with Livestock feeds (+21.1% YoY toN2.1 billion), Chemical and Allied Paints (+9.2% YoY toN1.8 billion) and Portland (+1.9% YoY toN718 million).

Figure 1: YoY Revenue growth across UACN subsidiaries

Source: Company’s Presentation, ARM Research

Spike in Flour and Sugar prices underpins gross margin contraction

- At

N15.4 billion, Q2 15 COGS fell slower (-0.7% YoY) than revenues resulting in gross profit shrinking 12.6% YoY toN4.2 billion with related margin contracting 2.2pps YoY to 21.4%. Management links COGS pressures to higher flour (+10% YoY) and sugar (+3% YoY) prices which are essential ingredients at the UAC food sub-division.

UPDC’s impairment loss and plunge in associate profit drives operating loss

- Q2 15 opex fell 4.4% YoY to

N2.7 billion (opex-sales ratio: -10bps YoY to 13.9%) underpinned by contraction in S&D (-5.6% YoY toN927 million) and admin expenses (-3.9% YoY toN1.8 billion). However, 46% YoY plunge in other operating income toN222 million as well as recognition ofN2.1 billion in impairments swung UACN from EBIT ofN2.4 billion in Q2 14 to operating loss ofN387 million in Q2 15 (excluding impairments, Pro-forma EBIT contracted 28.3% YoY toN1.7 billion). The impairment provision reflect decline (-13pps between 2013 and H1 15) in annual occupancy at Golden Tulip Festac Hotel (a subsidiary of UPDC Plc) pending outcome of reports of a professional valuation exercise. Management attributes a combination of factors such as: Ebola crises, socio-political uncertainties and infrastructural deficiencies to the drop in occupancy rate.

- Despite a 12.3% YoY contraction in finance income to

N371 million, lower finance expense (-36.7% YoY toN601 million) which tracked similar movement in LT borrowings (-8% YoY toN8.8 billion) underpinned 56.4% YoY decline in net finance expense toN229 million. Nonetheless, amid 22.4% YoY plunge in associate profit (UPDC REIT) toN466 million—possibly reflecting weakness in real estate activities— operating losses filtered through to bottom-line with UACN reporting a pre-tax and post-tax loss ofN150 million andN638 million respectively vs. PBT and PAT ofN2.4 billion andN1.5 billion respectively in Q2 14. Stripping out impairment losses, UACN would have reported 20.7% and 4.4% YoY contraction in PBT and PATN1.9 billion andN1.4 billion respectively with related margins shrinking 210bps and 10bps to 9.8% and 7.4% respectively.

Input cost pressures and continued struggles at UPDC weigh on outlook

- Going forward, subdued consumer purchasing power and difficulties at franchising business should continue to inhibit volume growth at the food business. Similarly, gradual replenishment of livestock by farmers affected by bird flu outbreak as well as increased competition should continue to weigh on GCL’s revenue. As for the real estate subsidiary, dissipation of political risks which management had linked to the weakness in revenues over H1 15, should provide some relief. Overall, improvement at UPDC, together with sustained growth at Chemical and Allied Paints, Portland and Livestock feeds should see an upswing in group revenues over H2 15. Nonetheless, following price hikes by flour and sugar producers, we see scope for continued gross margin compression over the rest of the year. In addition, UACN’s real estate business also provides further pressure to group earnings on two fronts. Firstly, as the economic forces which drove impairments and lower profits at UPDC and UPDC REIT remain intact, we see further room for an extension in the trend on both fronts even after conclusion of revaluation exercise at Golden Tulip. Secondly, announcement of plans to raise capital to deleverage UPDC suggests prospects for dilution of UACN stake. Beyond fundamentals, UACN links its decision to defer its AGM (earlier scheduled for July) to September, in order to enable shareholders approve UPDC’s capital raising plans, as the driver of delays behind FY 2014 dividend payment, a development which leaves the stock susceptible to negative domestic investor sentiment. Overall, despite attractive fundamentals, we see enough in the domestic environment and at UACN’s real estate division to drive weak earnings over H2 15. UACN trades at a discount to Bloomberg regional peers on a current (PE: 10.87x vs. 23.26x) and forward (PE: 16.35x vs. 17.30x) basis with our FVE (

N47.07) at a 27% discount to last trading which translates to a BUY rating.

SOURCE: ARM RESEARCH

![[Buy Sell or Hold] UACN After Release of Half Year Results](https://nairametrics.com/wp-content/uploads/2015/08/uac-building.png)