One of the most memorable dribbles in last season’s Champions League was the dummy Lionel Messi sold to Jerome Boateng before scoring the third goal against the Germans. Many loved that goal and talked about how sublime it was. Dummies can be much fun when it is sold. However, it is a different reaction when you are on the receiving end.

Okomu Oil Palm Plc was on our radar last year where we forecasted that the earnings per share was on track to beat last year’s estimate of N2.91. When their annual report did eventually come out a few months ago, the earnings per share dropped to N1.63, a massive 25% decline from a year earlier. So what exactly happened?

The dummy?

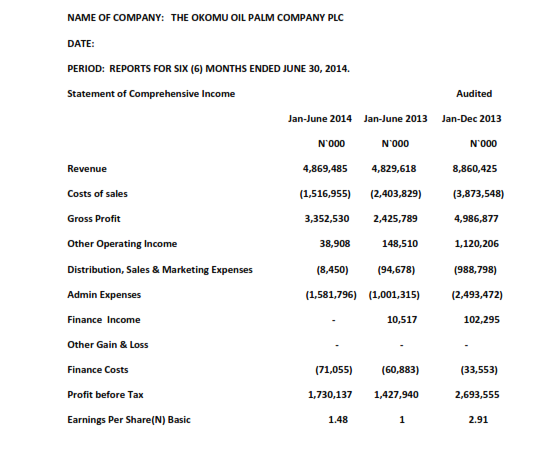

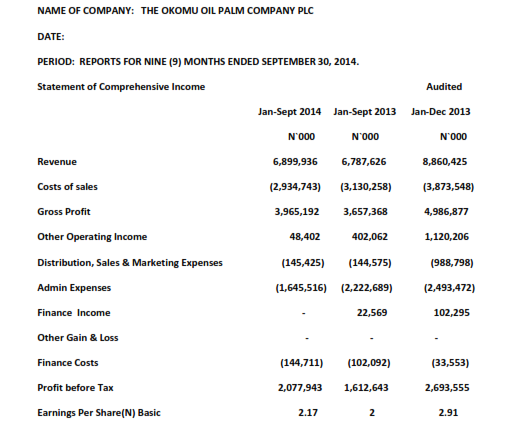

When Okomu Oil released its interim results in 2014 it conspicuously avoided stating any taxation. Apart from the shoddy reporting format used in stating its earnings, they for reasons best known to them did not state any taxation or profit after tax. What they however did was to state an earnings per share based on its pre-tax profits. See below

9Months

2014 H1

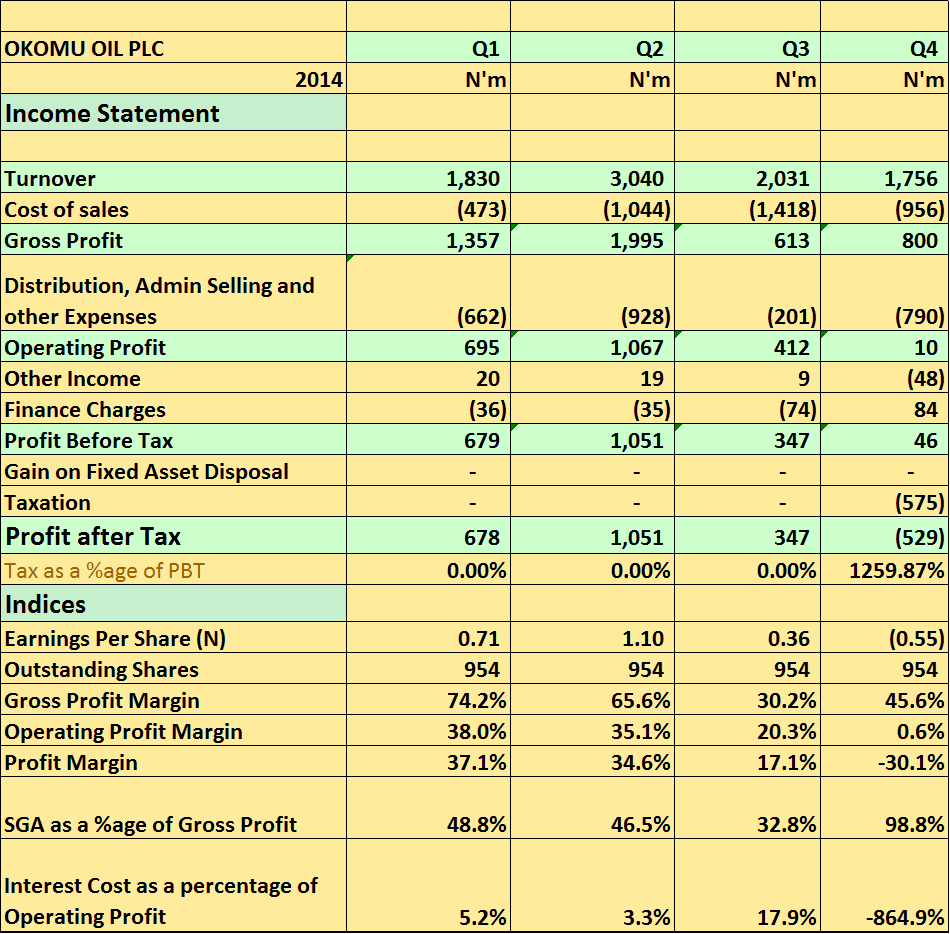

By now you realise ‘the dummy’ sold was to perhaps give the impression that 9 Months EPS was better than the full year in 2014 when annualized. However, by the time they released their Q4 results they back loaded all the taxes for the year in one quarter. The result of course was a loss for the fourth quarter of the year and a 26% dip in EPS to N1.63. Dummy Sold!!

By now you realise ‘the dummy’ sold was to perhaps give the impression that 9 Months EPS was better than the full year in 2014 when annualized. However, by the time they released their Q4 results they back loaded all the taxes for the year in one quarter. The result of course was a loss for the fourth quarter of the year and a 26% dip in EPS to N1.63. Dummy Sold!!

Another dummy sold was the way it reported its expenses. For some reason, operating expenses dropped significantly in the 3rd quarter of the year to N201m. One wonders if this was done to smoothen EPS numbers as we do not see how expenses could have way below the quarterly average of N700m. But then it’s not the first time. In fact, the quarterly results for 2012 and 2013 suggest it is a familiar trend for the company. Some companies incur their most expense in some quarters so that is understandable but this was different.

What we don’t see is a consistency in Okomu Oil’s reporting. Uneven operating expenses occurred far too frequently making it nearly impossible for any analysts to predict quarterly highs and lows. For example, in 2012 Q4 it reported an operating expense of N33million. Someone clearly needs to explain what is going on.

These are the sort of dummies we see being sold on Customs Street every other day. Companies unable to stick to approved disclosure requirements leave investors with nothing more than a wild guess at what future profits could be. Releasing results with full disclosures give investors a better shot at analyzing company results and properly valuing them. So, its probably easy to see why some companies hate to disclose full results accompanied with notes.

Okomu Oil is not alone in this kind of dummy. NASCON, NEM, UBA etc. to name a few all do it. The NSE? Well, maybe they just don’t get it. Even the regulator had to wait until June to release its own 2014 Full Year results.

Don Corleone

![[ANALYSIS] Did Okomu Oil sell investors a dummy?](https://nairametrics.com/wp-content/uploads/2015/06/Messi-Boateng.png)

smh. This is illegal . but when the nse itself isnt compliant how does one proceed. smh

Was just thinking of buying UBA shares but seeing the name here puts me on red alert.