Investors have often pondered why most finance journalist and analysts weren’t able to forewarn the public on the impending financial crisis of 2009 which culminated in the lost of significant investments.

One analyst gave a candid answer.

He said the relationship that subsists between the financial journalist and clients often deterred them from giving the true picture of a company.

Oando’s huge debt puts shareholders returns at risk

The huge debt in the books of Oando Plc, an indigenous Nigerian energy company puts shareholders in a precarious situation as return on equity could flounder.

The company’s continued delay in releasing its Full year 2014 results is making it difficult for analysts and investors to make informed decisions as other firms in the sector are bracing to release half year 2015 results.

There is a concern about Oando’s ability to survive a slump in oil prices and currency risk that could crimp the company’s expected cash flow from assets.

The spiraling interest expense in the books of Oando exposes it to financial risks if the company’s cash flows prove inadequate to meet financial obligations.

Shareholders will demand much a higher rate of returns for investing in a high risk company like Oando as it debt to equity (D/E) ratio increased to 163.18 percent in the third quarter of 2014 as against 157.23 percent in 2013.

A high D/E ratio means the company utilizes over 100 percent of lender’s money to finance its growth. Total debt as at September 2014 was N355.71 billion, an increase of 39.34 percent from N255.28 billion recorded in the corresponding period of 2013.

The large chunk of debt incurred by Oando is attributable to its appetite for acquisition of assets with a view to maximizing the value of owners and increasing its share of the market.

It acquired Conoco Phillips Nigeria oil and gas Limited, for a consideration of $1.5 billion, a strategic move that transformed the company into Nigeria’s largest indigenous oil and gas producer.

How long will hedging gains last?

Oando upstream subsidiary (OER) recently announced that gains from oil hedges facilitated the repayment of $238 million outstanding out of its $900 million debt.

According to a recent statement from the company:

“OER successfully realized $234 million by resetting its crude oil hedge floor price from an average of $95.35 per barrel to $65.00 per barrel on 10,615 bbls/day for the next 18 months and another 1,553 bbls/day for a further 18 months until January 2019.”

The large chunk of the $900 million debt is on the back of the acquisition of Conoco Phillips, according analysts at Chapel Hill Denham.

While the hedges have led to gains it remains to be seen what the pain threshold is for companies like Oando if oil prices continue to fall.

If the risk of the investment outweighs the expected return, the value of a company’s equity could decrease.

Financial highlights (Sept 2014)

It is curious that there are still investors bullish enough to bet on a company whose last earnings release was some 3 quarters ago.

For the first nine months through September 2014, Oando’s net income increased by 75 percent to N10.70 billion from N6.09 billion the same period of the corresponding year (Q3) 2013.

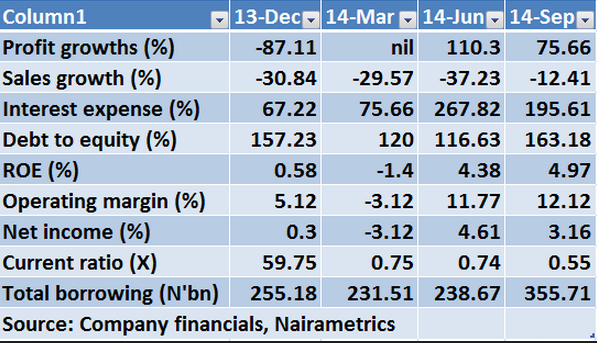

Sales reduced by 12.46 percent to N338.10 billion. Sales have never risen since December 2013 based on data compiled by Nairametrics. It dipped 30.84 percent in December 2013; 29.57 percent in March 2013 and 37.23 percent in June 2013. See Table.

Fig 1: Oando Plc Earnings, Liquidity and D/E ratios

- Cost of sales reduced by 23.86 percent to N258.51 billion in 2014 as against N339.52 billion in 2013. Cost of sales ratio fell to 76.45 percent in 2014.

- It means the company is spending less to produce each unit of products.

- Net margins, a measure of profitability and efficiency moved to 12.12 percent in the period under review from 4.27 percent in 2013.

- Operating profit margin moved to 3.16 percent in 2014 as against 1.51 percent last year.

- Current ratio, which measures the ability of a firm to meet its short term obligation as at when due reduced to 56 times in 2014 from 59 times in 2013.

- The 56 times figure is below the 2.1 times industry average.

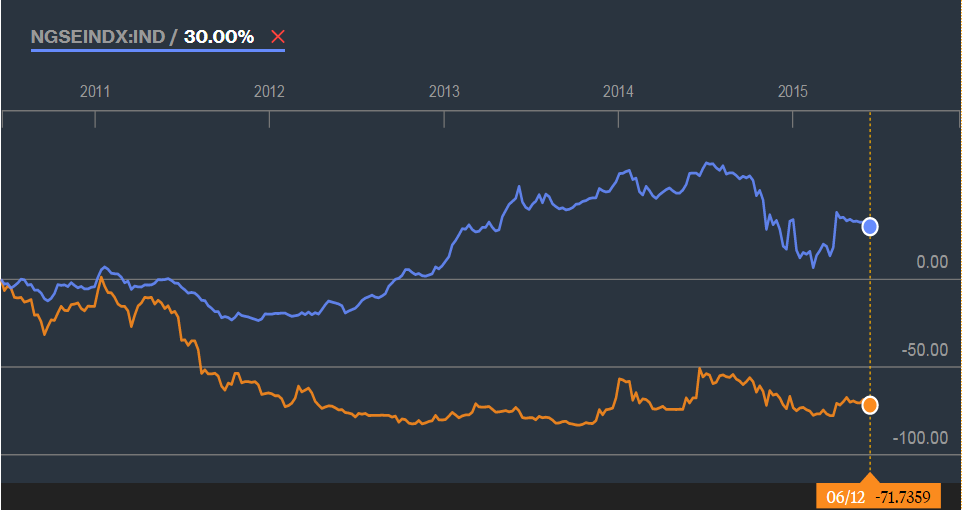

Oando’s share price has been dipping since its N60.72 peak in 2011. It fell to the lowest level of N12.07 in 2013 and is currently trading at around N17 on the floor of the exchange.

Fig 2 : Oando vs NSE – ASI 5 year chart

Source : Bloomberg

JON SNOW

![[ANALYSIS] Making sense of Oando’s levered balance sheet](https://nairametrics.com/wp-content/uploads/2015/06/Oando-Group.jpg)

[ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/NaZNuksC3k https://t.co/yCgaaNBwlm

[ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/qFHApijbdW https://t.co/LnYYOsV9OV

[ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/mhhFgOYBsY https://t.co/FfHx10hp49

[ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/Yaq50CkFiy

RT @Nairametrics: [ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/qFHApijbdW https://t.co/LnYYOsV9OV

RT @ugodre: [ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/mhhFgOYBsY https://t.co/FfHx10hp49

[ANALYSIS] Making sense of Oando’s levered balance sheet: Investors have often pondered why most finance journ… https://t.co/ffchFdz9lI

[ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/4F5OfJECVj

[ANALYSIS] Making Sense Of Oando’s Levered Balance Sheet

https://t.co/xp3TE30rIE

[ANALYSIS] Making sense of Oando’s levered balance sheet – https://t.co/hVWXTjC6gc

[ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/bdKoXteHdO

[ANALYSIS] Making sense of Oando’s levered balance sheet – https://t.co/StKF9wcJLO

Wow, so oando now produces over 10615bbl per day great if they clear their debts even at the current rate as stated, all fears will disappear in the medium term…

[ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/WQLpQbwdSn https://t.co/jRCvOc8ym1

RT @ugodre: [ANALYSIS] Making sense of Oando’s levered balance sheet https://t.co/WQLpQbwdSn https://t.co/jRCvOc8ym1

i dont think oil price will deep significantly again. Until the 2014FY figures come out, it is fingers crossed but i’m positive about it.

We have been positive for over 6 months now.