Slowing growth in Africa’s largest economy is the elephant in the room that few people are talking about.

As has been noted by analysts, the challenges facing the Nigerian economy are immense and ‘sobering’. The most significant includes a potential fiscal cliff. Following the fall in oil prices, both government revenue and spending is experiencing a sharp drop. The government, facing a cash crunch can do little more than just pay salaries, and its capital expenditure for the year is expected to be negligible. In a bid to shore up finances, the new administration is looking to find out and plug sources of leakage through reforms (chief of which is around the NNPC).

Although the biggest fears have been towards the potential fiscal crises, the government faces a much bigger problem – reviving economic growth, which is slowing at record pace.

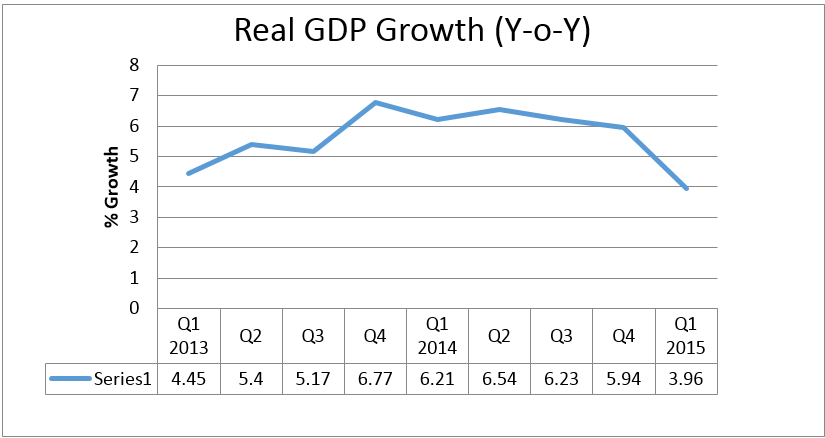

Nigeria recorded GDP growth of just 3.96 percent Y-o-Y in Q1 2015, compared to 5.94 percent the previous quarter.

The last quarter’s real GDP was 1.98 percentage points lower than the preceding quarter, and 2.25 percentage points lower than the corresponding quarter of 2014. Quarter-on-quarter, real GDP fell by as much as 11.57 percent (according to the NBS).

“The Nigerian economy is in deep trouble, and will require careful management to bring it round …” said new President Buhari, in his inaugural speech on Friday the 29th.

With the sharp drop in GDP growth, financing deficits with debt, as opposed to cutting spending altogether looks like the better option, as budget cuts and tax hikes – austerity measures, will only serve to crimp growth further (going by precedents from Europe’s double-dip recession).

In a move considered ‘apt’ by investment firm RenCap, the government has “for the first time since the 2008/09 global financial crisis, approached development finance institutions (DFIs) for loans to help bridge its $4bn financing gap”. BudgIT, a government budget transparency lobby group, estimates that the government will be seeking about N2.4 trillion to fund its annual budget.

Budget deficit as a percentage of revenue now potentially stands at 31 percent annualized, up from 14 percent in 2014, according to RenCap estimates.

But this seeming ‘fiscal stimulus’ is only a disaster-control measure at best, and will not propel the required growth.

With the government having little room to spur growth via spending, and monetary policy either approaching the limits its effectiveness or taking too long to take effect, how will growth be spurred given the prevailing circumstances?

CBN Governor, Godwin Emefiele, in his last MPC speech noted that the apex bank’s monetary policy measures was gradually approaching the limits of tightening, and will require that complimentary fiscal and structural policies be adopted to manage the economy.

To boost growth, the new administration can score quick points, by ringing structural changes that will unlock the flow of private domestic capital to fuel real sector growth.

Some potentially quick wins include:

Unlocking and mobilizing domestic private sector capital to fill the void left by government spending and foreign investment, by de-risking the retail and MSME lending sector:

World Bank data shows that the Nigerian private sector economy is starved of domestic credit when compared to other economies.

According to the World Bank, domestic credit provided by the financial sector as a percentage of GDP stands at 22.3 percent in Nigeria. In the USA it stands at 240 percent, while in the UK, the figure is 184 percent. South Africa’s figure stands at 182 percent. Reasons for this anomaly vary from structurally high lending rates, to the inherent riskiness of the retail and MSME sector that has made it un-investable.

“We need to fix the structural issues around retail lending and we will see capital flowing in that direction”, says a high-ranking banking sector executive that prefers not to be named. “Nigerian banks have little reason to lend because of the risk”.

Nigerian banks have been finding it hard to de-risk retail lending to individuals and MSMEs, but the sector still remains inherently risky.

The biggest causes of risk identified are a lack of collateral from borrowers, and asymmetric information — where a retail borrower doesn’t disclose sufficient financial information and banking history, which can sufficiently put a bank at risk.

To solve this structural issue, banking sector analysts are putting their faith on a movable asset / collateral registry, efficient and timely dispute resolution and a comprehensive national identification infrastructure.

“These things hinders consumer financing”, the banking executive said.

Following the launch of a collateral registry in Ghana by the Bank of Ghana, the MSME sector gained access to US$3.5 billion worth of financing. To date, 60,000 businesses and 224,000 people have benefited from the project. In China where moveable asset and collateral registry was developed as a way to boost the economy after the Asian economic crises, a total of US$3.5 trillion was disbursed to the MSME sector in five years. Also, in Vietnam, a total of 54,000 businesses have benefited from about US$600 million financing since its inception in 2012.

“The levers for capital formation are right there in front of us, but we cannot lend when 80% of land for collateral is not titled”, said the banking executive.

Banks are worried about the risk side, so government has to work on the central collateral registry”.

In a 2012 study by two Harvard banking and finance Professors, Robin Greenwood and David Scharfstein, titled The Growth of Modern Finance, it was noted that in the golden age of the US financial markets, when finance contributed the most to GDP (8.3 percent), growth in the financial sector was driven by growth in fees associated with an expansion in household credit, particularly fees associated with residential mortgages.

According to them, the growth in active asset management, household credit, and shadow banking were the main areas of growth in the financial sector.

“Our analysis identifies two areas of significant revenue growth: asset management and, more surprisingly, fees associated with the expansion and refinancing of household debt”, the study said.

“Household credit fees appear to explain 38% of the 6.1 percentage point growth of finance, when expressed as a share of GDP”, they said.

By raising CRR on public sector funds last year, Nigerian banks increased their lending for the second straight year but prior to that banks were comfortable with the spreads on government securities, using government money. With the Treasury Single Account, banks now have to lend to the real sector.

Also by cutting back on CoT banks are being forced to be innovative in engaging and lending to the economy.

Edozie Ifebi