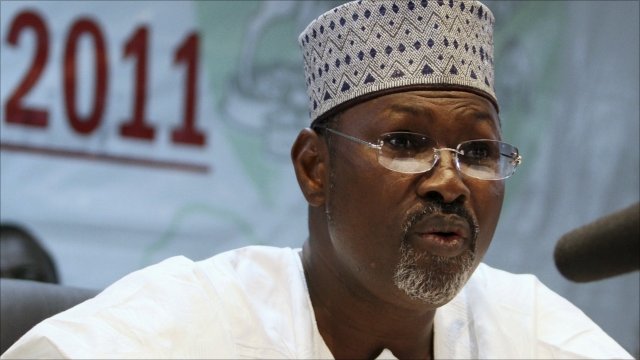

According to several onine reports, President Goodluck Jonathan has summoned the Chairman of the Independent National Electoral Commission (INEC), Professor Attahiru Jega to the presidential villa over the use of card readers for the March 28 and April 11 General election.

The decision to summon Jega followed the discovery by the presidency that the plans to jam the card reading machines meant for the election would not work. Yesterday the All Progressives Congress (APC), had alleged that the PDP had hired an Israeli, Gyora Berger to try and jam the card readers. The party said that apart from disabling the card readers, the jammers will also disable all telephones, iPads, etc. within the states radius of those carrying them on their persons. It said an order has been placed for 75,000 pieces of the jammers at a cost of 200 US dollars per piece, bringing the total cost to 15 million dollars. The jammers will be air freighted to Nigeria next week. ”

If the story above is true, then we expect the economy to falter temporarily and the stock market which started the week in deep red to continue to bleed weeks after the election. Jega’s removal in our opinion will negatively affect the credibility of the elections regardless of what happens with either side crying foul. This is because we believe whoever loses to be unhappy and may find it difficult curtailing their supporters from resorting to violence even if it is against the will of the loser. We also believe politicians will continue to ratchet up their rhetoric in the next 7 days and perhaps week after and each voice only adds to the layer of uncertainty.

Whilst the effects on the wider economy, if any, might take its time to manifest, we believe the immediate impact will be felt in the capital market, money market and foreign exchange market. Here is a sneak peek

Equities and Money Market

Just a week after the elections was initially postponed stocks fell to its lowest points in two weeks as investors fled the equities market. Bond yields also spiked just as exchange rate for the Naira depreciated to its highest ever. Already the market has lost over 4% in the last 3 days trading sessions and is primed to lose bigger if Jega’s removal is confirmed. The impact of his removal is bound to reverberate across the money and equities market with the all share index falling sharply and yields spiking. Exchange rate may also see a renewed depreciation with more people dumping the naira for the dollar in response to political backlash that might ensue.

The wider economy

The National Assembly might find it hard passing the 2015 budget further holding the economy hostage. Legislators on both side of the aisle may continue to trade tantrums following this removal leaving them with little or no time to discuss economic matters.

With the government nearly going broke borrowing in the bond market might become more expensive and difficult as foreign and some local investors may shun bond buying in response to the uncertainty in the air. This could affect payment to fuel importers, government contractors, workers salary etc. The effect of this , if it does occur is unimaginable.

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg)

2 more weeks and this propaganda fueled Election would be gone.If the plans for Jammers have failed, why would the jammers still be expected in the Country next week

IT AFFECTS YOUR CREDIBILITY AS A FINANCIAL BLOG WHEN YOU ENGAGE IN SUCH WANTON SPECULATION AND PROPAGANDA.

THESE ARE UNPROVEN ALLEGATIONS.